This is quite a complicated update, but it came to mind when I saw that JPMorgan analysts are predicting stablecoins could destabilise the traditional financial markets. This is because the Federal Reserve decided in April that money funds created for the sole purpose of accessing its overnight reverse repo facility, which is called ON RRP, were deemed ineligible as a counterparty.

So, if you are a new start-up wanting access to stabilise your funds overnight, you need access to ON RRP. If you don’t have it, then you have far more potential volatility. That’s the issue.

First question: what is RRP?

A reverse repurchase agreement (RRP) is a transaction in which the trading desk sells a security to another financial institution (counterparty), with an agreement to repurchase that same security at a specified price at a specific time in the future. Making it simpler, imagine you have $1 million. Overnight, you can park that $1 million with a bank knowing that, in the morning or even in a month, it will still be worth $1 million.

The issue JPMorgan highlights is that stablecoins seeking to park cash and unable to access the Federal Reserve bank’s facility, will have to compete with the $5.64 trillion money-market fund industry. This will move them to look for other securities and assets like Treasury bills, T-bills for short, and potentially pushing those rates below the offering level on the RRP.

Did I say this was complicated? What does it mean? Well, if stablecoins grow in value, and have to buy T-bills and other assets, rather than having access to the repo markets, then confidence in the American system might fall through the floor.

Let’s look at this in a little more detail. According to Investopedia, falling yields indicate caution in the markets and, if stablecoins push down T-bill rates then the US, traditionally seen as a safe haven for capital, would be impacted by a loss of confidence. Covering JPMorgan’s report, Bloomberg states:

“The combined reserve portfolios of the two largest stablecoins — Tether and USDC — was $114 billion as of June 2023, with over 60% in T-bills and 25% in repo. Even though they only represent 2% of the bill market, the strategists said additional growth in stablecoins could crowd out other buyers and intensify the supply-and-demand imbalance in the money-market space, leading to shortages in T-bills and repos, pushing rates even lower.

“As the number of stablecoin issuers grow and enter short-term funding markets, there’s also an increasing exposure of the traditional financial system to turbulence in the crypto space.

“For example, the collapse of TerraUSD in May 2022 underscored how quickly a run could occur in the short-term rates space. That’s because a swift and massive liquidation of other high quality liquid assets such as Treasury bills by one stablecoin issuer could impact the net asset value of other issuers and money-market funds holding T-bills, prompting even more liquidations.”

The reason why I’ve posted this is that I find it interesting where we have reached a stage where cryptocurrencies and stablecoins are becoming so mainstream that they could destabilise traditional financial systems. How quickly times change.

Postscript:

A little more background on repo markets courtesy of the ICMA (the International Capital Market Association).

Repo is a generic name for both repurchase transactions and buy/sell-backs.*

In a repo, one party sells an asset (usually fixed-income securities) to another party at one price and commits to repurchase the same or another part of the same asset from the second party at a different price at a future date or (in the case of an open repo) on demand.** If the seller defaults during the life of the repo, the buyer (as the new owner) can sell the asset to a third party to offset his loss. The asset therefore acts as collateral and mitigates the credit risk that the buyer has on the seller.

Although an asset is sold outright at the start of a repo, the commitment of the seller to buy back the asset in the future means that the buyer has only temporary use of that asset, while the seller has only temporary use of the cash proceeds of the initial sale. Thus, although repo is structured legally as a sale and repurchase of securities, it behaves economically like a collateralised or secured deposit (and the principal use of repo is in fact the secured borrowing and lending of cash).

The difference between the price paid by the buyer at the start of a repo and the price he receives at the end is his return on the cash that he is effectively lending to the seller. In repurchase transactions, and now usually in the case of buy/sell-backs, this return is quoted as a percentage per annum rate and is called the repo rate. Although not legally correct, the return itself is usually referred to as repo interest.

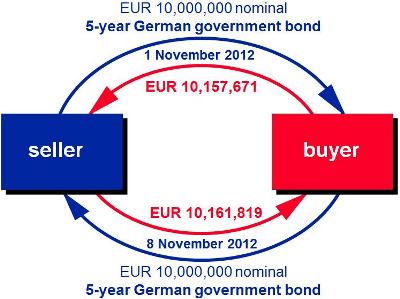

An example of a repo is illustrated below.

The buyer in a repo is often described as doing a reverse repo (ie buying, then selling).

A repo not only mitigates the buyer’s credit risk. Provided the asset being used as collateral is liquid, the buyer should be able to refinance himself at any time during the life of a repo by selling or repoing the assets to a third party (he would, of course, subsequently have to buy the same or a similar asset back in order to return it to his repo counterparty at the end of the repo). This right of use (often called re-use) mitigates the liquidity risk that the buyer takes by lending to the seller. Because lending through a repo exposes the buyer to lower credit and liquidity risks, repo rates should be lower than unsecured money market rates.

* Repos are sometimes known as ‘sale-and-repurchase agreements’ or just ‘repurchase agreements’. In some markets, the name ‘repo’ can be taken to imply repurchase transactions only and not buy/sell-backs. Repurchase transactions are also known as ‘classic repo’. Under EU regulation --- along with securities lending, commodities lending and margin lending --- repurchase transactions and buy/sell-backs are types of ‘securities financing transaction’ (SFT).

** In the Global Master Repurchase Agreement (GMRA), the same or similar assets are described as ‘Equivalent Securities’. ‘Equivalent’ means assets that are economically but not necessarily legally identical (the same issue of securities with the same ISIN or, if the issue is divided into classes or tranches, the same class or tranche, but not the same part of that issue, class or tranche).

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...