I’ve been sitting and thinking. Not a bad thing, but a dangerous thing. I’ve been sitting and thinking about AI, Artificial Intelligence. How will AI change banking and finance? Specifically, how could we use AI to change banking and finance?

When I think about this, I think about how banking has changed since the last century. Banking has moved from branches to apps; the system is run on data instead of paper; we deal with banks through screens rather than humans … and next?

Next is a bank that deals with everything in an automated but intelligent way. Back in the 1990s we had this discussion. Could we create an automated infomediary? How would it work? What would you need to do?

Well, thirty years later, we are there. In the 2020s we will see new banks that do a lot more than just data enrichment. Today, in 2023, I can click on a bank transaction (only if using a digital challenger bank’s app) and see where I made that payment on Google Maps. Tomorrow, in 2030, I can click on a bank transaction (only if using an AI bank’s app), and it will tell me the impact that transaction will have on my life for the next month or year.

This is where it gets interesting as we have always said that banks need branches for advice. AI blows that argument away. We no longer need branches or humans in banks for advice. Technology is far more effective.

You don’t believe me?

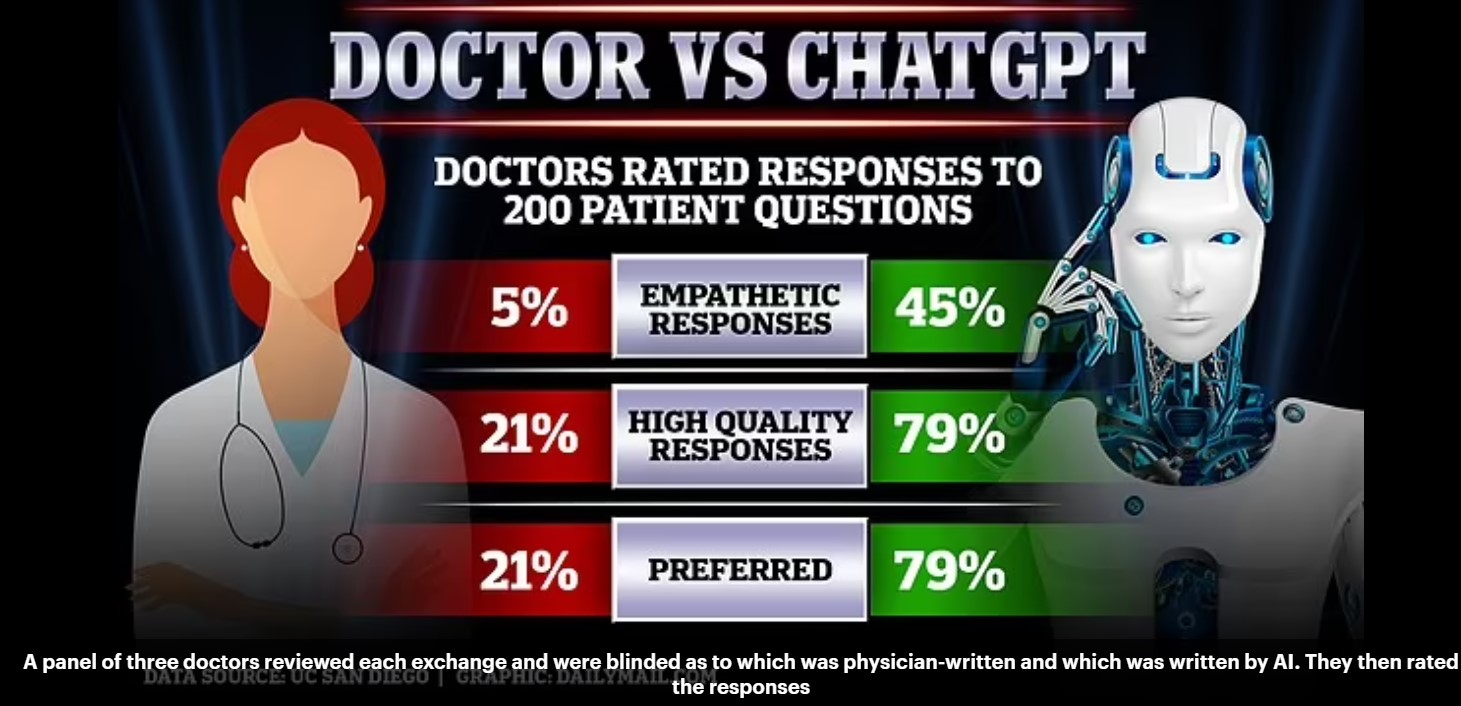

Well, back in April, ChatGPT was asked to advise on health issues and, in a survey of hundreds of physicians, gave better advice and empathy than the human doctors.

By way of example, one patient sent in this challenge: “question about risk of going blind following bleach being splashed into an eye, resulting in irritated and dry eye”.

The answer from the doctor was: “Sounds like you will be fine. You should flush the eye anytime you get a chemical or foreign body in the eye. You can also contact Poison Control 1-800-222-1222”.

ChatGPT's answer:

“I’m sorry to hear that you got bleach splashed in your eye. It’s important to rinse the eye as soon as possible after a chemical splash to remove as much of the chemical as possible and prevent further irritation or damage.

“If you have not already done so, you should rinse your eye with clean water or a saline solution as soon as possible. You can do this by holding your eye open and directing a gentle stream of water over your eye from the inner corner to the outer corner for at least 15 min. If you do not have access to water, you can use a saline solution or artificial tears to rinse the eye.

“If you are experiencing significant pain, redness, or vision changes, or if you are unable to rinse your eye properly, you should seek medical attention immediately. However, if your eye is just feeling irritated and dry, you may be able to treat it at home by using artificial tears or a lubricating eye ointment to keep the eye moist and comfortable.

“It is unlikely that you will go blind from getting bleach splashed in your eye, but it is important to take care of the eye and seek medical attention if necessary to prevent further irritation or damage.”

Which one do you prefer?

As you answer that question, I asked ChatGPT to tell me: if I’m debt and cannot pay my bills, what should I do? Here’s the answer:

If you're in debt and struggling to pay your bills, it's important to take steps to address your financial situation as soon as possible. Here's a general guide on what you should do:

- Assess Your Debt: Start by gathering all your financial statements, bills, and credit reports to get a clear picture of your debt. Know how much you owe, to whom, and at what interest rates. This will help you prioritize which debts to tackle first.

- Create a Budget: Make a detailed budget that outlines your monthly income and expenses. This will help you understand where your money is going and where you can potentially cut expenses to allocate more towards paying off your debts.

- Contact Your Creditors: If you're having trouble making payments, reach out to your creditors as soon as possible. Explain your situation and see if they're willing to work with you on a modified payment plan, reduced interest rates, or a temporary hardship arrangement. Many creditors have programs in place to help people in financial distress.

- Debt Consolidation: If you have multiple high-interest debts, consider consolidating them into a single, lower-interest loan or credit card if possible. This can make your payments more manageable and reduce the overall interest you pay.

- Credit Counselling: Seek assistance from a reputable credit counselling agency. They can provide budgeting advice, debt management plans, and negotiate with creditors on your behalf. Be cautious of agencies that charge high fees or promise unrealistic outcomes.

- Prioritize Debts: Determine which debts are the most urgent. High-interest debts like credit cards usually take precedence. Make at least minimum payments on all your debts while focusing on paying off the highest-interest ones first.

- Emergency Fund: Try to establish or rebuild an emergency fund to cover unexpected expenses. This can prevent you from relying on credit when unexpected costs arise.

- Explore Government Assistance: Depending on your situation and where you live, there may be government programs or local nonprofit organizations that can provide financial assistance or support for housing, utilities, or food.

- Consider Bankruptcy as a Last Resort: Bankruptcy is a serious step with long-term consequences, so consider it only as a last resort when other options have been exhausted. Consult with a bankruptcy attorney to understand the implications and requirements.

- Financial Education: Educate yourself about personal finance and money management. Understanding how to budget, save, and invest can help you avoid falling back into debt in the future.

- Seek Professional Advice: If your debt situation is overwhelming, consider consulting with a financial advisor or counsellor who can provide personalized guidance based on your specific circumstances.

Remember that addressing debt takes time and discipline. It's crucial to stay persistent and committed to your financial recovery plan. Seek support from family and friends, and don't hesitate to ask for help if you need it. Additionally, consider seeking advice from a professional financial advisor or attorney to ensure you're making the best decisions for your unique situation.

I’m pretty sure that my branch teller would not be able to tell me that.

Postscript:

If you have not seen them, here is Wave ... an AI generated girl band.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...