It is a wild ride with cryptocurrencies. Rising rapidly with Trump’s presidential campaign – after all, he is the crypto President! – things have gone south badly in the last week. It’s kind of that crescendo from zero to hero to zero again. The rises and falls in cryptocurrency values are a real rollercoaster.

For that reason, as I write this, bitcoin and its brethren are not digital gold. Gold is pretty stable and certain as an investment; cryptocurrency is not. As Ledn says: “While people may enjoy the benefits of a volatile BTC, gold is offering something very different: steady rises and predictability”.

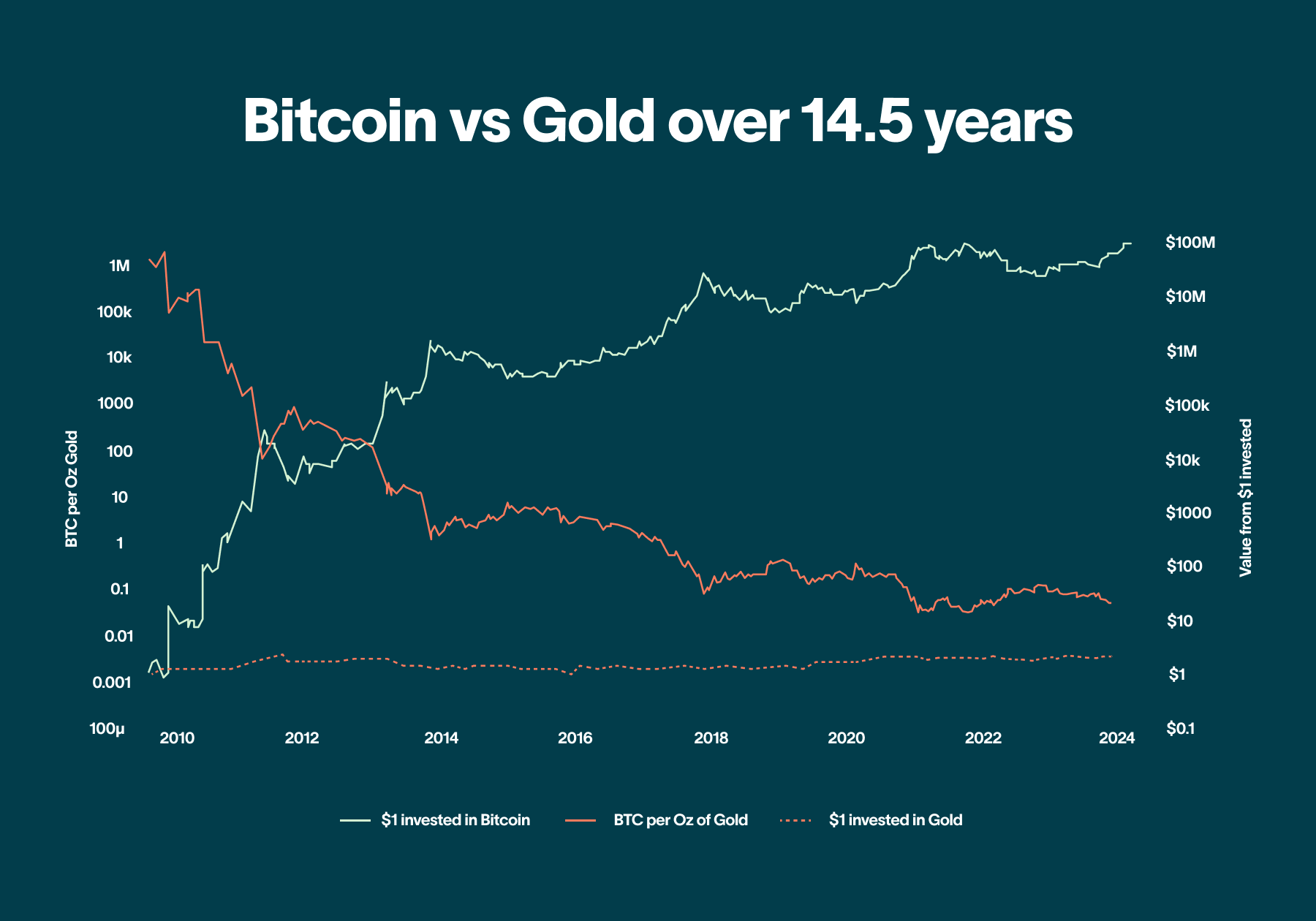

The thing is that, when you put an investment in BTC into context, the currency has outperformed gold by miles over the last decade.

Source: Ledn

But then it’s also far more volatile and, if you don’t like volatility, then investing in crypto is not for you. That’s the reason why true cryptocurrency believers hodl – they hold the currency through thick and thin.

As an experiment a decade ago, I invested in cryptocurrency and have had this roller-coaster ride. You wake up one morning and your portfolio has increased massively; you wake up the next, and it has tanked through the floor. The thing is that you should not follow your portfolio on a day-to-day basis. Cryptocurrencies are a long-term play, not short-term.

If you look at it on the basis, as the chart above demonstrates, you see a massive swing upwards over time. My first investments in bitcoin was when it was valued at $60 … today it’s almost $80,000. That speaks volumes.

And tomorrow? Well, probably the biggest advocate of cryptocurrency is Michael Saylor, Chairman of MicroStrategy. If you’re not aware, MicroStrategy – now known as Strategy – has made a major stake in bitcoin as part of its treasury strategy. As of February 23, 2025, Strategy’s total Bitcoin holdings amount to almost 500,000 bitcoins, purchased at an average price of $66,357 per bitcoin which totalled over $33.1 billion invested. The company’s strategy of accumulating Bitcoin has been a focal point for investors and the market alike so what is the thinking?

Speaking at a recent event Saylor reassured investors, claiming Bitcoin could never drop to $1, and if it did, he would buy it all. The question is why?

Well, he believes that Bitcoin is backed by strong fundamentals, institutional adoption, and a fixed supply of 21 million coins. Even during severe downturns, Bitcoin has never experienced a complete collapse in demand.

More fundamentally, major financial institutions and companies now hold billions in bitcoin. Even if prices drop, buyers like BlackRock, Fidelity, and Strategy would step in before it ever reached a fraction of its value. In other words, bitcoin has now become institutionalised as an asset equavlent to gold. It has become digital gold.

More importantly, Saylor predicts that things will only get better markets create a spot Bitcoin ETF, bank custody with lending, and fair value accounting for BTC on corporate balance sheets. Thanks to these trends, he predicts that BTC will reach $500,000 per coin in the near term and $5 million per coin in the long run. Wow! In fact, he argues that bitcoin will exceed physical gold as the dominant store of value as digital gold. Thoughts?

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...