I was thinking about what it would be like to be a bank CEO right now. That happens quite often, and I often attend meetings where these things are discussed and the challenges that bank CEO’s face. The last great presentation I saw such insights was when we had the CEO of the British Bankers’ Association at the Financial Services Club, Anthony Browne. Anthony cited five specific areas where CEOs have issues, namely:

Politics such as Eurocrat rules and taxes, Brexit and all that stuff;

Competitiveness when the UK Chancellor had introduced five new bank taxes in five years, many of which punish the smaller banks more than the bigger ones;

Competition in general, with the UK banking industry, like most countries, concentrated in the hands of just a few big banks;

Banking conduct which is why the UK created the Financial Conduct Authority to clear up the mess of LIBOR and other scandals from mis-selling to breaching sanctions to market rigging; and

Doing digital with, even a decade ago, most Chairs of the big banks were talking about it, as they don't want to suffer a Kodak moment, but the question is what to do about it.

It was a really powerful presentation and made me realise that dealing with these five big issues is like spinning plates*. You have to keep your eye on all five at the same time, and make sure you’ve put just enough shake into the bank to keep everything spinning up high.

Anyways, Anthony’s presentation stayed with me, and I was therefore interested when, at another recent conference, the discussion returned to the big issues for a bank CEO. This time, using different language, the conference highlighted eight big areas of challenge:

Governance, risk and compliance, with greater enforcement, scrutiny and fines that have risen to highest levels in history;

Inflation with costs increasing dramatically and concerns around credit degradation and defaults;

Security threats dd with rapidly rising cybersecurity issues combined with internal financial crimes;

Changing customer and staff behavrious, bearing in mind that most people these days have the attention span of a gnat;

ESG (Environment, Social and Governance) issues rising higher in the frame of everyone’s mind;

Digital concerns particularly about the speed of change, as evidenced by Geneartive AI;

Black Swan events in that we thought the financial crisis was a Black Swan, but then we had the pandemic and more; and

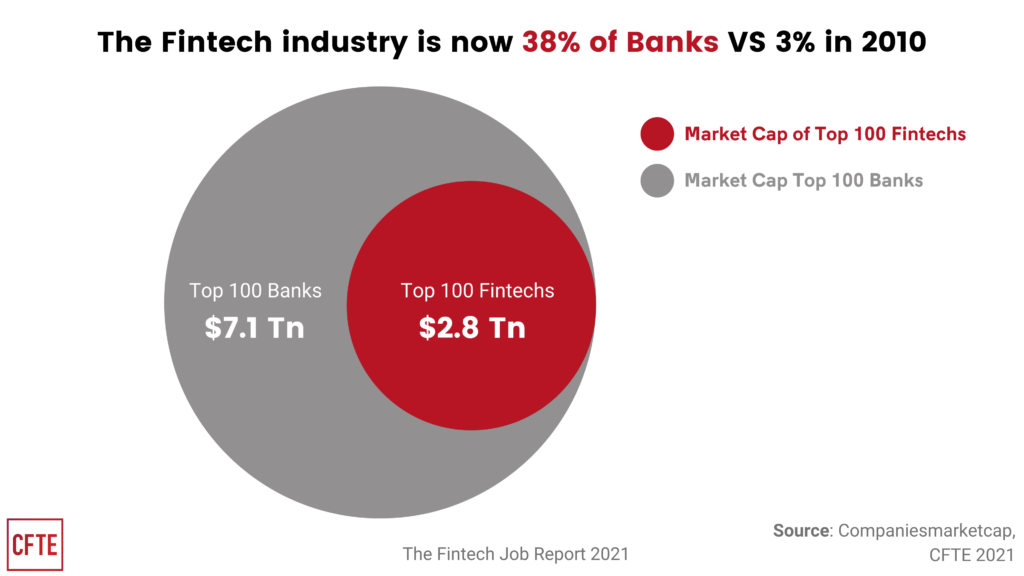

Competition, as per Anthony’s presentation, although the rate of specialist competitors in the Fintech sector has exploded in the last decade;

Between all of the things cited on this list, I’d probably say that bank CEO’s have at least ten or more things to consider and focus upon right now, and probably more. No wonder the CEO is kept awake at night.

Postscript #1

Note: customers are not mentioned.

Postscript #2

Spinning plates is an analogy I use quite often, particularly in the context of digital transformation and change management.

Postscript #3

It’s funny that there was a line in that 2015 blog which goes like this:

“McKinsey produced a report that shows 60% of bank profits from lending will disappear in the next decade”.

As most people do not bother checking such statistics, I picked up on this line and found it interesting when reading McKinsey’s review of the global banking sector in 2023, where they report that most large banks have published record results:

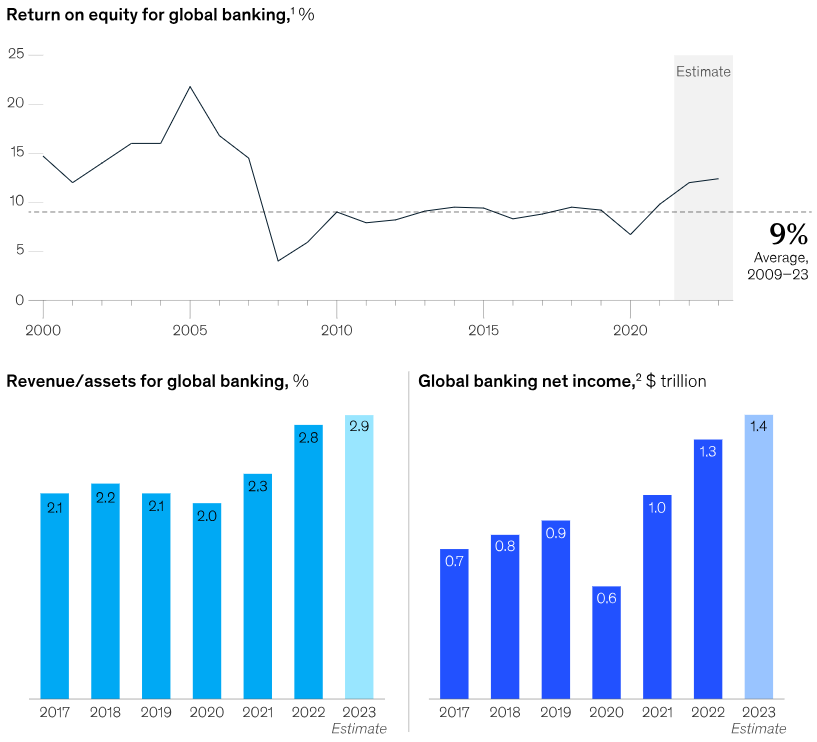

“The recent upturn arises from the sharp increase in interest rates in many advanced economies, including a 500-basis-point rise in the United States. The higher interest rates enabled a long-awaited improvement in net interest margins, which boosted the sector’s profits by about $280 billion in 2022 and lifted return on equity (ROE) to 12 percent in 2022 and an expected 13 percent in 2023, compared with an average of just 9 percent since 2010.”

Lies, darned lies and statistics.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...