I don’t like blogs on a Saturday – we should be relaxing – but this X update from one of the Winklevoss twins (Tyler) caught my eye and so I just thought I would leave it here. Here's what Tyler posted:

Today, the Fed confirmed that Operation Choke Point 2.0 remains in full swing, provided valuable insight into how it works, and verified that the Harris crypto "reset" is a scam. The Fed revealed all of this in a 13-page enforcement action it issued this morning against crypto-friendly bank @CustomersBank.

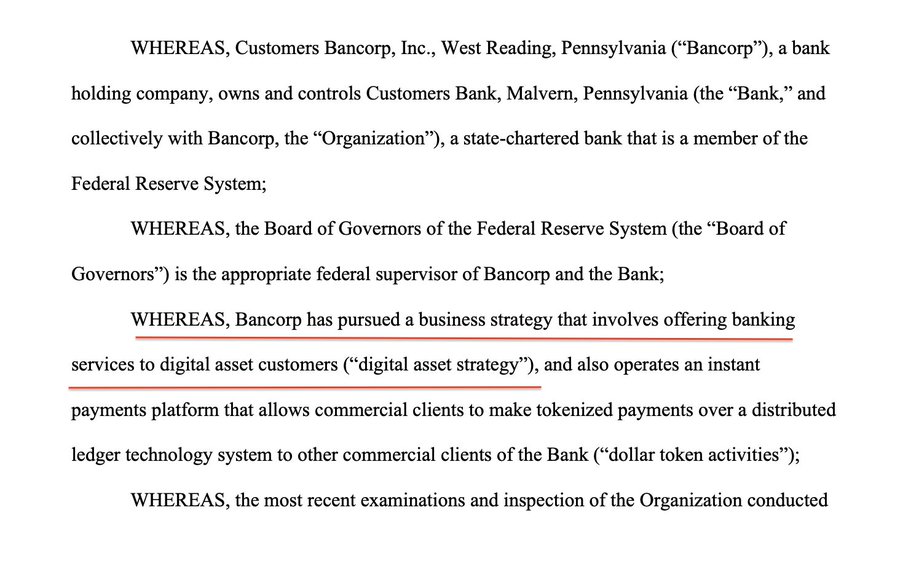

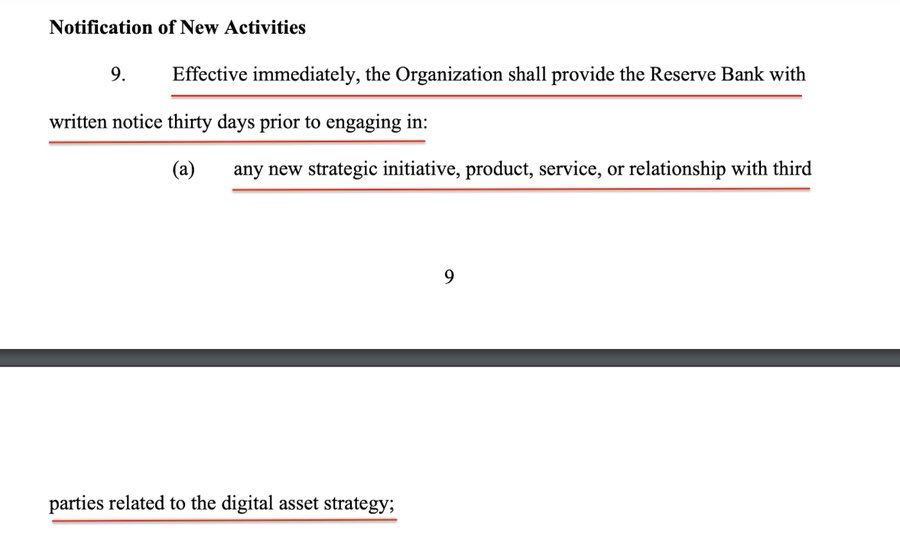

The punchline of this enforcement action is that Customers Bank must now give the Fed 30 days of advance notice prior to entering into any new banking relationship with a crypto company. Of course, the only way you can understand this is by connecting the 3rd paragraph on page 1 of the order with that last paragraph on page 9.

Given that Customers Bank is one of the only few crypto-friendly banks remaining in America today, this means that the Fed is now a direct gatekeeper standing between crypto companies and their ability to get a new bank account. This is not how principles-based regulation is supposed to work. The decision whether to bank a company should be decentralized across the entire banking industry and made by each bank at its own discretion. Now, this decision has been centralized by the Fed and will be made by the Fed at its sole discretion.

The Choke Point has been created.

What exactly did Customers Bank do to earn this regulatory straitjacket and be forced to abdicate its own business judgment and decision-making to the Fed with respect to banking crypto companies? That part is entirely unclear. The non-allegation allegations are so hand-wavy and vague, they would make Franz Kafka blush. All we know from the 13-page order is that during the most recent examination and inspection, the Fed “identified significant deficiencies.” Not a single fact or tangible finding, however, is provided to back up this claim. The public must take the Fed's words for it. Trust us they say. How convenient. You can read the whole order here: https://federalreserve.gov/newsevents/pressreleases/files/enf20240808a1.pdf…

The punishment (for now) for these “significant deficiencies” is that Customers Bank must rewrite many of their policies within the next 60 days. Something the Fed could have simply asked them to do sans enforcement action lol. But that’s missing the point. These “deficiencies” and their remedies are pretextual. The Fed’s real concern and purpose for this exercise is to build a public case, however ambiguous, that gives it the excuse, air cover, and rationale it needs for its ultimate goal, which is control.

The unlawful control of what companies and industries a bank can bank, and what companies and industries it cannot. Apologists will say that Customers Bank can still bank crypto companies, they just now need the Fed’s explicit approval to do so. Maybe so, but what are the statistics on how many crypto companies are getting approved and how many aren’t? Is the Fed willing to publish these numbers? I’d sure like to see them.

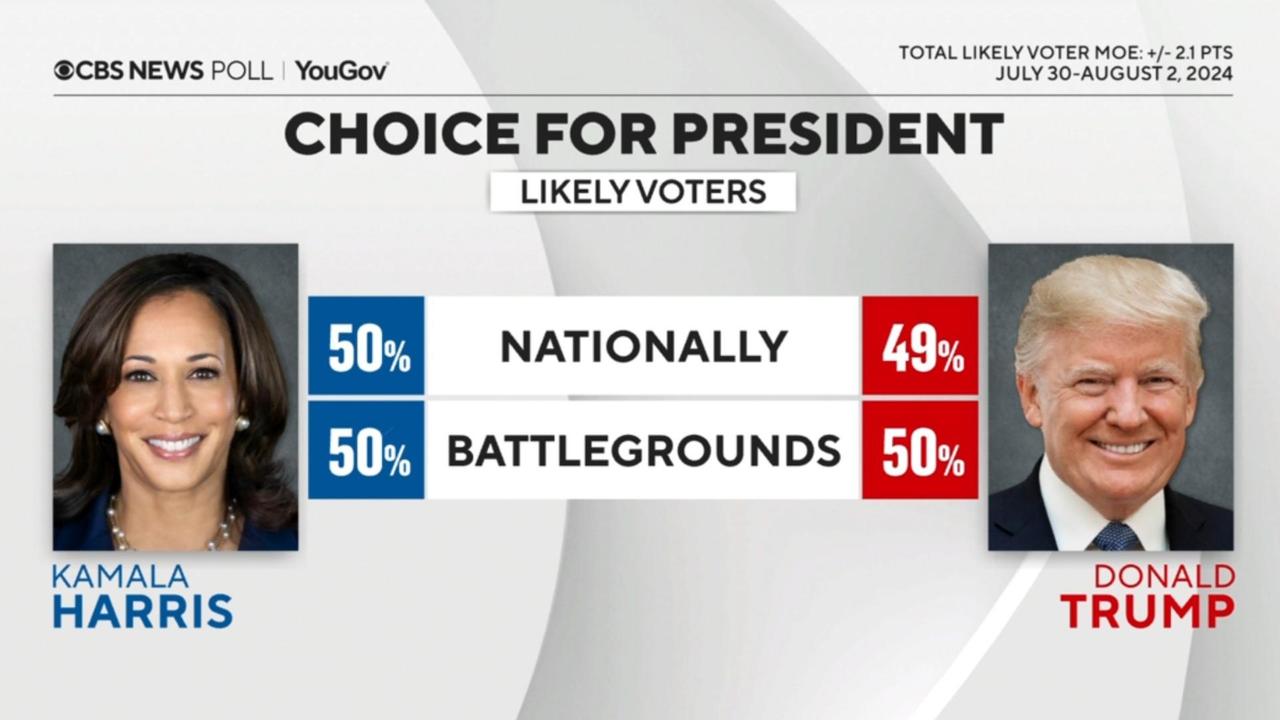

And what will those approval numbers look like if Kamala Harris wins in November and Elizabeth Warren is still a sitting Senator.

My wager is next to zero if not zero. And make no mistake, this enforcement action is the Fed playing nice with nerf guns. It's just the table setting. Not even the appetizer. The Fed is on its best behaviour at the moment because the election is around the corner. If Harris wins in November, the gloves will come off. Hope is not a strategy. It’s time to demand real change now.

Onward!

According to Coin Telegraph, this is the strategy of Kamala Harris. In other words we have the anti-crypto candidate versus the pro-crypto one. Having said that, as some have commented, asking for a 30-day period to onboard a partner firm is just a standard in the banking industry and that Tyler does not understand how banking works. Either way, he is a finfluencer.

The thing for me is that it is setting a tone in the run-up to the US election that if you vote for the democrats, you vote for an anti-crypto future versus a vote for a republican is for a pro-crypto future.

Views?

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...