The Wall Street Journal reported that Apple has sent Goldman Sachs a proposal to end their partnership within the next year, leaving Apple to find a new backer for its financial products.

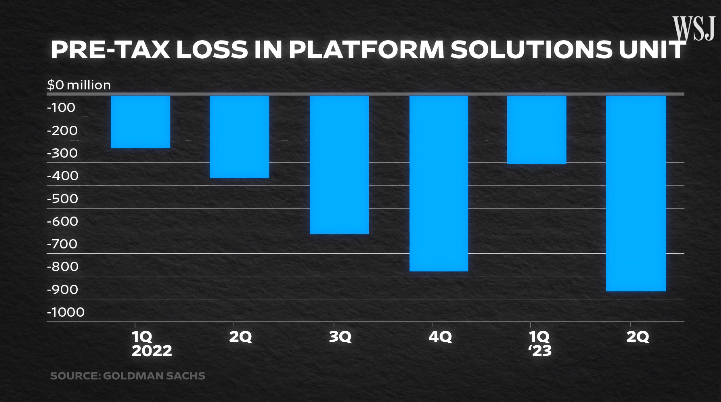

The Apple Card program was launched in 2019 to great fanfare but, within a year, Goldman Sachs was lamenting losses and costs for the partnership. Then it got worse as not only was the bank making more and more losses.

Though initiated by Apple, Goldman Sachs has allegedly been interested in ending its partnership with Apple for a while now. The financial losses seem like the biggest point of contention between the companies, but the WSJ also reports that Apple has frustrated Goldman Sachs execs by demanding that most people who apply for an Apple Card get approved, and that all Apple Card customers receive their bills on the same day (banks typically try to spread these bills out to avoid a deluge of customer service calls). Executives also partly blame Apple for regulatory issues that Goldman has had with the Consumer Financial Protection Bureau and the Federal Reserve.

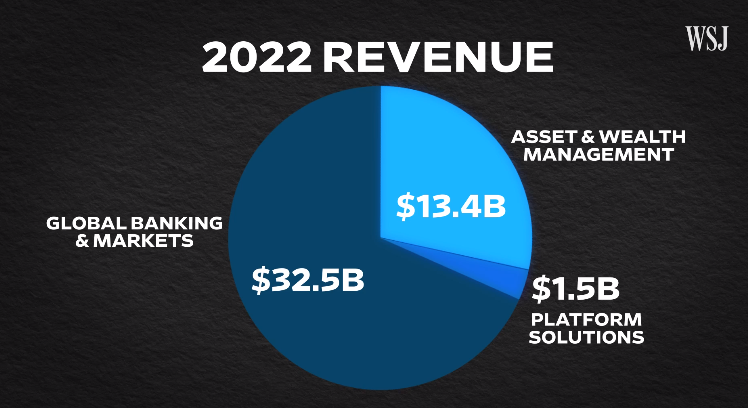

This, combined with the failure of their digital bank Marcus, has led to over $3 billion of losses in just a few years.

Platform solutions is their consumer banking

But the Apple Card failure is a bigger issue because of the major losses, as reported by CNBC.

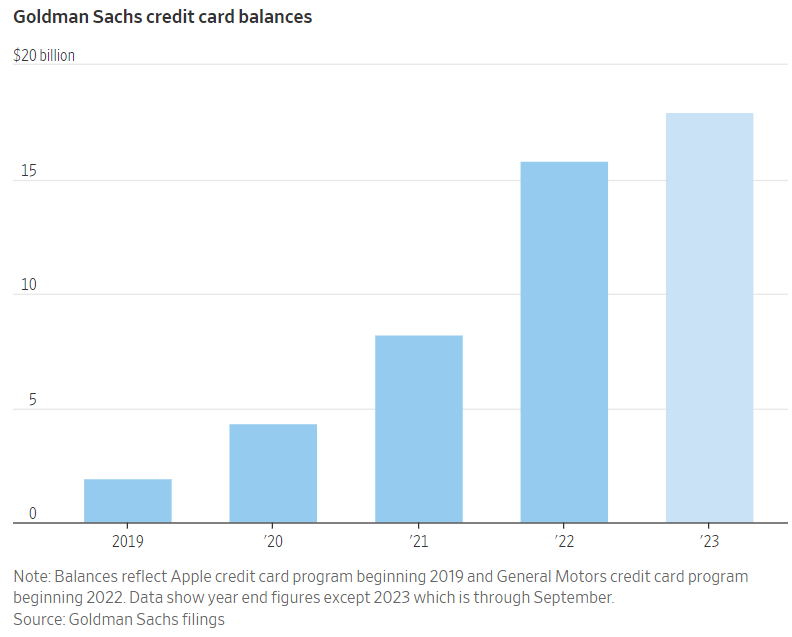

Goldman’s loss rate on credit card loans is the worst among major American card issuers and “well above subprime lenders” at 2.93%, according to a September note from JPMorgan. Add onto this that more than a quarter of Goldman’s card loans have gone to customers with FICO scores below 660. That could expose the bank to higher losses if the economy experiences more of a downturn, as is expected by many forecasters.

In other words, Apple’s insistence on accepting every applicant – even those with low credit ratings – is leading to more and more failures in unsecured debt, with more and more American borrowers missing payments and defaulting on their loans. No wonder when many successful card applicants were stunned to learn that they had been approved for an Apple Card, even though they had terrible credit histories.

Add on to this that analysts were saying Goldman would only make a profit on a cardholder if they stayed for four years - it is estimated that it costs $350 to onboard each account (compare that with NuBank where it is $5) - so break-even is in year four. As larger numbers of customers only stayed for two years, you can see why the losses are compounded further.

Yet, on the other hand, Goldman’s partnership with Apple since 2019 has arguably been the company’s biggest success, in terms of gaining retail lending scale. It’s the largest contributor to the division’s 14 million customers and $16 billion in loan balances, a figure that Goldman expected to double to $30 billion by 2024. Well that ain't gonna happen now.

All in all it’s a shame that Goldman has let down Apple, or was it the other way around? In the partnership, Apple is the dominant player and leader, and it is their decision as to when the partnership ends. Nevertheless, it looks like American Express or Synchrony Financial will replace Goldman for the card business.

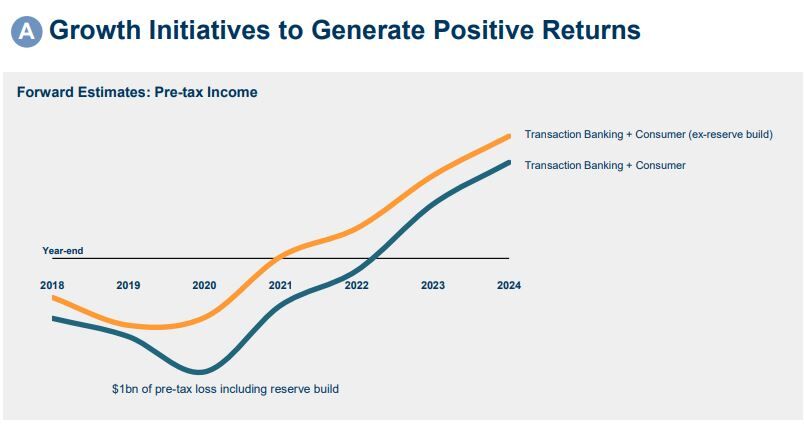

Such a far cry from the investor day in 2020 when Goldman’s CEO said that they would be to consumer banking what Amazon Web Services is to cloud.

Goldman Jan. 2020 Investor Day slide

Source: Bloomberg

Meanwhile, the news that Monzo thinks they can crack America last week is an interesting contrast.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...