Every day there appears to be another update about how AI will change our world. The latest one in my inbox is a report from the Institute for Public Policy Research (IPPR), who warn that AI is likely to have a “seismic impact” on the economy and society, particularly in roles reliant on computer-based tasks. That’s almost all of the jobs in banking, finance and fintech isn’t it?

Almost everything that can be automated will be automated. Software is eating the world. Data is air. How many more cliches can I give you?

This is nothing new. John Cryan, the former CEO of Deutsche Bank, said that most of the people who worked at the bank would be replaced by AI ten years ago ...

“In our bank we have people doing work like robots. Tomorrow we will have robots behaving like people. It doesn’t matter if we as a bank will participate in these changes or not, it is going to happen.” Handlesblatt Conference, 2017

... and today it comes true.

The IPPR report reckons that AI will transform or replace as many as 70 per cent of tasks in computer-based jobs, and asks for greater government oversight of the rapidly developing technology.

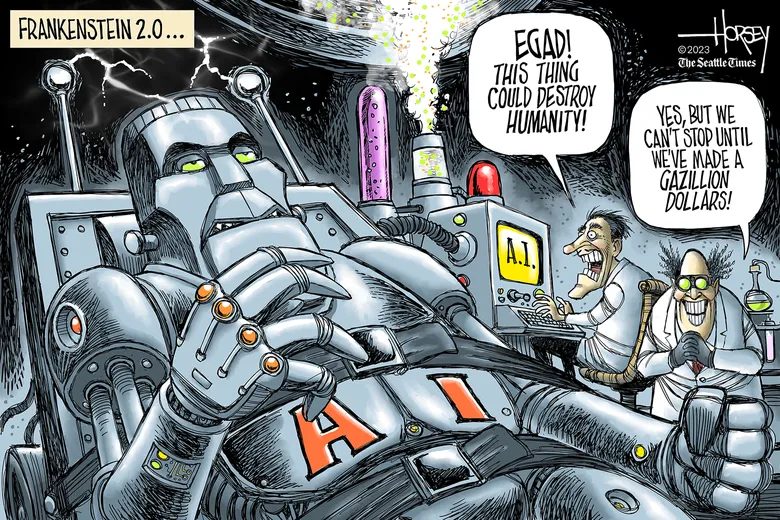

Intriguingly, this update landed on the same day as I saw that the 'AI godfather' Yoshua Bengio, who helped create the foundations of neural networks back in the day, sees a need for a priority shift to more thoughtful and deliberate work on AI technology.

Bengio believes that today is a "turning point," where we either implement meaningful regulations or risk letting AI spiral into something unpredictable. Meanwhile another godfather of AI Professor Geoffrey Hinton, the British-Canadian computer scientist who was awarded the Nobel prize in physics for his work in AI in 2024, said there was a “10% to 20%” chance that AI would lead to human extinction within the next three decades.

OMG!

Maybe this is why governments around the world are acting. The UK and USA want to be big AI centres, whilst the EU wants to shut it down.

- Prime Minister sets out blueprint to turbocharge AI - GOV.UK

- Trump’s Artificial Intelligence Shift: Repealing Biden’s Export Order and Policy and Regulatory Implications

- EU pushes ahead with sprawling AI regulation

What’s interesting here is that, as usual, the EU wants to regulate AI whilst America and Britain want to encourage its innovation. Innovation or regulation … a regular theme.

The thing is, bearing in mind that most of these policymakers are late millennials or older, is that they have grown up with a fear of technology taking over our lives. Everything from the Terminator to Ex Machina to Black Mirror paints a picture of technology being frightening and yet it is not. Technology is making our lives better. We get much more done, our productivity is raised, we have access to far more services direct and in real-time. The world is being made better by technology.

Think about it. Think about how you used to write a cheque (Americans still do) that would be sent in an envelope to the supplier. It would take days or weeks. Today, you just swipe and order and it turns up tomorrow, or even today with a drone.

Technology rules our lives today. Digital is everything and everywhere all at once. We cannot reverse that process but yes, we do need to regulate that process. And there’s the rub … how do we put brakes on technology developments before they are let out in the wild and destroy lives? Maybe that’s been a question that’s been around forever and the answer is …?

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...