Being debanked is pretty awful … just ask Nigel Farage or Chris Skinner ... but what about if you’re a woman? As money controls life, do women get a good deal? Not really. Everywhere around the world, women have less access and use of banking, and yet women are the global influencers of finance. What’s going wrong?

The main thing is work and money, which is largely controlled by men. This is reflected in figures from every economy but here is an example that illustrates it well:

Source: The World Bank

What is interesting in this debate is that, as I’ve blogged often, money controls life. When a woman does not have a bank account or depends on a male for their financial needs, then there is a change of power and a power influence that is a distortion. There are many papers that highlight this issue, and the core point is that if you cannot have a bank account or are dependent upon a partner who has one, then you are controlled and possibly subjugated. Danske Bank makes this clear, showing that financial abuse can be when someone:

- Stopped you from having access to your bank account or insisted their name be added to your accounts.

- Prevented you from spending on essentials items like food and bills.

- Asked you to account for everything you spend.

- Insisted you give them your income from salary or benefit payments.

- Takes out money or gets credit or loans in your name without your knowledge or permission.

- Spend your household budget on other things without telling you.

- Forces you to put all the household bills in your name.

- Has offered to buy shopping or pay bills with your money, but you don’t see this happening.

- Withdraw money from your account without your knowledge or permission.

- Puts pressure on you to draw down, transfer or stop making pension payments.

- Makes you take out or stop paying for insurance policies.

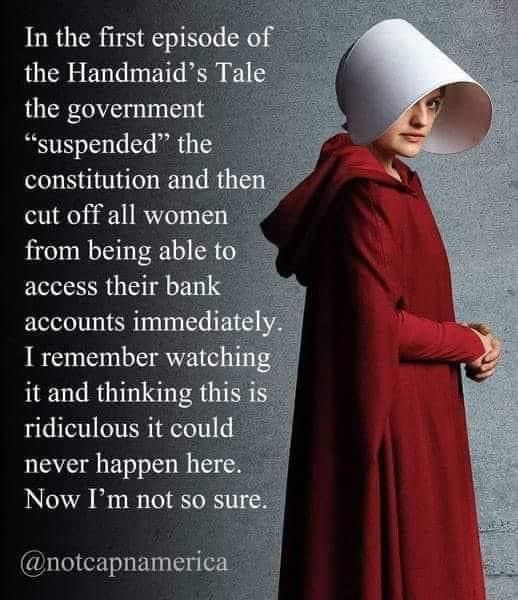

This point came home to me when watching The Handmaid’s Tale, Margaret Attwood’s amazing story of a dystopian future where fertile women [“Handmaids”] are driven into child-bearing slavery. How did that come about? Well, harking back to Margaret Attwood’s seminal book, she points to the first point of control: money. Paper money had been replaced by Compucards that accessed bank accounts directly. One day, after the fall of the government, Offred – the lead character in The Handmaid’s Tale – tried to use her Compucard in the local store, and her number was declared invalid. She called her bank, and got a recording stating that the lines were overloaded. When she reached her home, Offred called her friend and learned that women could no longer legally work or hold property. Their bank accounts were transferred to their husbands or the nearest male family member.

Money is power and power controls everything.

For this reason, I think it is interesting to watch the number of women founding and running financial firms and fintech startups. Here are a few:

- Amber Skinner-Jozefson, Chief Executive and Managing Director of Oakam

- Karin Fuentesová, Founder and CEO of Digitoo

- Sofie Quidenus-Wahlforss, Founder and Chief Executive of omni:us

- Marie Assé, Co-Founder and CEO of Clustdoc

- Camilla Giesecke, Chief Expansion Officer of Klarna]

- June Felix, Chief Executive Officer of IG Group]

- Aiga Senftleben, Co-Founder and General Counsel of Billie]

- Sara Koslinska, Co-Founder and Chief Executive Officer of Limitless

If you want to know more then checkout the Women in FinTech powerlist, published annually by Innovate Finance (run by a woman), but what got me, in thinking about The Handmaid’s Tale, is that if you debank someone then that’s it. They have less or no power and, for women, many are debanked. For many women, they depend upon a partner to provide their financial service. That’s not right and needs to change. We need more access for all women to open banking and full financial services. There’s a big opportunity there and some are taking it. Is this something you could do?

Cover image sourced from here: The Living Wage can loosen the grip of women’s poverty

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...