A colleague posted a view about Fintech and the Rule of 40 the other day.

The Rule of 40 is a financial metric, primarily used in the Software-as-a-Service (SaaS) industry, which suggests a healthy company's combined revenue growth rate and profit margin (often measured by EBITDA) should equal or exceed 40%. It serves as a benchmark for assessing a company's financial performance and its ability to balance growth with profitability.

So, Davide Sangiovanni posted the other day about the myth of the Rule of 40 in fintech.

The Myth of the Rule of 40 in Today's Fintech Market by Davide Sangiovanni

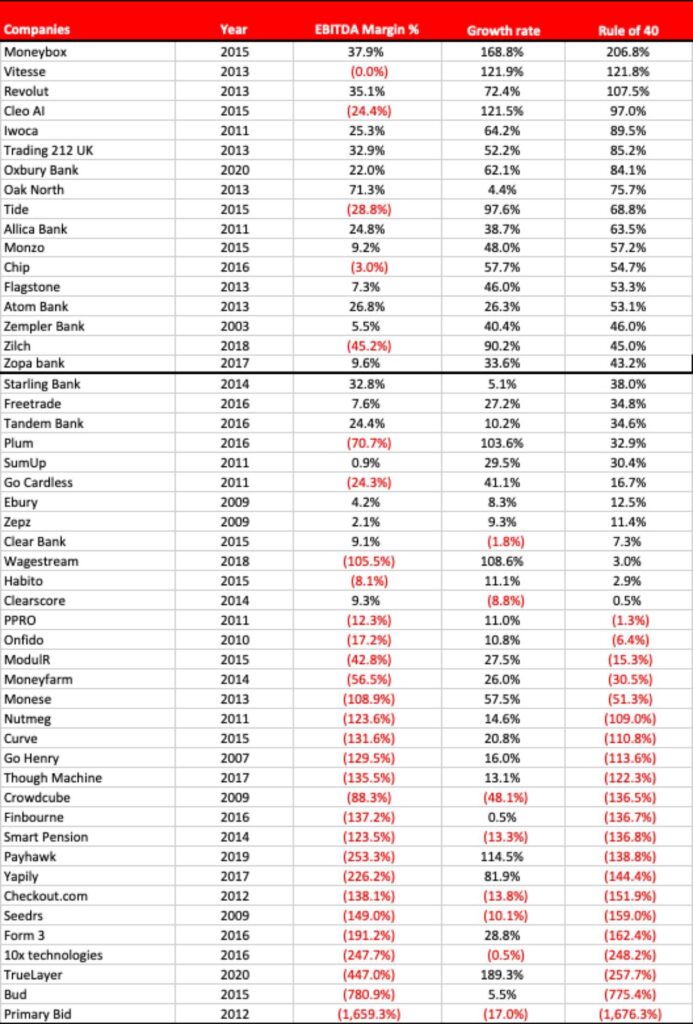

His view is that most private fintech companies do not deliver and gives some data to prove it. His data shows that the median Rule of 40 was only achieved by 9% of the leading UK fintech firms in 2024, and only 2% in 2023. In fact, of the hundreds of Fintech firms in the UK, only 17 companies achieved the Rule of 40.

Even with 17 companies achieving such success, only 12 are profitable. In fact, as it turns out, Moneybox, Vitesse and Revolut are the only 3 companies with a Rule of 40 over 100%. Meantime, many others miss the mark. For example, Starling Bank has a profitability of 32% but the growth rate is just 5%. On the other side Chip grew 54% but still has a negative EBITDA Margin (-3%).

You can find out more in Davide’s update, but what really got me is the chart above. Why? Because many of these firms are not ten years old or more but, more importantly, I think it gives a really good insight into the state of play of UK fintech firms.

It may or may not surprise my fintech friends to find Revolut, Oaknorth, Oxbury and others in the top of the list, but it did surprise me to find 10x, Bud, Seedrs, Thought Machine and others at the bottom of the list. Some would say that this is a sign that the gloss on Banking-as-a-Service (BaaS) has gone. I personally don’t think so (ed: did I ever mention that I came up with this term?) , but it does demonstrate something else. What is it?

Well, I think we have gone beyond the days ten years ago where firms could create a comprehensive set of open banking APIs to provide banking services. We are moving to a dual age of either do something brilliantly well or integrate all things in a brilliant way. This is illustrated by either being a Stripe who massive focus on making payments globally an easy thing – doing something brilliantly well – and Revolut who are becoming a full-service financial firm by bringing everything together – integrating all things in a brilliant way.

What Davide’s chart illustrates is that you cannot be a jack of all trades and master of none; you need to be a master of something. A master of doing something brilliantly well.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...