I just got the latest Finch Capital report on The State of Fintech 2024. Many of us think that fintech valuations and investments have gone through the floor, and this reports make clear that it depends where you are. The UK is doing well, as is the Netherlands, whilst Ireland has seen a 90% drop in investments. It all depends where you are.

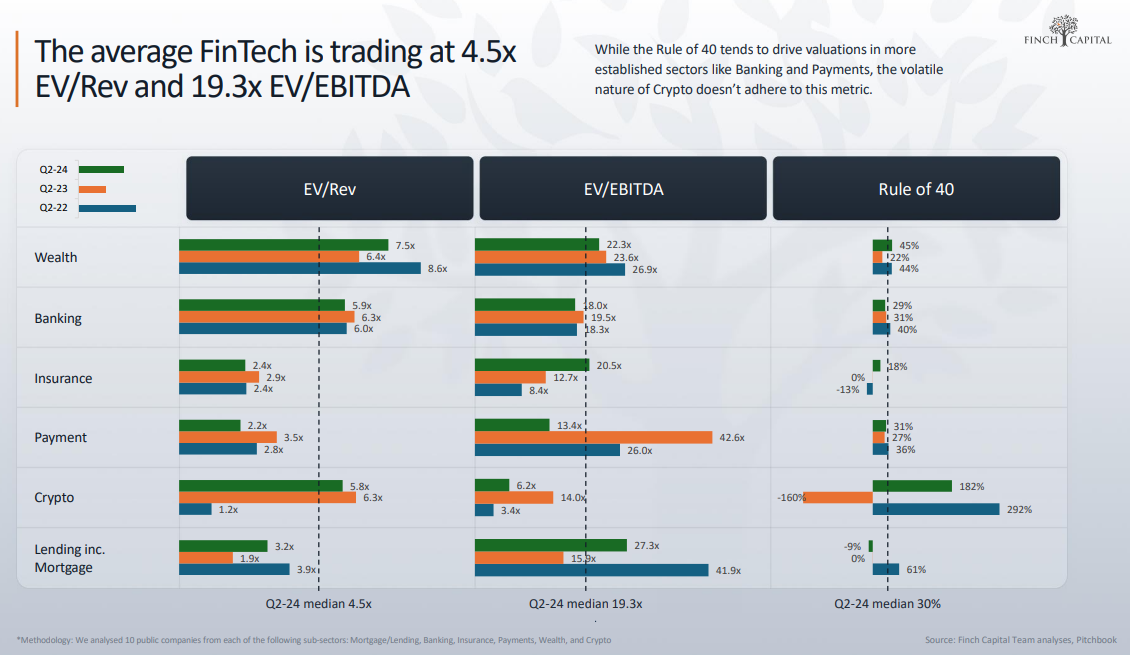

What caught my attention was this chart of valuations by the different areas of fintech interests:

The chart takes some explaining for the uninitiated as EV/REV, EBITDA and stuff is for investors and not the person on the Clapham omnibus. So, let’s just explain terminology for beginners and then move on.

What Is the Enterprise Value to Revenue Multiple (EV/R)?

The enterprise value to revenue multiple is a ratio that compares the value of a company, its potential market worth, with its revenue, the actual money the company earns. The lower the EV/R multiple the more attractive a company is to investors, as it means the price of the company or its stocks corresponds with what they're worth.

What is EV/EBITDA?

EV/EBITDA is a ratio that compares a company’s Enterprise Value (EV) to its Earnings Before Interest, Taxes, Depreciation & Amortization (EBITDA).

What is the Rule of 40?

The Rule of 40 is a principle that states a software company’s combined revenue growth rate and profit margin should equal or exceed 40%. SaaS companies above 40% are generating profit at a sustainable rate, whereas companies below 40% may face cash flow or liquidity issues.

Now you know the background, here are a few reasons why this slide stood out for me.

First, EV/REV. I was with a VC the other day and he told me that Wealthtech is where the action is today, and this chart confirms this with EV/REV at 8.6x. Compare this with bank valuations where, as of October 2023, the average EV/Revenue multiple is 1.8x. The average fintech is 4.5x. That’s pretty impressive and is because investors are looking at the future projected growth of these businesses. Traditional banks are not forecasted to grow like a Revolut or a NuBank. Hence, the multiples are completely different.

Having said that, I have to wonder why the crypto companies have tanked from a multiple of 6.3x a year ago to just 1.2x today. What’s going on? Well, there’s a whole lot pressures in the crypto markets, pushing values down and creating questions about the future. These pressures are mainly with investors, who are concerned about interest rates, and strong inflation data, combined with risk aversion, which is why bitcoin fell by more than 16% in August and Ether had its worst drop since 2021.

Second, EV/EBITDA. Most banks aim for this to be below 10, as the more a bank can provide returns that match valuation the better. But the fintechs are trading at twice this multiple, almost 20x EV/EBITDA. More than this, some fintech sectors – payments and lending – were running at over 40x during 2023. In fact, looking at the chart, those two sectors have been on a roller-coaster over the past two years. This is because these are now the most mature sectors in fintech and profitable, so investors have been far more attracted to a proven track record.

Third, the Rule of 40 does not apply to banks, as they are not SaaS companies. Should they become one? It depends, but unlikely as bank metrics and valuations are completely different to fintechs. Banks are not technology companies and they are not fintechs. They are banks. This is where core bank platforms come in—helping fintech companies quickly launch and scale digital banking and payment products. Core bank systems allow fintech startups to offer banking services without the long and complex development cycles that traditional banks typically face. That’s why a fintech with measly revenues can become a unicorn overnight, but banks cannot.

Anyways, this was a little bit of nerdy blog but, if it interests you enough, go and download Finch Captial’s report to learn more.

Meantime, a final comment from Mike Brennan, a partner at Finch Capital:

“The challenges that fintech faced in 2023 were necessary for the sector to mature and become more sustainable. While funding may be down overall, and unicorn chasing has slowed, there is plenty of opportunity for companies that are capital efficient and have a clear path to profit.

“With AI transforming the industry and significant dry powder still available, the next 12-18 months will mark a turning point for fintech in Europe. The next wave of fintech success stories will likely be built on sound financials rather than rapid revenue growth alone.”

In other words, investors have moved from fintech to AI. Just wait till Quantum hits.

Definitions sourced from Indeed, the Corporate Finance Institute and Cloud Zero.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...