Whilst I was in South Africa, they couldn’t help talking about Rugby (could they?). You may remember that South Africa won the Rugby World Cup last year* for the second time in a row – a rare feat – and are the top-ranked world rugby team right now. So, it’s not surprising they would talk about rugby, is it?

Whilst a debate took place on stage about rugby, I was interested in a throw-away comment about data. Data-driven sport is a big thing.

Behind the scenes, you’ll find that the Springboks work harder — and smarter — with the help of data analytics. Data-tracking technologies monitor players’ moves and vital signals such as heart rates, collision impact and body temperatures during training and match play, offering detailed insights into wellbeing, preparation, performance and recovery. “All players at this level are really good, so there’s an ongoing technical battle between coaches that’s similar to playing chess,” Jacques Nienaber, head coach of the Springboks said. “You must figure out the strengths and weaknesses of your team and the other teams’ coaches and players. We depend on data to help with that.”

Source: Technology Decisions

It’s interesting as I heard the same about Liverpool football team recently, and their rise to European Championship glory. Relying on an expert in data analytics, Liverpool adopted mathematical models “to assess player performance beyond what traditional stats showed. This unique perspective didn’t just focus on a player’s goal or assist tally but illuminated the potential impact they could make within Jürgen Klopp’s tactical framework.”

The reason I cite these two examples is that to be the best-in-class you have to be data-driven and, as mentioned the other day, you cannot be data-driven if you are data-dumb. The traditional banks are inherently data dumb because they have not created a core technology stack that is digital. The core operations are fragmented and wrapped up in a technical debt that is too big to break. This was called out by TS Anil, the CEO of Monzo, last week at London Tech Week:

“The incumbent banks…are burdened by legacy technology, legacy, business models, legacy mindsets. The naysayers will always say they might be able to build a good product, but can they actually scale a successful business? We deeply believe that the trajectory we’re on is the proof point of that.”

What this actually means is that challengers are digital masters and data wizards – how else could they become mainstream banks within a decade? – whilst traditional banks are sitting on data mountains that they have no idea how to mine.

Coming back to sports, if traditional banks were competing in the rugby world cup or football (never call it soccer) premiership, they would be bottom of the league**. Oh … that’s exactly what they are!

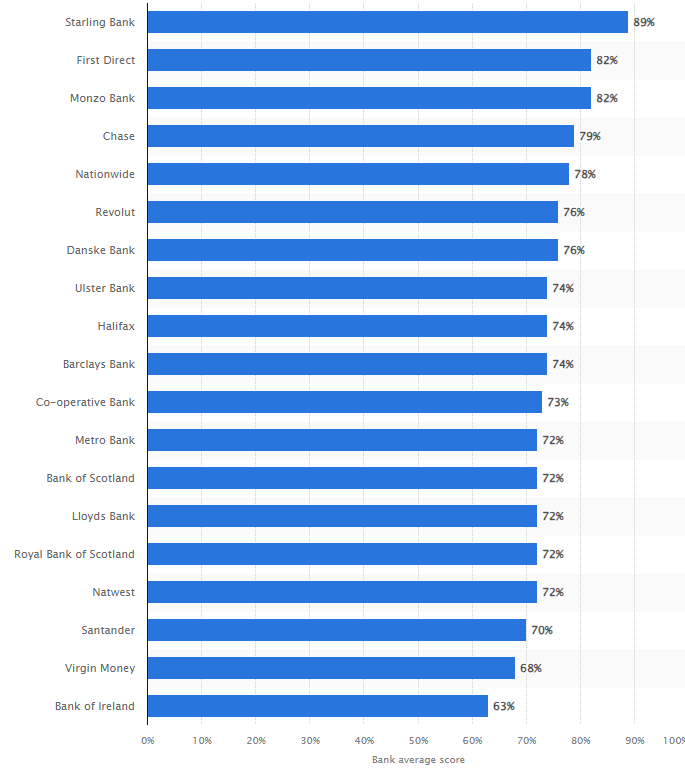

Customer Satisfaction Rankings for UK Banks

Source: Statista

* For those into this stuff, the South African team beat France, England and New Zealand by a single point in the quarter, semi and finals.

1-1-1.

It was an amazing performance and win.

But then I couldn't believe it was the referee's 111th game ... and then he retired.

More than this, the total number of points scored by South Africa from the quarter final to the final was 111 points:

-- South Africa beat France - 29 - 28

-- South Africa beat England - 16 - 15

-- South Africa beat the All Blacks - 12 - 11

29+28+16+15+12+11 = 111

Who would have thought?

** If banks were a football team https://thefinanser.com/2022/09/if-finance-was-a-football-team

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...