In an excellent article on LinkedIn, Priscilla Russo laments the state of Agentic AI from a payments point of view.

Bearing in mind that 2025 is the year of Agentic AI – a world where AI agents do everything for you on your behalf – it is clear that we have a dichotomy between the open API marketplace for integrating great experiences and the back-end checkout processes that support them.

She illustrates this well in a summary:

Like many of you, I’ve delighted in watching an AI agent navigate Expedia to book the perfect flight—until a login or payment prompt yanks me back to reality. Most AI agents, including OpenAI's Operator, still rely on humans at critical steps in the web browsing and checkout experience. They use outdated fixes like cookie copying and screen scraping to reduce friction. These measures underscore a problem I have been researching for the past couple of months: our digital identity system isn't ready for AI agents.

In a longer and more in-depth article, she expands upon this theme and makes a specific point that I agree with:

Our identity infrastructure is a mess, and has not been able to keep pace with the rapid development of AI agents. AI agent developers are relying on cumbersome “human-in-the-loop” authentication or outdated tactics like cookie copying and screen scraping. This isn’t for lack of trying. Many of them are piecemealing an identity solution based on what’s available in the market. Established network providers like Visa and Mastercard are lagging in developing robust "Know Your Agent" (KYA) procedures and still do not issue agent credentials, based on recent interviews with insiders.

In other words, we have a fragmented and broken system where commerce is not connected with checkouts. More than this, the system is broken because we have not worked out identification, authentication and verification processes.

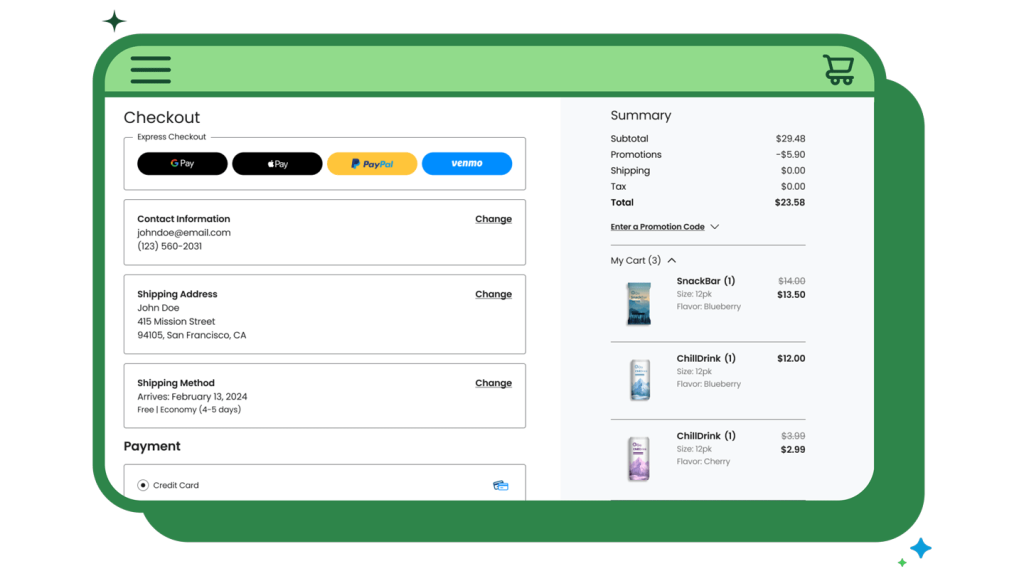

The best example for me is the checkout process for most activities – flights, Amazon, Wise … you name it – where you set everything up to pay and get a moment where it is going to switch from the app to the card payment and asks whether you want an SMS text or email to verify the payment. Even worse is, in some apps, you have to verify the payment in one app that then switches to the bank for a second approval, each of which require biometric, password and OTP approvals. In these processes you have four, five, six or more touches on the process to get to an approval, with requests here, there and everywhere to open the bank app and enter a verification code. It’s a terrible system and a terrible process.

The thing is that we know why the process is there – do you really want a payment to be made without your approval? – whilst the alternative reality would be a fully integrated, open API system that would allow us to delegate the approval to our agentic AI apps.

Priscilla’s argument is for the latter and I tend to agree, but with limitations. I would delegate a payment process to an agentic AI as long as there were checks, balances, brakes and fixes to ensure that the delegated authority is being done right.

I guess it comes back to a comment made recently by Nvidia CEO Jensen Huang:

“It’s going to take AI to catch the darker side of AI”

Too right and, until that trust is in place to achieve this, our AI agents are going to have to suffer the last century processes of the card companies and banks to approve their payments. Or should they?

Priscilla’s posts make me realise that the commerce providers have leapt pretty quickly into agentic AI but our card companies and banks have not even thought about it. What will prove most interesting is how the neobanks – who are the first movers in digital most of the time – change their systems to adapt to these issues.

In other words, watch Revolut, NuBank, Chime, Checkout, Monzo, Wise, Stripe, Adyen, PayPal and more to see how they are integrating with agentic AI in 2025. This will set the standards for the next decade or more and is an important space to watch.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...