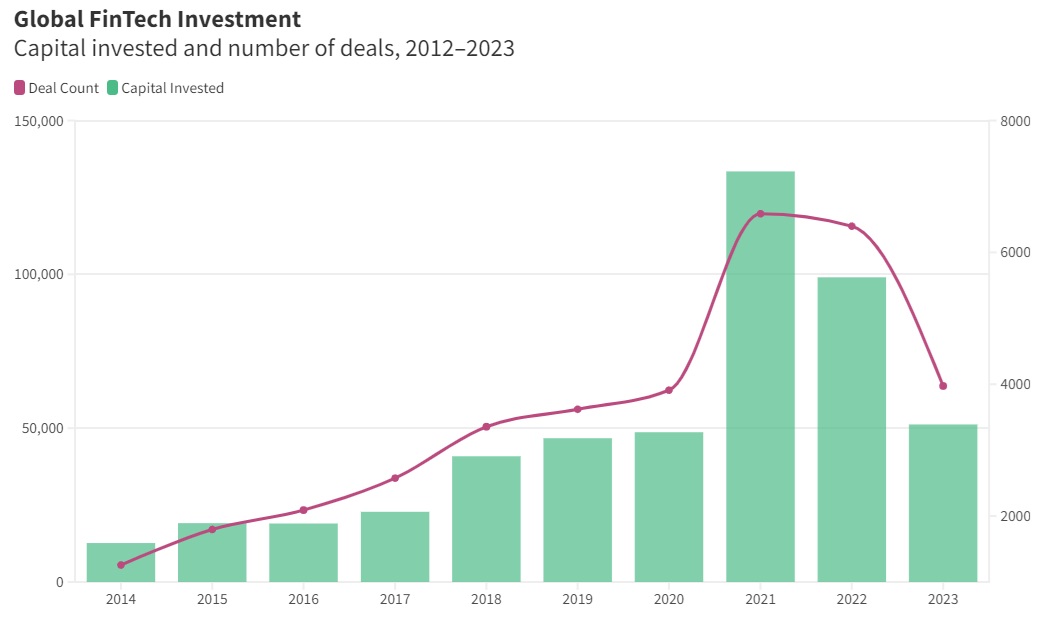

I find times interesting, as so many fintechs had an amazing ride in the 2010s but, in the 2020s, it seems not. Fintech took a hammering in 2023 with investing down 48% compared to 2022, which was also a bad year …

… and now we move into 2025 and reflect on 2024 where it went down even more. Innovate Finance notes that investment was down 20% in 2024 globally ... and that’s on the back of a big downward investment trend in 2022 and 2023. Times are hard in our space.

This really struck me when I saw a write up on LinkedIn by Jason Mikula on Varo Bank. If you don’t know them, Varo Bank is an American neobank headquartered in Salt Lake City, Utah. Launched in 2017, Varo was the first neobank to receive a national bank charter from the Office of the Comptroller of the Currency. The company is led by founder and chief executive officer Colin Walsh.

I spotted them some years ago because Colin, who has spent most of his life in consumer banking in Lloyds Banking Group and American Express, made a bold statement that Varo is betting that they may be digital but they have to be like a traditional bank to win. “It’s really the only long-term sustainable route if you want to be around 50 to 100 years from now,” said Mr Walsh.

That is sound thinking and aligns closely with my own view. You need to be a bank to be a bank. That means you need a license, a regulated structure and a trust in your institution’s ability to protect my deposits. I have learned over the years that the license and regulation does not necessarily mean the state – it could be the network of the people – but, either way, you have to have trust that you won’t lose my money.

Anyways, the reason for talking about this is that Varo Bank, like many fintechs, is struggling in the these difficult times. Equity is down and profit is still elusive.

As a result, Colin has stepped down as CEO. Why? Because he predicted that, last year, Varo Bank would be in profit. It still is not and looks a long way off.

While Varo highlighted a 22% increase in revenue, 38% improvement in net income, and 31% reduction in customer acquisition costs in 2024, it is still far from profitability, posting a net loss of $65 million last year and, as of its last call report for Q4 2024, just $60 million in bank equity capital remaining. Maybe this is why they only managed to raise half of the funds they wanted in the latest round. Varo had been hoping to raise a $55 million Series G round but has, so far, closed only $29 million according to their latest SEC filing.

Varo illustrates what I see with many fintechs today. They have bold vision and plans, but a run-rate of capital that is facing a cliff for many. Techcrunch quotes Carta, a research firm, that found in the USA 966 startups shut down, compared to 769 in 2023. That’s a 25.6% increase and maybe more.

All in all, it strikes me that we are living through the times that are equivalent of the internet boom and bust of the early 2000s. The companies that survive will come out stronger and larger – take note NuBank, Revolut, Monzo and more – but those that were fledgling well, many will have fallen off the cliff.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...