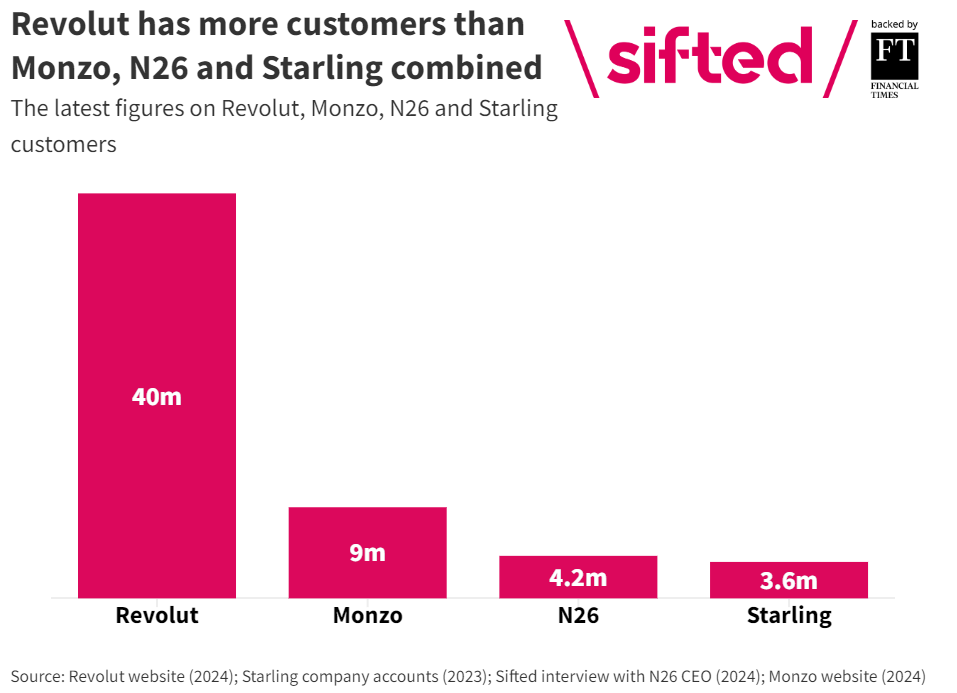

As Revolut reports exceeding 40 million customers across Europe and Monzo raises $430 million at a $5 billion valuation, many people are thinking that the challengers are no longer challengers. They are banks. Putting it in context, in the UK, NatWest have 14 million retail customers; Monzo has over 9 million. The challenger has matured. Yet, when reading various news reports on such companies, there are doubts. For example, The Financial Times argues that the new banks have not materially changed UK banking but just offer a boutique service for day-to-day payments. They quote various folks and end with this one:

“It’s silly to suggest that neobanks have materially challenged the hegemony of traditional institutions. Arguably, their only lasting impact is pushing big banks to improve their own digital platforms.” Alex Barkley, managing partner at Lancero Capital.

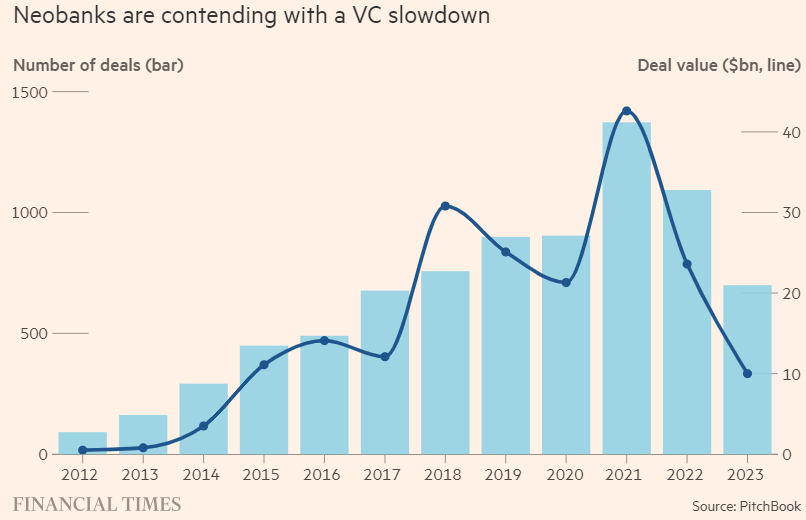

It’s an interesting take and, specifically, the FT’s take is that with investor funding drying up and a lack of product diversity, their future is uncertain.

I’m not so sure. As mentioned yesterday, some people believe digital banking is done and there would be no point in investing in a new digital bank. I disagree as there is still some way to go. For example, think about when Monzo and Starling were launched. All the buzz was about PFM (Personal Financial Management). Today, it’s all about AI. Tomorrow, it’s all about Quantum. There’s always space for a new contender.

That’s why it’s interesting when you look at a company like NuBank in South America. Sifted reports that: “Brazil’s Nubank made neobanking history by announcing that it had reached 100m customers, 11 years after its launch and two years after it listed on the New York Stock Exchange. It’s the first time that a neobank outside of Asia has hit the milestone and comes hot off the news that it made $1bn in profit and $8bn in revenue last year. Those are numbers that Europe’s big-name neobanks — Monzo, Starling, Revolut and N26 — could only dream of.”

Customer base by bank today:

Source: Sifted

The thing is that NuBank focused upon the unbanked and underbanked – a huge population in the South American markets – and therefore had different opportunities and challenges to the UK and European challengers. Meantime, there are significant moves in Europe between the old banks, new banks and neobanks. Again, at the head of the pack, is Revolut. Why? Because, according to Sifted, Revolut has Unlike Nubank — and its European peers — Revolut has “blitzscaled”.

It’s so far launched in 37 countries and is available in an extra 14 territories and countries, including Chile, Azerbaijan and Kazakhstan, where it functions largely as a money transfer app with some crypto trading services.

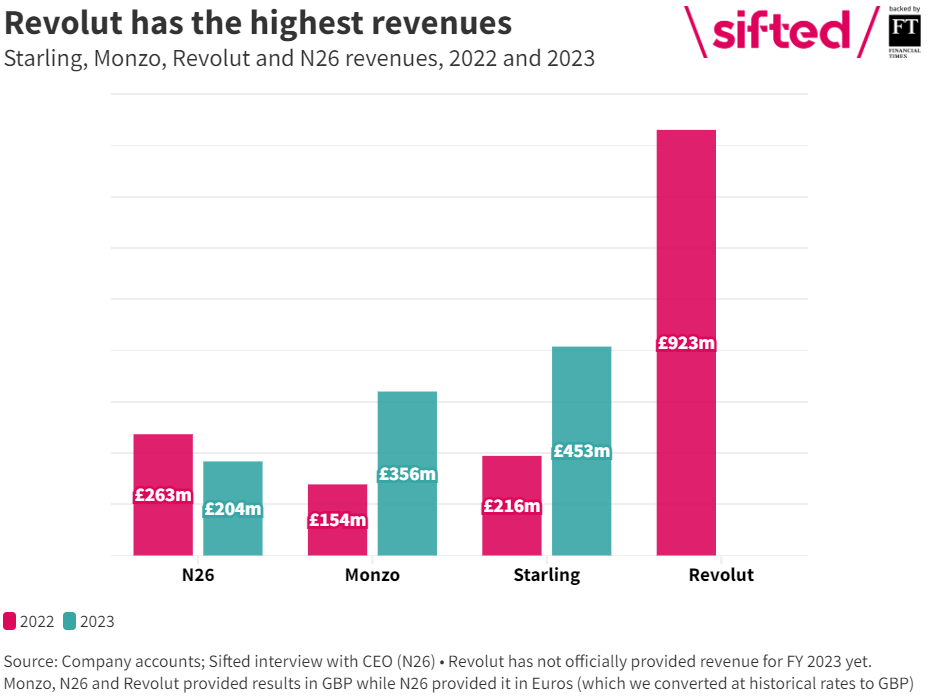

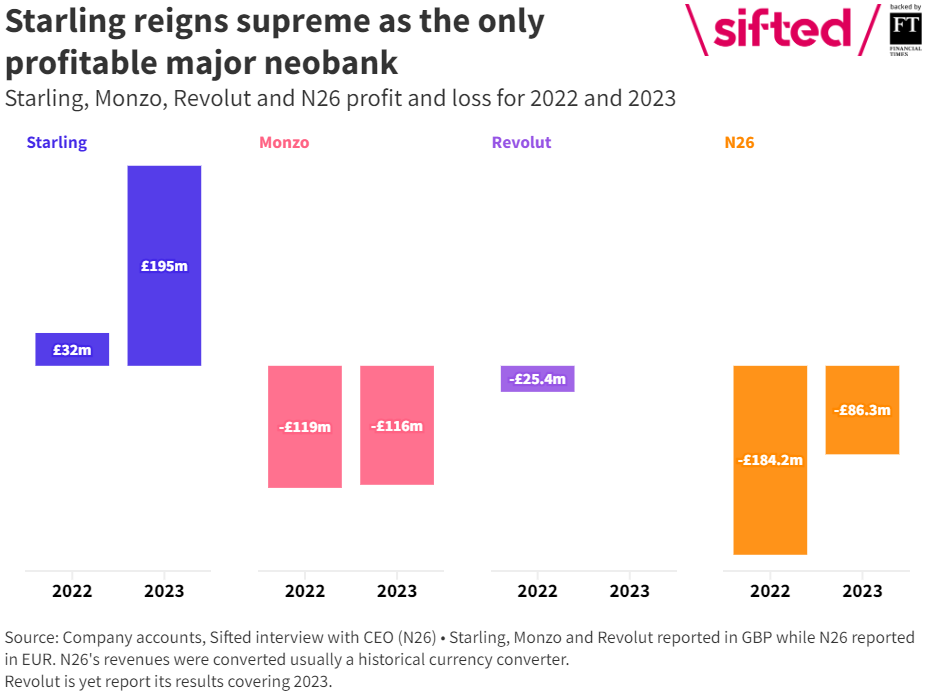

That doesn’t mean it’s all the yellow brick road for Revolut. In fact, there’s a bit of a rocky road as interchange fees are around a third of its £923 million in revenue reported in 2022, whilst foreign exchange and wealth drove £270m in revenue for the business and, despite making close to a billion in revenue, the neobank sunk back into the red with a pre-tax loss of £25.4 million after reporting a £39.8 million of profit the previous year.

That’s rather different to Starling Bank, who made a pre-tax profit of £195 million last year with £453 million in total revenue through a different focus of lending to small and medium-sized enterprises (SMEs).

All in all, I would agree that yes, digital banks are growing up. From being called challengers and neobanks, they are now fully-fledged digital banks. However, that does not mean there’s no room for another one. Another one that is 100% Generative Finance …

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...