I find it funny that we talk so much about onboarding, KYC (Know Your Customer) and AML (Anti-Money Laundering), and yet the whole of that system is broken. Every day in every way, everyone is getting around the system.

You may think that account opening is hard. You have to send identification documentation; you have to get things to prove that you are you; you have to prove yourself. Then, once you’re through all of that process, you have access to the whole world of money and, by saying “the whole world”, I mean the whole world.

But that system is all broken, as evidenced by a recent 40-minute video produced by The Financial Times. Did you see it? If you didn’t, it’s here …

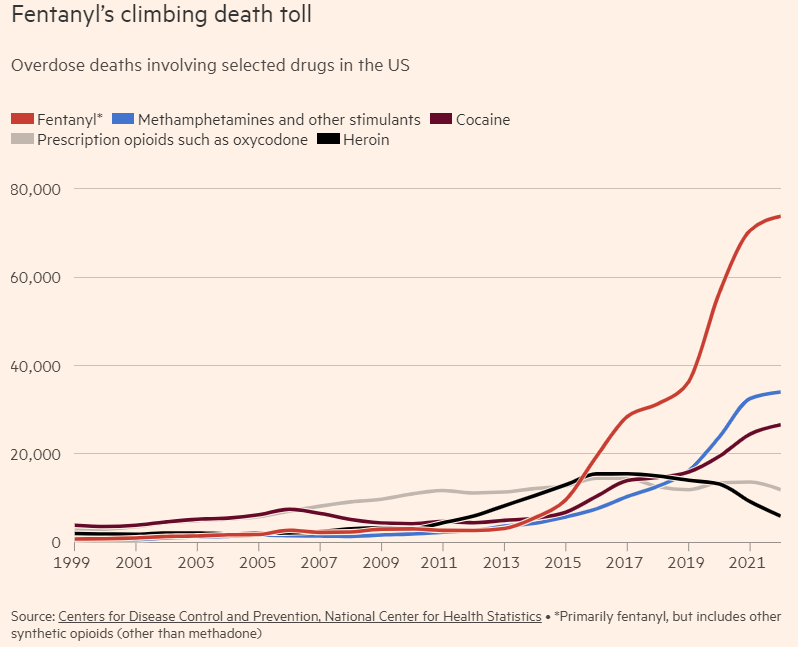

… and the core message is that money launderers from Mexico to Italy to China are connected and co-ordinated, and creating the health crisis in the USA with Fentanyl.

Apparently heroin is too weak. Fentanyl is the real deal if you want to zone out. But how can this be? We have huge amounts of drugs pushed to kids and funded by banks?

In essence, the officials claim, a new global money laundering network has evolved that marries two powerful financial forces — the huge stockpiles of cash being accumulated by the Mexican drugs cartels from selling drugs in the US, and the rapidly growing volumes of capital seeking an escape route from China.

Wow.

You would think with all of our onboarding AML and KYC checks, this would not happen, but it turns out to be easy. For example, HSBC laundered almost a billion dollars for Mexican drug cartels in the 2000’s. In the movie Cartel Bank, it charters the role of the global bank in moving funds and notes that:

- HSBC laundered over $881 million for Mexico's Sinaloa and Colombia's Norte del Valle drug cartels.

- HBC's weak AML controls led to illegal fund transfers and currency exchanges through their correspondent banking services.

- HSBC was but one of a string of major banks caught in illicit transactions: ING, Barclays, and Credit Suisse, among others, faced serious fines for violating sanctions in place against countries like Iran and Libya.

- In 2012, U.S. federal regulators hit HSBC Holdings with a $1.9 billion fine, along with $665 million in civil penalties, for significant lapses in its compliance and anti-money laundering (AML) systems.

Now, according to The Financial Times, Citigroup is the launderers favourite global bank where a senior DEA official is noted as saying that, “in this investigation, we had money couriers making 24 back-to-back deposits totalling $16,000 to a Citibank ATM . . . There were 15 back-to-back deposits totalling $20,000 also to a Citibank ATM . . . They figure out the places that are more favourable to them.”

So, HSBC, Citi and many other banks are an integral part of the money launderers network and seem clueless in how to deal with it. No wonder it’s money laundering as a service.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...