I’ve recently had a couple of interesting visits to the Middle East and Africa, namely Riyadh and Cairo. Both are keen to highlight progress in fintech, which is interesting as they are two cities that have been on my radar but a little behind others like Dubai and Lagos. So, I was interested in what would transpire and it did not surprise that both are developing fast.

Saudi Arabia has been particularly active. Since his eminence Salman bin Abdulaziz Al Saud became King in 2015, there has been rapid change in the Kingdom. Women are allowed to drive, people can go to cinemas, and a massive new city is being built on the North coast called Neom. Launched by crown prince Bin Salman in 2017, the city is going to be 26,500 square kilometres of the smartest technolgoies ever deployed in a new build.

There’s also the Line, a two trillion dollar project to build a new city.

The Line is one of the first developments of Neom, and is a linear smart city under construction already in the Tabuk Province. The Line is designed to have no cars, streets or carbon emissions.

The Line, planned to be 170-kilometre-long (110-mile), is just one of the nine announced regions of Neom and is a part of the Saudi Vision 2030 project, which aims to create 460,000 jobs and add $48 billion to the country's GDP.

I was aware of these things, and fascinated to see how fintech has grown up in the country since I last visited. Back then, fintech wasn’t really mentioned. It was rules, regulations and the relationsihps between the central banks and commercial banks. Today, it’s all about fintech.

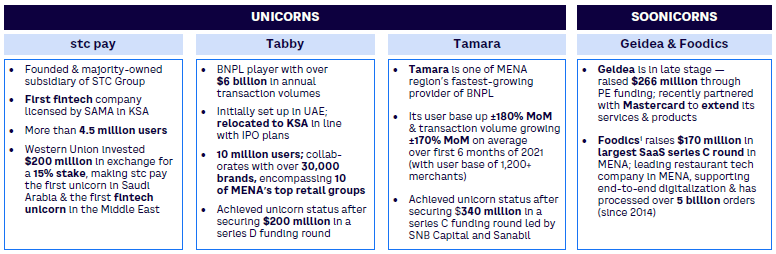

This is recognised in a new report published by Arthur D. Little. The report, titled “Realizing Potential of Fintech in Kingdom of Saudi Arabia”, the consulting firm highlights the rapid growth and innovation within the sector, spearheaded by initiatives such as Fintech Saudi. Fintech Saudi was launched in April 2018 by the Saudi Central Bank, also known as SAMA, and the Saudi Capital Markets Authority, and has already seen over $1 billion invested in local fintech firms.

It's worth a read.

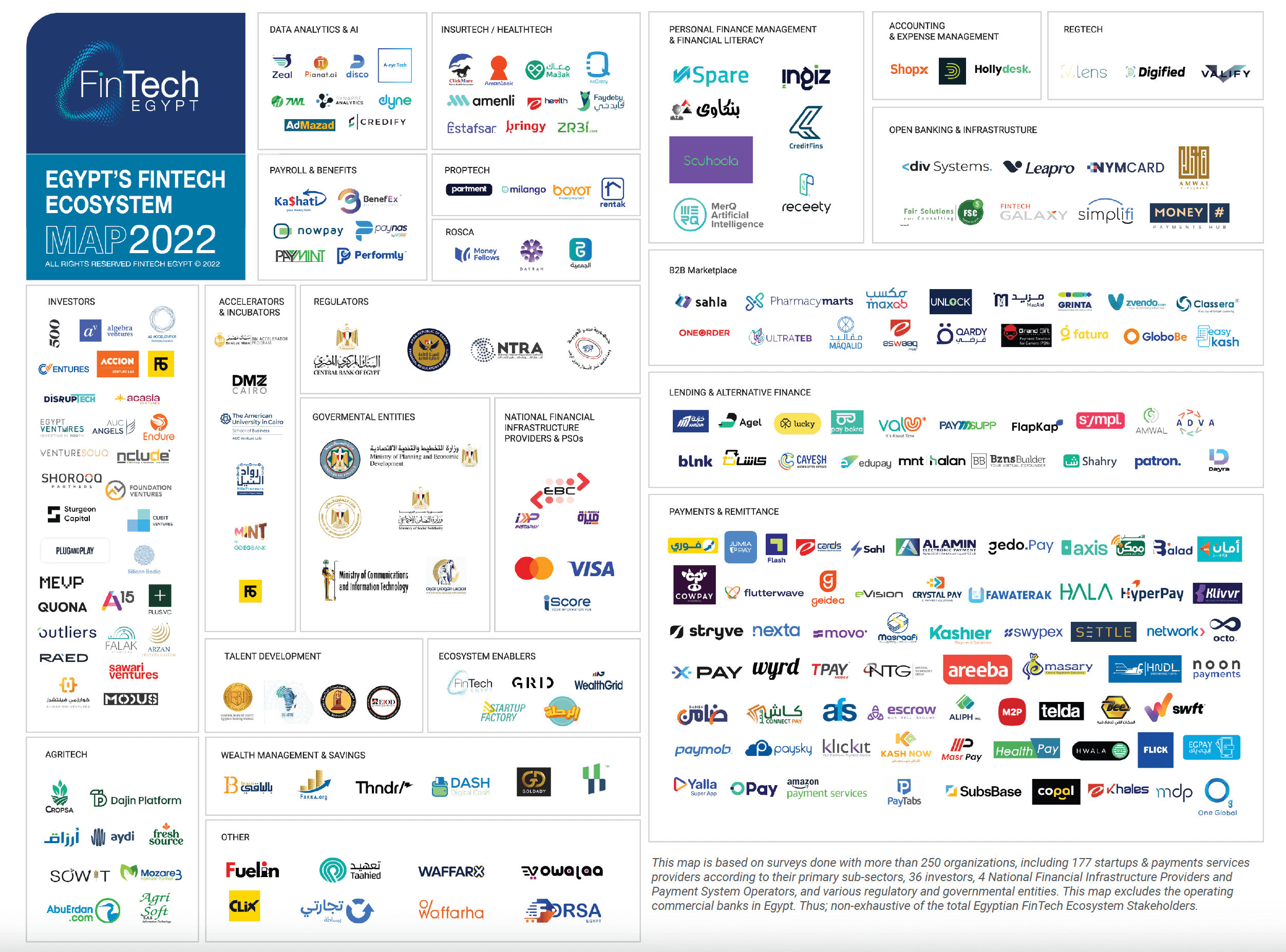

Similarly, the Central Bank of Egypt has been promoting fintech by creating a platform: fintech Egypt. Recently they also released a report, analysing the developments in the region, and a key part of the report jumped out at me.

The report revealed that the Egyptian fintech Investments hit a milestone in 2022, with a total of $796.5 million invested, where private equity investments represented $437.7 million, and a further $358.8 million VC investments. That represents an increased multiple by 28.7 times in the past 3 years.

Currently, there are 177 fintech and fintech-enabled startups and Payment Service Providers (PSPs) offering innovative solutions in the Egyptian market. Out of which, 139 startups provide pure FinTech solutions, while 38 provide technological solutions, along with embedded finance.

To put this in perspective, there were only two fintech startups in Egypt in 2014, rising to 112 in 2021.

Both Saudi and Egypt are rising fast as fintech centres, as are other countries. In fact, I can a MENA (Middle East and North Africa) burgeoning alliance of fintech centres from Riyadh to Dubai to Cairo to Nairobi to Cape Town to Lagos. In other words, you could see the day where these financial centres work together to give a blanket innovation platform for MENA.

That would be a good thing.

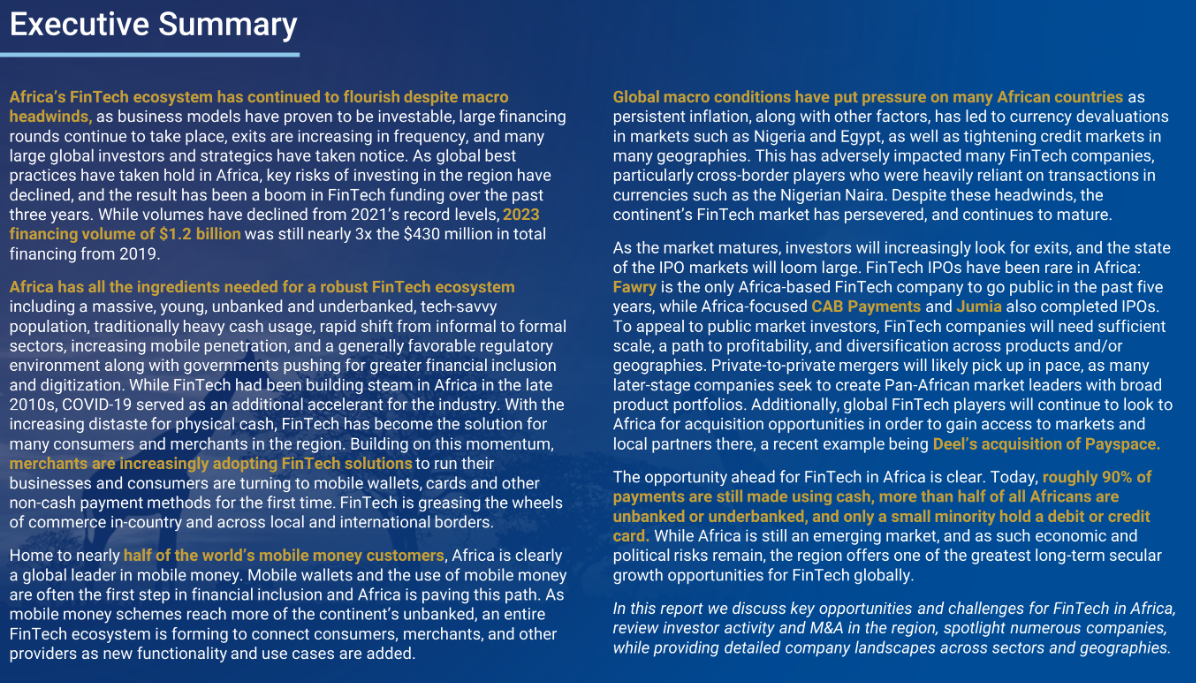

This is something explored by FT Partners, a serial investor in start-up fintechs, who just produced a really amazing report (218 pages) on the landscape for fintech in Africa overall. Their conclusion.

Meanwhile, you can download all three reports using the embedded links above.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...