I find it interesting that most reportage of fintech is very much B2C focused. We talk a lot about Stripe, Adyen and Klarna; we talk about A2A, P2P and PIS; we talk a lot about challenger banks and neobanks; we talk a lot about retail and consumer markets. We don’t talk so much about B2B or G2B (Government to Business). These are the areas that are growing fast, more than B2C where the fintech successes have broken through. In B2B, in particular, the space is still early days.

Full disclosure: I recently got involved in a B2B start-up called WebAccountPlus or, as I shorten it to WA+. WA+ is focused upon providing small businesses with automated accounting using AI. It’s a pretty good proposition and, if you would like to know more or invest, more details here: https://webaccountplus.com/

The reason why I mention this is the B2B fintech space is going to be the biggest growth area for the next decade. The B2C fintech space is near enough done, although there are still areas of growth, specifically around AI.

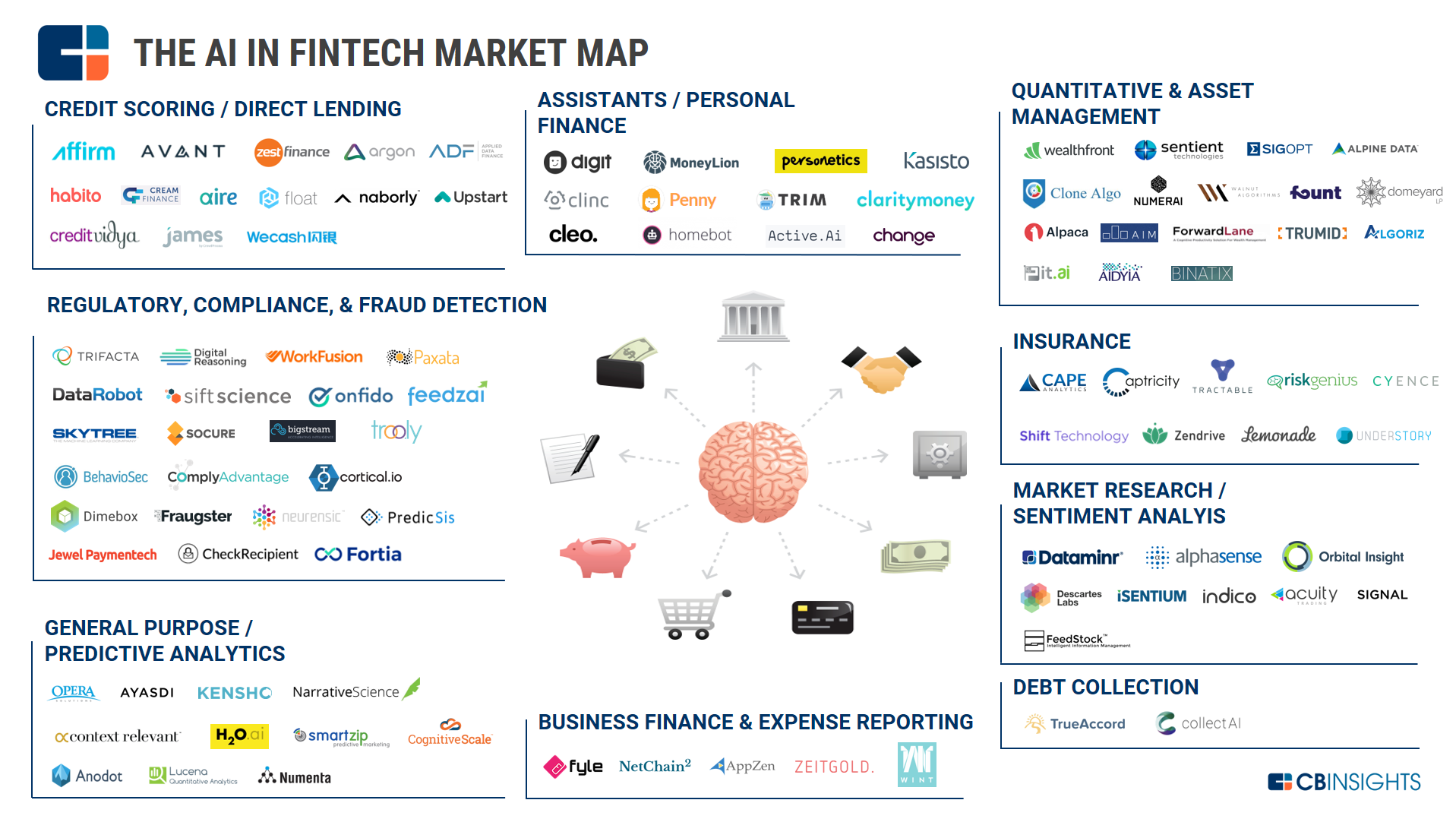

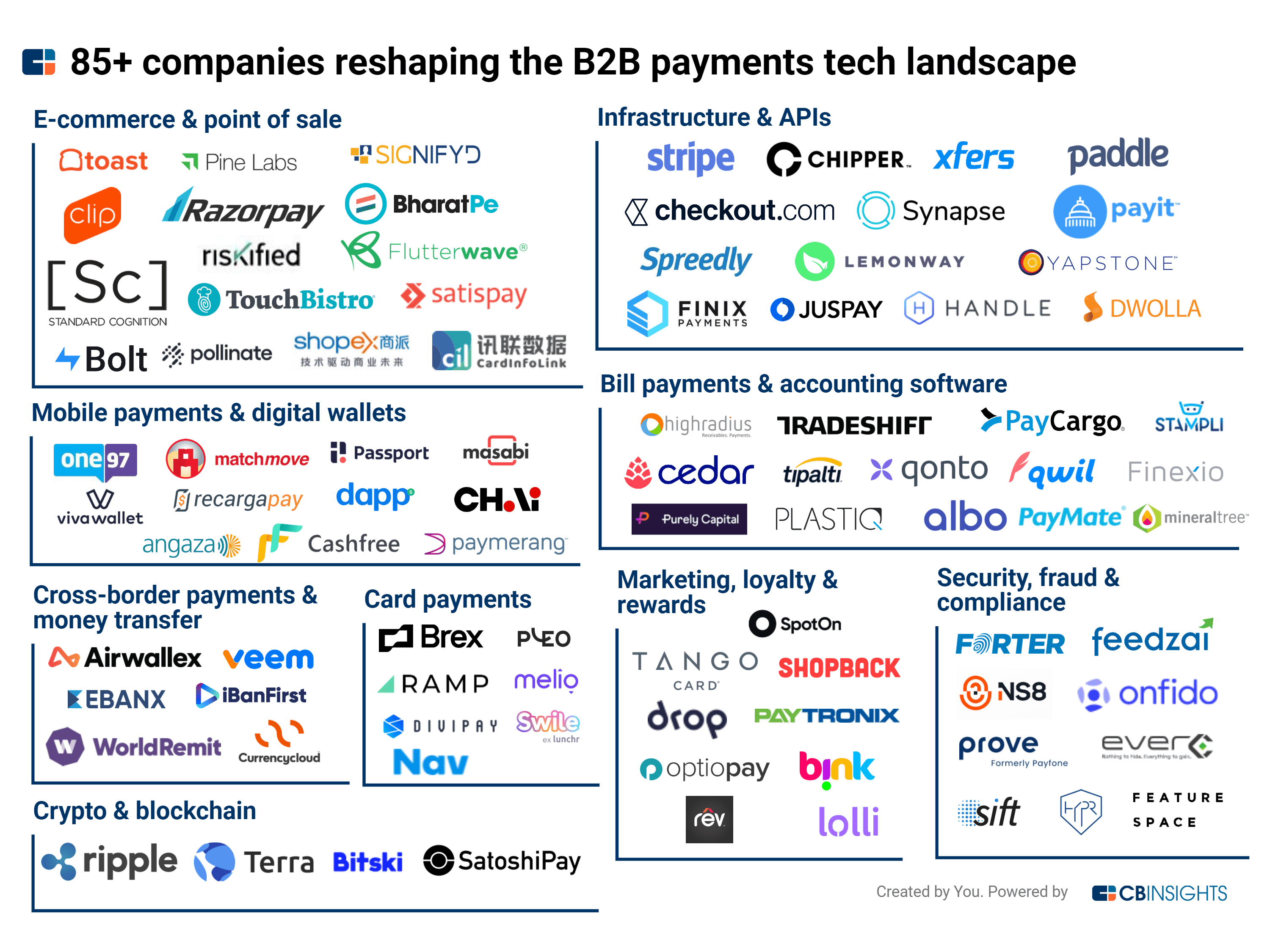

Bear in mind that these two charts from CB Insights are purely shining a light on two very specific areas – AI and B2B payments – and you realise how early days we are.

We think of the unicorns and breakthrough companies, but there is still a long way to go. That’s why the motto at 11fs is digital is only 1% done. As Jason Bates wrote eight years ago:

“When we talk to banking clients at 11:FS, we often use a slide that says ‘Digital banking is 1% finished’. Clients ask us what it would take to get it to 2%, but that’s not really what we’re trying to communicate. ‘1% finished’ is a mindset, it’s an acknowledgement that the current shift from commodity banking products to intelligent digital services will create a new playing field that is completely different from before. In this new world commodity banking products will be buried beneath intelligent services, end-to-end journeys, guided marketplaces and financial platforms that will make everything about your finances clearer, easier to manage, and more transparent.”

And what intrigues me, as time goes by, is that start-ups are attacking every area of processing and financing, piece-by-piece, with technology, innovation and vision. We are creating a whole new world of banking through the network. Whether it be currencies (crypto and CBDC); payments (Adyen and Stripe); banking (Monzo, Nubank and Chime); or investing (roboadvisors and eToro) … every part of banking and finance is being disrupted by tech and yet we have hardly event started.

All of the examples given in the last paragraph are mainly focused upon the B2C space, but what about the B2B markets? What about government to business? Government to consumer? Company to employee?

This is where the next wave of change will come, and it will be even more massive.

Equally, even in the B2C space, nothing is finished. It has only just started as we now have AI and, soon, quantum. Digital is purely about a journey, a continuum of change. It is nothing to do with a project or a finite journey. Bear this in mind as you look at your projects and change programmes.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...