Trust and money and day-to-day life go hand-in-hand. It’s all about who you deal with, how and the outcomes. Recently, I’ve lost trust with Apple, my bank, my friend and my brother. That’s pretty sad, isn’t it? But who do I trust? David Bowie.

David Bowie, RIP. Artist, music man, alien and hero. He was a force, and I was one of his biggest fans.

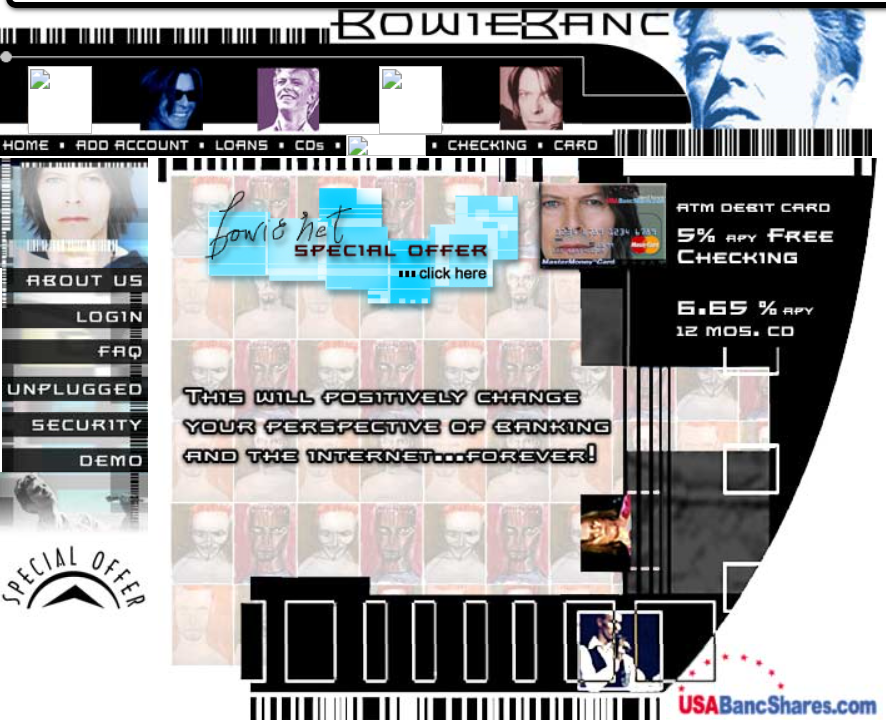

In 1999, he launched the David Bowie bank – bowiebanc.com.

Note the c on the web domain as it was not a real bank and didn't have a bank license. Hence, it could not be bowiebank.com. Instead, it was a bank launched with a bank partner – USABankShares – who did have a bank license, except this financial service was designed to capture the hearts and minds of his millions of followers.

“When I was a kid, music was the fascinating alternative future. But now it’s just another career choice such as banking or being a travel rep.” David Bowie, 1998

I guess that's why he opened Bowie Bank in 1999.

It didn’t succeed, because it was ahead of its time. In fact, when I look back to the dotcom boom and bust, around the year 2000, it was when the first generation of the network operated and it was full with faults. Remember, this was the age of AOL and dial-up lines. It was too early. However, Bowie being a visionary, he could see the future.

“I think the potential of what the Internet is going to do to society—both good and bad—is unimaginable. I think we’re actually on the cusp of something exhilarating and terrifying.” David Bowie, Newsnight interview, December 1999.

Since 2000, we’ve seen the smartphone, cloud computing, AI, biometrics and more technologies impacting society and the world. We are now in the world where, if Bowie had launched a bank, it would have rocketed I reckon. So, what would David Bowie launch today? Well, it wouldn’t be the David Bowie bank app, as he’s in heaven (or is he?). No, today it be Swiftbank. Not Swift, as in SWIFT – the Belgium based network for interbank messaging. No it would be Taylor Swift’s bank.

Taylor Swift. The biggest global superstar today, as evidenced by the Eras tour. Her net worth has just broken through over $1 billion and she is the biggest artist of all time, even beating the Beatles as the fastest artiste to rack up 12 number-one albums in just 11 years and six months.

In December 2023, Forbes named Swift the world’s fifth most powerful woman, ranking her just after the European Commission President, the President of the European Central Bank and two politicians.

So what bank should Taylor Swift launch?

Well, it would obviously do all the usual stuff – transactions, debit and credit cards (but only in digital wallets and in a virtual form), crypto and personal financial management stuff.

I don’t think it would go much further in Version 1.0 as you need an MVP (Minimum Viable Product), except there would be a few Swiftie extras that would appeal to her fans. There has to be an emotional connection with her worldwide fan base, not just offering banking. In fact, it has little to do with banking. It’s about increasing the breadth of the brand.

Therefore the key is to add emotion and authenticity to her community. How do you do that? Well, as The Conversation tells it:

“In this regard, Swift’s approach is pure genius. In the lead up to the release of her album 1989 she spent time scouring the internet and selecting 89 fans who were invited to her home for exclusive listening sessions – now referred to as the 1989 Secret Sessions.

Taylor treats fans as friends with whom she shares secrets. Her lyrics, albums, videos and even her NYU honorary doctorate speech are littered with hidden messages that fans can discover, decode and discuss.

This level of shared intimacy – albeit with millions of fans– keeps Swifties engaged in speculation and builds a community of ‘insiders’.”

Therefore, for Swiftbank, first and foremost is authenticity and transparency, the Swift brand values. Second is community. She would put the brand values into a banking context of girl-next-door who connects with her fans, trading bracelets, and feeling part of a fan community. In fact, the keys to her success include consistent messaging, differentiation and brand experience.

These would be core to Swiftbank, a bank you can love because you are all a part of it.

In fact, much of Swiftbank would operate like a mutual. The more love you give, the more love you get back. This means that if you take a loan, you can see the fans who funded your loan and connect. If you save with Swiftbank, you can see why you are getting more back on your savings from the fans you loaned to. It’s peer-to-peer love through money.

Then there would be the uniquely appealing gifts, such as early access to tour tickets and news about upcoming releases a day before the press release goes out. There would be things that appeal to the values of her community, such as being green (even with her private jet) and beautiful (the Swift beauty range starts here starts here).

The thing is that it would create a massive threat to her stardom if it wasn’t authentic, transparent, mutual love in a community-based bank. Equally, if anything went wrong or if service wasn’t brilliant, is it worth it?

It’s a huge risk, but one Bowie took. Will Swift?

For more about Taylor Swift in banking, click here https://thefinanser.com/2018/03/really-digital-bank-just-shake-off

If you’re interested in more about David Bowie’s view of the future, click here https://bowiesongs.wordpress.com/tag/bowiebanc/

Meantime Bowie and his management team were very innovative, creating the first Bowie Bond in 1997. What’s a Bowie Bond? Is it Jame Bond, played by David Bowie. No.

Bowie bonds were a type of bond backed by recording artist David Bowie's royalty streams, and marked the first such security backed by a performer's cash flow potential.

Bowie used the $55 million raised from the issuance to buy rights to his music from his former manager, which would then generate more royalties to bondholders.

The banker credited with making this happen, David Pullman, has since issued similar securities from other performing artists.

While an interesting concept, this type of artist-backed debt instrument has lost appeal with the rise of online streaming and file sharing.

For more on this, click here https://www.investopedia.com/terms/b/bowie-bond.asp

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...