Unsurprisingly, after a major election that will influence the Western world, the election of Donald Trump resulted in a flood of PR releases and contacts to tell me how this will influence the economy, Europe and the world. Some even got more specific, talking about how it will change fintech and cryptocurrencies. Let’s take a quick look.

Thys Louw, Emerging Market Fixed Income Portfolio Manager, Ninety One said: “The initial market reaction reveals the expected policy mix to comprise more expansionary US fiscal policy, reduced government regulation, a change in geopolitical stance, and increasingly aggressive trade policy towards global manufacturing centres such as Europe and Asia.”

Daniel Casali, Chief Investment Strategist at Evelyn Partners, believes that:

“The combination of a clean sweep victory means tax cuts are likely over the coming year. That will be beneficial for equities as it means lower taxes will boost company earnings. So, the combination of a clear victory along with the impact of those tax cuts, will be beneficial for growth and the equity markets are reacting positively to that.”

It may be good for equities, but it is not so good for the future of the world some believe. Nazmeera Moola, Chief Sustainability Officer, Ninety One comments:

“The Republican victory is likely to see the US retreat from all global climate initiatives – much like we saw in the first Trump presidency. This is likely to slow momentum to combat climate change unless other parts of the world step up and fill the gap.”

This is backed up by comments from Garry White, Chief Investment Commentator at Charles Stanley:

“[Trump] will want to accelerate growth, promote US business, boost real incomes and jobs. He will regard the domestic economic imperative as more important than foreign policy … [and] there will be a major shift in government attitudes to net zero.There will be fewer bans and subsidies to promote green investments and more licences for fossil fuel.”

The bottom-line seems to be volatility.

Lindsay James, investment strategist at Quilter Investors, said:

“Volatility is likely to be the defining feature of this presidency. With the future of Ukraine now in the balance, and geopolitical risks seemingly increasing every day, investors will be best placed to try to block out the noise, remain invested and base their decisions on the fundamentals of corporate America, instead of the measures enacted out of the White House.”

Lots of other views here at IFA Magazine.

What does this mean for banking?

Wells Fargo analyst Mike Mayo thinks it will be a boom.

In a research note, Mayo said Trump will be a “regulatory game changer” for the banking sector. A new Trump administration would mean “more free markets, less harsh oversight (aids capital, costs, fees), and reduces ‘regulatory risk.’”

These things would help banks by driving investment banking revenues, loan growth, and a more pro-business attitude that will help banks’ bottom line. Citi is a favourite to benefit, according to Mayo.

Nice.

What does this mean for tech?

Big tech firms are jumping for joy as many of them backed Trump to the hilt. Sure, Elon Musk appeared at his rallies but, in the background, other big hitters were bhined him all the way such as Peter Thiel. Why? Tax cuts. As The Verdict reports:

“A second Trump presidency will see economic policy focused on extending the business tax cuts of his first presidency. In 2017, the first Trump administration cut business tax from 35% to 21%, with a further cut to 15% expected during a second Trump administration. However, political economy research firm TS Lombard noted in its US Election Executive briefing that Trump has wavered on this commitment to a 15% rate given the growing US fiscal deficit.”

What does this mean for fintech?

It could be good, as there is a view that he would like to see more neobanks launch. UK fintech DECTA’s CEO Scott Dawson said:

“A second Trump term means a change of leadership at major regulation and enforcement bodies like the FTC, with an emphasis on getting rid of regulations. It’s likely that we’ll see the granting of new banking charters, and, with a general lack of effective regulation, it’s a certainty that low-quality players are going to enter the market. This could mean increased competition, or it could mean a race to the bottom.”

What does this mean for cryptocurrency?

This is clearly the area where it is most positive and impactful, as I said before the election. Specifically, his relationship with Elon Musk, Peter Thiel and other tech Tsars will see a crypto revolution in the next four years in America, as evidenced by the rise of bitcoin which surged to a record high of $75,060 on 4th November. This is fuelled by investor confidence in the cryptocurrency space at the prospect of a Trump presidency. Trump wants to be the Crypto-president.

Nigel Green, CEO of financial and asset management firm, deVere Group, said:

“Trump’s open support of cryptocurrency has triggered this surge, as many investors anticipate that a Trump victory would clear the path for mainstream adoption and regulation that is both favourable and necessary for Bitcoin’s continued growth.

“Also, public backing from influential figures in the crypto world has given Trump’s campaign substantial credibility among tech investors. This pro-crypto narrative could pave the way for regulatory clarity, bolstering institutional investments that could send Bitcoin to unprecedented heights.”

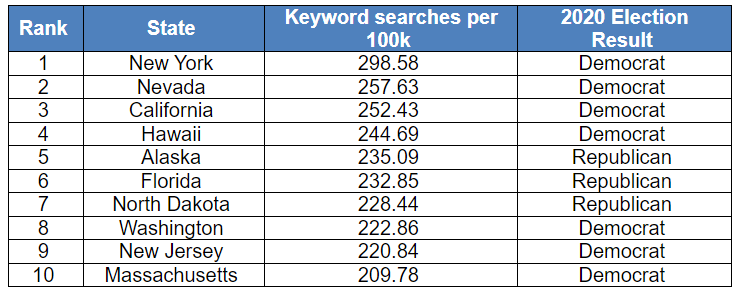

Having said all that, it's interesting that the most crypto-friendly states are voting for the Democrats according to the crypto Amazon shopping site Zellix who analysed Google search volumes for terms related to cryptocurrency, such as “Which crypto to buy today” and “What crypto will explode in 2024.”

What does this mean for the future?

I guess it means that Polymarket is the next trillion dollar company.

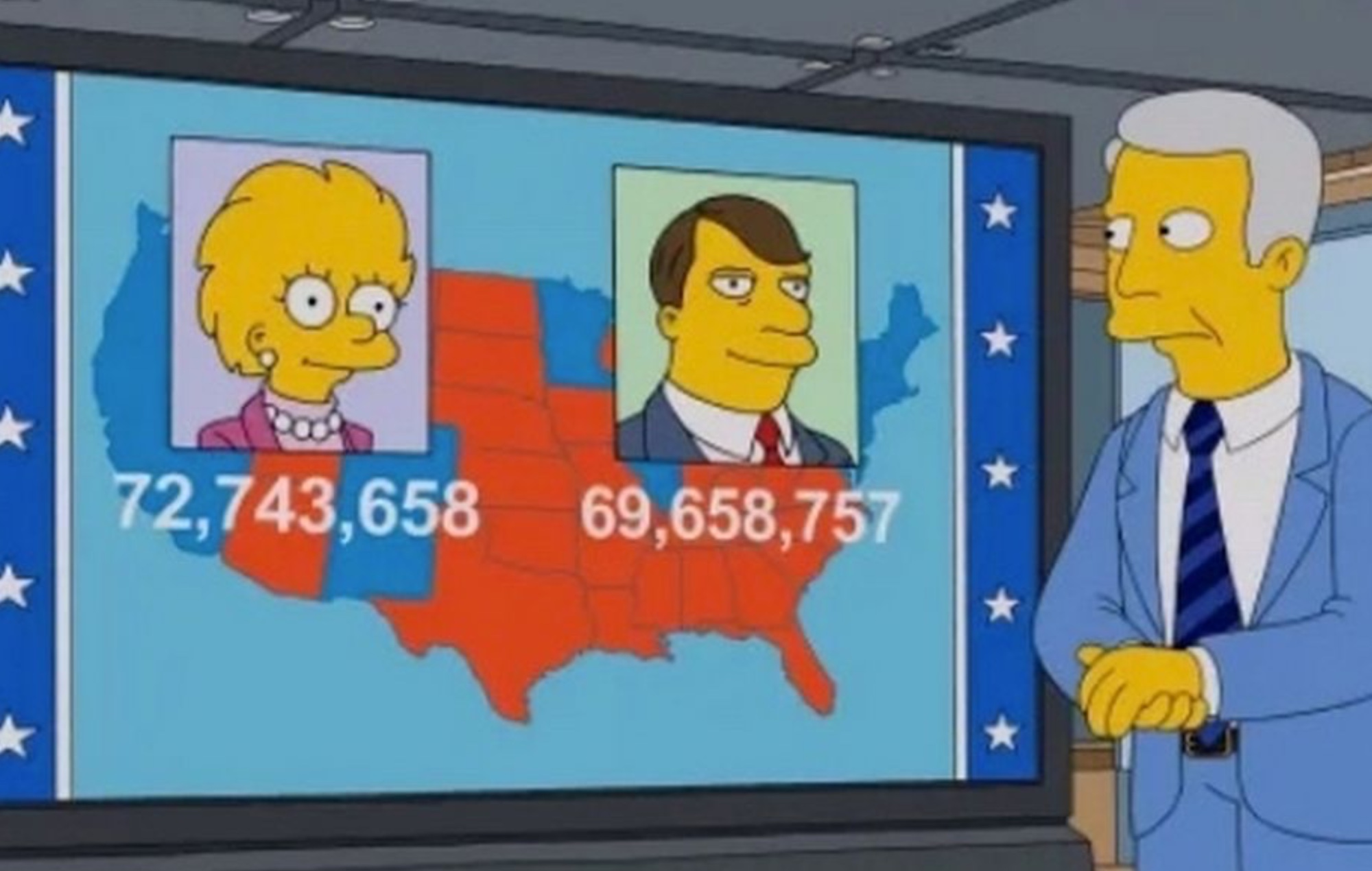

Or is that The Simpsons?

I could go on, but you can find out more for yourselves. The net:net seems to be that the Trump victory is good for banks, good for tech, good for fintech and good for crypto. Happy New Year!

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...