For some time, Jill Castilla has been on my radar. Winning numerous awards for innovation in US banking, she shines out as someone special, so I made contact and asked if she would have a chat with me. She said yes!, so here is that conversation.

Chris Skinner:

The main reason I reached out is you really jumped into my face during the pandemic, because of the stimulus checks that were being distributed by the government, and most banks weren’t doing anything about it. Yet you suddenly managed to get them out there within a week. I believe Mark Cuban helped, and he’s quite a big name, but maybe we could just start with that story and how he got involved.

Jill Castilla:

It was such a time of just desperation and chaos, and the Treasury announced that it was going to take a couple of weeks before the stimulus checks would get to American families. We were starting to see a lot of concern from the families in our community. Stories of people not being able to go to work, the prospect of how long this would potentially last. We were busy trying to figure it all out, and started modelling how we could send everybody $1,000 and just say: “pay us back when you can”. Of course, that would have used up quite a bit of capital that the bank had, and so that wasn’t going to work.

Then I got a text message who said that Mark Cuban had just tweeted (now X) that he wanted to partner with an FDIC insured institution to get stimulus checks out to Americans faster.

I immediately responded to that tweet and gave my cellphone number. Then Mark didn’t respond.

Then someone else from our FinTech community texted me and said, here’s his email address. I emailed him, and he called me within a few minutes. I pitched my idea, which was basically allowing there to be an overdraft that all banks could allow their consumers to have, where they could overdraft their accounts without a fee, and then carry that for a certain period of time.

He was wanting more of a line of credit and, because it was a consumer loan, I knew that that would run into a lot of regulatory burdens. I then reached out to one of my friends at the Federal Reserve Board of Governors, and she put me in touch with their consumer lending specialist.

It was on a Thursday that I got that call from Cuban. By Monday, we had a plan that we rolled out. Mark Cuban then challenged several hundred banks – he challenged the banking world and credit union world – to do the same.

Within days, about 300 banks contacted me and, I assume, implemented something similar. It was just a way of being able to really deal with a problem creatively and come up with some type of solution. I think in times of crisis people are just looking for some type of action, and someone saying: “I’ll step forward and see if I can help in any way”. It just calms fears. When the community knows that there’s people out there that care who aren’t going to take advantage of them, that’s really fulfilling as a community banker. It really taps into the spirit of what this institution’s about.

We are a really small bank with just one location and 55 team members, so it’s very satisfying to know that you can make a big impact like that by taking a little bit of risk, by being solution focused in times of crisis.

Chris:

I did see that you joined the bank in 2009, celebrating 15 years with the bank, but I heard when you joined it was very different. I won’t say it was a mess, but you can tell me what it was like.

Jill:

Well, it was defined as a troubled institution, so saying it’s a mess wouldn’t be a reach.

We had an examination that identified lending related activities and credit activities that were improper. They were bumping the due dates of loans without collecting interest, and had been doing that for some loans for years.

Within thirty days when I came in, I found internal expense abuse to the order of several million dollars, and the bank’s net income at that time was just several million dollars. The bank would’ve made double the amount, if that abuse had not occurred.

It was also, culturally, full of immoral, unethical behaviours that went unchecked, and exposed the bank to a lot of risk. For example, many things were well outside the income statement and balance sheet.

So, my job ended being a complete turnaround of an institution. It was trying to change the culture, while you’re dealing with credit issues, putting controls into place that could prevent harm from reoccurring from different abuse situations.

It was a really scary time.

The bank’s largest shareholders were wrapped up in their employee stock ownership program, and we saw that share value plummet 90% by value in one year, due to these issues.

It was a very lonely period for me.

I identified the fraud. I had one team member. I had worked at the bank 20 years prior in the bookkeeping department and my boss, my supervisor, in that job was now the Chief Operations Officer. We ended up being a tag team of two, working side-by-side with each other.

We were working alone, with one another, to identify where we had fragility, and then to try to recommend opportunities to strengthen that to the board of directors. Fortunately, they listened to us and, one-by-one, we started turning heads and hearts, and changing the culture raised to the original foundations of the bank. The regulators took us off our written agreement in record time, without adding capital. The thing you really need to remember here is that we didn’t have a rich shareholder that we could tap into, and of course no-one wanted to put money into the organization.

It really changed who we were.

We had seven branches at that time and ended up selling all of our branches, keeping the deposits shrinking by about $100 million, about a third of our asset size, and then just reaffirming that the bank wanted to be here for another century or more.

That was a really hard period of time but then, looking back, it was such a blessing because it was one of those staring death in the face moments, and then knowing we can take risk and not have these types of outcomes. If we have a firm foundation, strong policies and procedures, and exceptional talent and some professional courage, then we can really turn this into something special.

It was already. We saw during the turnaround the customers wanted this bank to survive, not necessarily because they had deposits here, but we heard repeatedly that the bank was special and important to the community. That social capital that the bank had built for a hundred years, we used a lot of that during that crisis.

Now, we are really focused on outside the balance sheet, the importance of that social capital. A lot of banks don’t really focus on that as much. For us, it’s as much of a focus as the financial condition of the bank. We know that social capital is something that is tradeable and connected with the community. It is really where you can create a variable, valuable franchise, and something that becomes a pillar in the community, not just someone that’s doing deposits and loans.

Chris:

It sounds a bit like James Stewart in It’s a Wonderful Life.

Jill:

Exactly!

Chris:

Moving on. Once you stabilised the bank, you then got this reputation of being an innovator and winning lots of awards for being one of the most powerful women in banking. So how did you move from sleepy old bank that was misbehaving to the innovator?

Jill:

It really happened when the board said: manage this bank to be here for another century. That permission helped us back away and say: okay, what would we need to do?

I don’t know if you have read the book 10x is easier than 2x https://www.amazon.com/10x-Easier-Than-World-Class-Entrepreneurs/dp/140196995X/ , but when you have the ability to think about not how to survive in five years but how to survive in a hundred years, it really starts expanding the short-term and long-term goals. Rather than being quarter-to-quarter. You’re thinking: I’ve got to make some decisions this quarter because that could impact twenty, thirty or forty years from now. So, it’s not just this quarter to make the next quarter better.

That moment in time really provides permission.

This led me to thinking about doing things like FaceTime at the ATM. Because we had sold our branches, we still wanted to connect face-to-face, and there was a colleague of mine whose daughter and son-in-Law have a company here that does interactive kiosk at high-end hotels throughout the world. It’s called Concierge. Then there’s a local drive-in called Sonic, that’s nationwide and has always provided the ability to do audio and communications.

Now they do audio video, so we partnered with them and Concierge to create this interactive teller where they could run videos of how they could deposit at the ATM with proximity detection, that we could greet customers as they came to the ATM. And we did this for just $15,000 an ATM compared to IBM, where it was ten times that amount.

Around the same time, we had a customer that wasn’t willing to bank with us in urban Oklahoma City, which is about twenty minutes away from where I am. It’s a little coffee shop but all economic activity in Oklahoma City goes through this coffee shop.

They said: because of what you do socially, we want to bank with you, but the issue they felt is that they have a lot of cash transactions. Could we handle them?

Within about a three- or four- month period, we were able to implement a high dollar cash recycler and it integrates with our core. Doing those two things in such short proximity to each other, and being very bold about selling our branches before, was kind of the cool thing to do.

This was 2013. We got such praise from our customers of taking some risk, and involving them in the development of something new and different, and we had no negative publicity and didn’t lose any customers.

When we sold our branches everyone came to our main location, and our business expanded. So, you can really see that it’s so scary as a banker to think about failing during our turnaround, but failure was not an option. It was our motto. But now it’s about having permission to fail. We know what failure is, but what do just missteps look like? How can we partner with customers to not ever put their funds at risk, their privacy at risk, their security at risk? How do we partner defining what the rest of community banking is going to look like, and let the customer help us do that?

We stopped caring about the bank down the street anymore.

This permission to think long-term and to fail gave us this cavalier spirit where we feel like: let us do the hard work. We will create the pathway for other communities to follow us, so that they can remain relevant as well. We felt like we could say if we survived this, then you can too. Just kind of showing the world that it isn’t as scary when you step out of your comfort zone. In fact, there’s a lot to be reported for that.

That professional courage our team has, and that the board allowed us to foster and cultivate, has allowed us to stand out more than what a one location, 55 team member bank really should be able to do.

It’s because we’re just not scared.

We view ourselves as exceptional risk managers, and that it’s our job as bankers to do that very well. It does not mean we should just be risk adverse, but to be able to analyse risk and be able to take steps forward to be able to understand what the repercussions could be, partnering with regulators to ensure that they’re well informed, and that we’re not catching them by surprise.

We do this in lots of efforts. Just a few years ago, we did the first commercial development in forty years in northeast Oklahoma City. It’s our traditional black community and it has honestly been red-lined in many ways. When we focused on this area our whole goal was to say: let’s finance this, but others need to come. Some of these businesses had received thirty nos from banks in our community, and we were the first to say yes. How do we create more yeses for them?

That’s how we view success for us. It’s not that we are dominating and have a sole success area, but who else is following us and is it sustainable success for everyone in our community?

Chris:

I just wanted to get a general view around how you see digital banking, digital transformation, FinTech and everything that’s been going on for the last decade in transforming banking.

Jill:

Well, when we sold our branches, we decided to take those funds and deploy them into digital experiences. What we found early on was that it doesn’t necessarily have to be big reaches; it is more just how we interact with customers, and elevating that to more of a concierge or hospitality level.

You cannot change banking without changing the types of services that you provide.

Once you do that, once you have that affinity that people start feeling towards you, whether it’s from a community aspect as well as externally, then you get partners wanting to seek you out to make things more economically viable. For a small institution like ours, I think that the danger is that you’re chasing the shiny objects and that you think: okay, I’ve got to integrate AI into everything I’m doing right now.

Chris:

That’s my new book.

Jill:

That’s great but, for us, AI is wonderful for some things, but we have to be able to really analyse the risks associated with that. We can leverage technology to elevate what we do, and to be able to make our products and services more accessible, and to increase our efficiencies internally. That is really helpful, but you don’t just want to jump off without really understanding what you are getting into.

That first seeking to understand, and then understanding your customer base and whether that is something that would be beneficial or not, is key. Then always looking for the need to look for what isn’t available there.

As community bankers especially, we have such a pulse of what’s happening in our communities and our customers that often we can drive what the product and service looks like, or fill a gap in the market that doesn’t exist.

Back in the day, we used to go to Best Buy and buy off-the-shelf but now, you cannot shop that way. The world is so much different and expansive now. So you have to be engaged and listen to thought leadership like yours, to really understand what are the opportunities and how do I think not just for what’s on the shelf today, but what needs to be on the shelf five years from now.

Chris:

I see that you just announced you’re going national across the US with a digital platform that you’ve developed with a partner called Nami. I also know Mike Butler at Radius Bank, so I was quite interested as they also use Nami. So how can a 55 team member, one office community bank go from there to being a digital national service?

Jill:

Well, we were their fastest launch they have ever had at a small institution. So much of that comes from talent. It is the fact that the talent has to be able to understand the risk engagement from the very beginning, with all of the compliance, and that your regulators know exactly what’s going on right from the beginning so that you’re not caught off guard in the examination.

In fact, Michael and I were on a panel during the pandemic and, after, we got all the panellists start to discuss how to work together to make this happen? When you find partners that equally want to help one another, then you’re able to do really special things well beyond what you thought you could do. And for us, we were thinking firstly about the digital account opening in the lobby for our customers, and those that maybe are after hours.

We provide 24*7 support for our customers, so this would make it an easier lift for us than what we normally have. But then I met people out-of-state who really pushed me to think bigger than that. One guy, Neil who was with the army, said: Jill, I really want to bank with you and I’m not in Oklahoma, and I know other people who want to bank with you that you can go far beyond Oklahoma.

And at the same time, we were considering a digital bank for the military. So, we started to think more outside of where traditional community is not just about geography. Community can be like-minded individuals wanting to support one another, like friends.

We found that, in the case of our military bank called ROGER, an affinity group of those with like-minded challenges and opportunities. So, whenever you start redefining community and what a community bank is, what we do exceptionally well is just like It’s a wonderful life, and thinking how do we go beyond Bedford Falls? How do you have a Bedford Falls feeling? But to have that if you’re in London or New York or wherever you might not have accessibility to George Bailey. You can have a virtual version of that, and they want to have that same sense of community with you just as if you were their neighbour in Bedford Falls.

Chris:

Is ROGER competing with USAA or how do you position it?

Jill:

No, we really weren’t trying to compete with USAA, or any of the other military banks. There’s a segment of the population that’s underserved in the military. It is that new soldier, marine, sailor or airman that’s coming on board.

I enlisted when I was nineteen, and there wasn’t a bank there. There’s not a bank focused on the entry level service member.

As a result, they get exposed to a lot of different schemes that the more mature in their career service members aren’t as exposed to. They don’t get as many of the benefits that someone earning more income or has a college degree has access to.

And so ROGER, our military bank, was really created for someone like me when I was nineteen. I had banked here at Citizens Bank of Edmond, and did not have digital capabilities. A family member wrote checks on my account the entire time, and I lost everything that I had earned.

When I tell that story thirty years later, every time I say it, Chris, I have service members coming up to me saying, this was my story. So, it’s still happening.

Chris:

Yeah. It must’ve been a burning experience.

Jill:

Yeah, I mean it set the stage for so much of my life and it was really challenging. It was a point of desperation. It definitely shaped who I am and I think it’s really important, in that I wasn’t driven by a sense of patriotism to join. It was out of desperation and, to put this in context, our break even for this product is 1,900 accounts whereas, if you look at USAA, they have millions. We’re just a blip to them.

More than this, you have to be a member of USAA to open an account and so, when you are enlisting and you’re not in yet and you’re filling out that direct deposit form, you have to call or you have to go to a bank and get the direct deposit form completed. We do all that in our app. So, you just open the account and within seconds you have a direct deposit form signed by me that you can give to your recruiter. There’s no need to go to the bank.

Many of these young people are homeless and they’re in the situation where they don’t have an advisor or parent that can take them to the bank. It is really those who have been underserved that we are trying to focus upon.

Chris:

What drives you? What’s your thing that makes you passionate about what you do?

Jill:

The number one thing, and it’s our mantra here, is if we do good, we do well. So, ensuring that we’re really contributing to generational success in our communities. The biggest joy I get is identifying someone who wants to make an impact, and has all the tools and passion. They just need a little bit of resources – whether that’s my time or product or capital or team’s talent – then I love seeing something or someone take off. Being part of the stories, whether it’s alone or if it’s an event happening in our area. That’s where I get the most, just seeing the success that other people can have and deploying leadership, and that we’re able to provide some type of seed to help make it flourish even more.

Chris:

And if you think about one day, sitting in your rocking chair on an Oklahoma bench terrace admiring the view, what will you think you’ll be looking back on? What do you want to leave as your legacy?

Jill:

It would be amazing to see that there’s not a disparity in economic success throughout my community and the communities that we serve; that because of the work that we were able to do here, that families have better living conditions and better opportunities for education, and better opportunities for their children and grandchildren; that businesses that maybe wouldn’t have been able to get off the ground, are now causing there to be robust economic activities and areas in which there have been more economic deserts in the past.

It's all about seeing those that we’ve been able to interact with do great and good things, whether that’s team members here at Citizens or those that we’ve been able to serve. They’ve already been able to get a taste of that.

Being able to see that continue would be really fulfilling as we look into retirement.

Chris:

The end game legacy is not to sell-out the bank and be acquired?

Jill:

That’s definitely not on the radar. I had a bank reach out to me about buying us a couple weeks ago and my response was, no, thank you. The goal is to be here a hundred years from now.

I sit and stand in the lobby, that’s where I am right now, and a couple steps from me is the original vault of the bank. That was from 1901, and it’s still the same name: Citizens Bank of Edmond. It was a national charter.

A hundred years from now, I hope someone else is sitting in this chair. It definitely will be someone else, not me, of course, and that they’re having that same touch point and that we’re still Citizens Bank of Edmond, still doing really good and still taking that legacy of building social capital for generations.

All that goodness from the past, being able to carry it forward, that they’re able to have that same experience.

Chris:

So good to speak you with Jill, and yes you are a banking star.

Jill:

Thanks Chris, and keep up the good work.

Chris:

You too!

About Jill Castilla

As President and CEO of Citizens Bank of Edmond, Jill Castilla is a nationally recognised innovator in the banking industry - or "no talk and all action" according to entrepreneur and Shark Tank star Mark Cuban. Under Jill's leadership, the one-branch community bank in an Oklahoma City suburb became a major player on the national stage and now sits alongside banking industry heavyweights.

Jill's visionary leadership earned her and the Citizens team an impressive collection of industry accolades including: one of the 25 Most Powerful Women in Banking (American Banker), Banker of the Year (Cornerstone Advisor), Most Innovative CEOs in Banking (Bank Innovation), Most Admired CEOs in Oklahoma (Journal Record), 100 Most Influential People in FinTech (FinTech Weekly), and Community Banker of the Year (American Banker) among others.

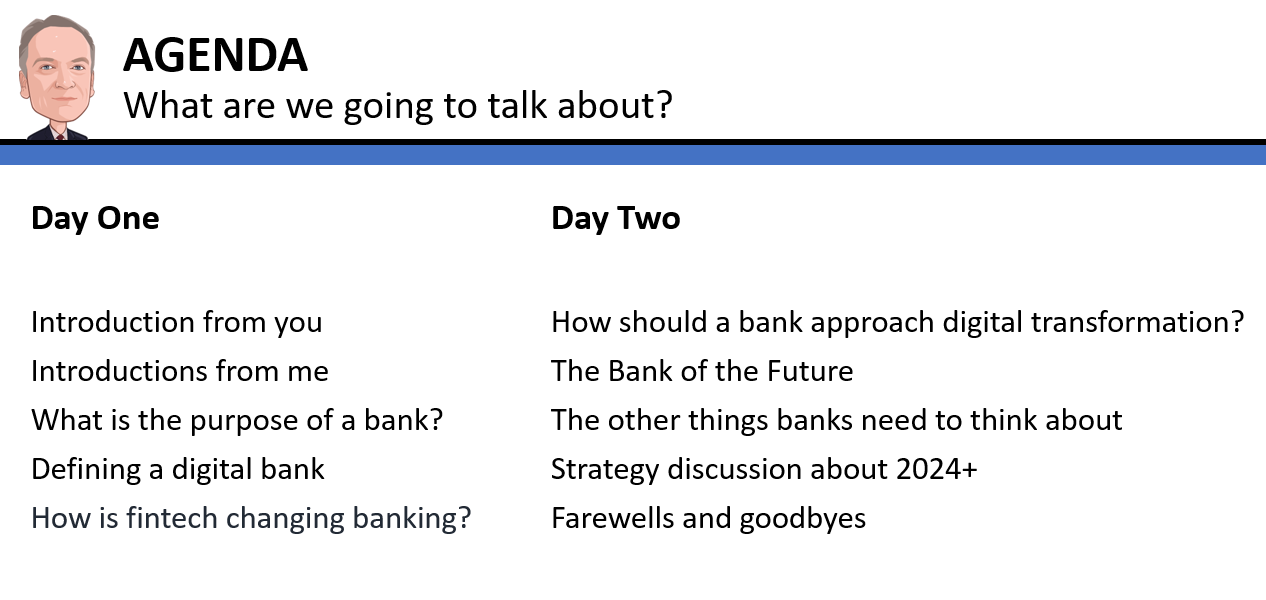

Oh and just an fyi, I'm running a series of immersive workshops on banking, fintech and tech so, just mentioning that it may be a good time to consider this for your 2024 kickoff planning!

:

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...