For the past decade, Jamie Dimon has regularly been decrying bitcoin as a scam. Here’s a few of his quotes:

- Jamie Dimon tells Davos that Bitcoin is a 'pet rock' that does nothing—except help with fraud and money laundering

- Jamie Dimon lashes out against crypto: ‘If I was the government, I’d close it down’

- JPMorgan CEO Jamie Dimon says Bitcoin is a ‘hyped-up fraud’ and cryptocurrencies are a ‘waste of time’

- Jamie Dimon Slams Bitcoin as a ‘Fraud’

... the list goes on. He has said this over and over again for over a decade, ever since bitcoin started to take off in the 2010s. His most famous comment? Well, the one I would pick on is when he said that crypto companies "want to eat our lunch", which led to a truck being driven around Wall Street stating that yes, bitcoin wants to eat his lunch.

The thing is that all of these comments by the billionaire banking boss are based upon his own belief that bitcoin is not an asset and yet, according to sources at The Street, Jamie Dimon and his company JPMorgan Chase trade over a billion dollars a day in cryptocurrency. It’s called the JPMCoin, so that makes it OK and, because it is backed by the US dollar, it’s their stablecoin which makes it OK. Or does it?

They also offer Onyx: “an asset tokenization platform that enables financial institutions, asset managers and fintechs to unlock untapped utility for their financial assets”. So a proprietary internal digital asset trading system makes it OK. Or does it?

Then there is an investment group working with JPMorgan Chase, and therefore with Jamie Dimon, to provide cryptocurrency investments, transactions, payments and exchange. The group is called Grayscale … an interesting name. In 2021, JPMorgan rolled out access to four funds from Grayscale Investments and one from Osprey Funds: Grayscale Bitcoin Trust, Grayscale Bitcoin Cash Trust, Grayscale Ethereum Trust, Grayscale Ethereum Classic Trust and Osprey Bitcoin Trust. So, offering bitcoin trading through third-parties makes it OK … or does it?

And now, in an exclusive analysis by The Finanser, we have discovered that there was an alleged $1 million invested in cryptocurrencies bitcoin and Ethereum in 2012. The value of that investment is now worth almost $100 billion, and this seems to be gross hypocrisy.

In an interview with one advisor, it turns out that the only reason for the public rock throwing at cryptocurrency, and bitcoin in particular, was to get the libertarian communities who are anti-state and anti-bank to invest more in these assets. It’s been a clever strategy, bearing in mind that bitcoin is now worth near $70,000 compared to just $50 in 2012, which makes this person one of the biggest whales in the crypto world.

Having said all of this, we should make it clear that this person who made that million dollar investment in 2012 is not Jamie Dimon. It’s Brock Pierce who leads the Bitcoin Foundation amongst other businesses. I’m guessing Jamie wishes it was him.

Meanwhile, the value of those two pizzas which cost 10,000 bitcoins back in 2010 would be worth $700,000,000 – seven hundred million dollars – today. Take note: global two pizza day is coming on May 22nd.

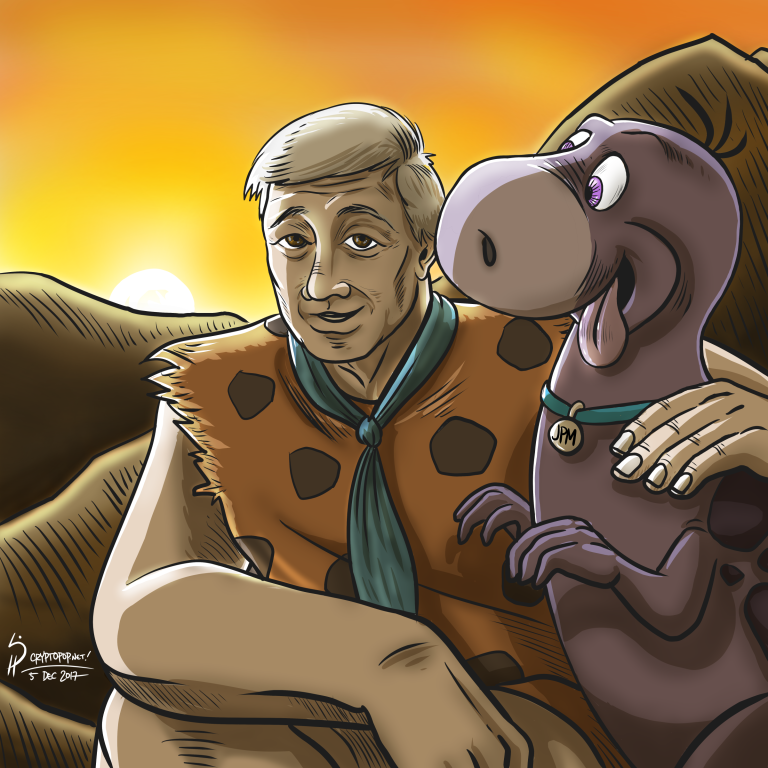

Finally, the main image on this update is the Dimonsaur: an old banker who cannot accept the system is changing (picture from Cryptopop).

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...