The latest BIS (Bank for International Settlements) run a survey of over 50 central banks every three years. I’m not normally that surprised by their figures, but this year seems to mark a milestone as they found that the worldwide movement of currencies had risen to almost $10 trillion a day!*

Here are the key highlights of the report:

- Trading in OTC FX** markets reached $9.6 trillion per day in April 2025, up 28% from $7.5 trillion three years earlier.

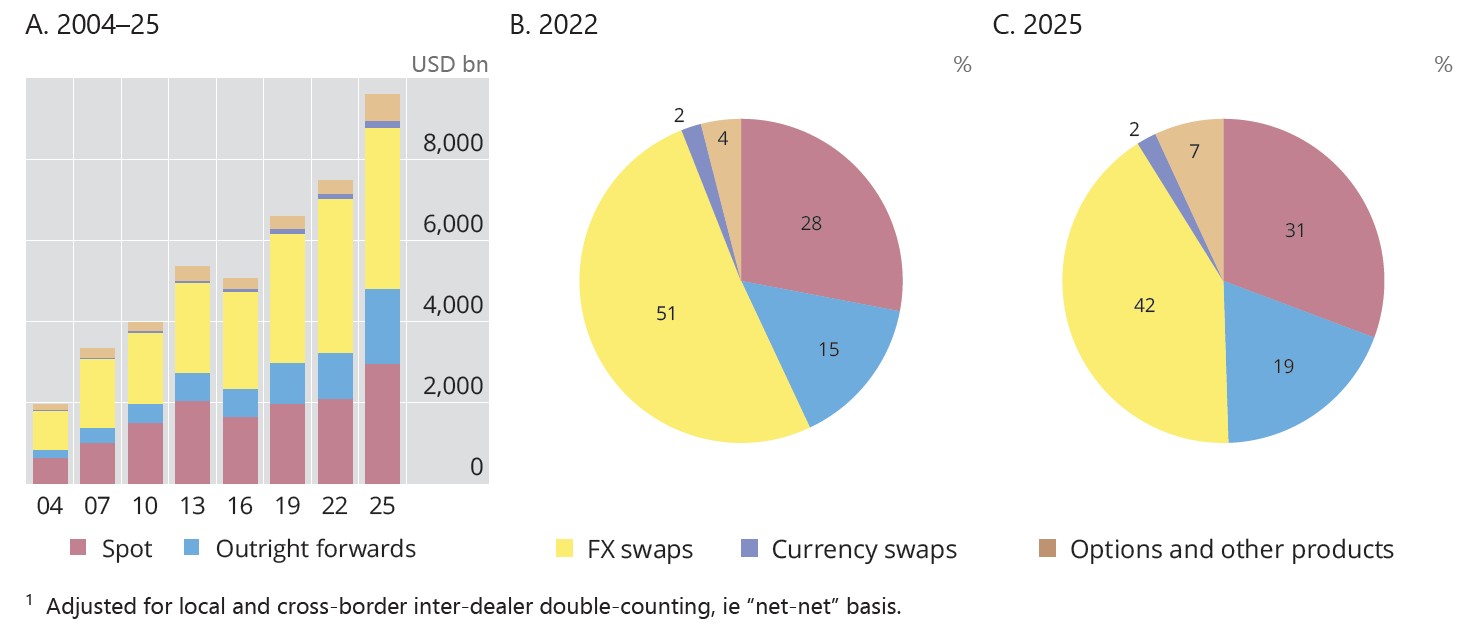

- Turnover of FX spot and outright forwards*** was 42% and 60% higher, respectively. Their shares in global turnover thus increased, from 28% and 15%, to 31% and 19%, respectively. Turnover of FX options more than doubled. Turnover of FX swaps grew modestly, resulting in a drop in their share to 42% (from 51% in 2022).

- The US dollar continued to dominate global FX markets, being on one side of 89.2% of all trades, up from 88.4% in 2022. The share of the euro fell to 28.9% (from 30.6%) and that of the Japanese yen was virtually unchanged at 16.8%. The share of sterling declined to 10.2% (from 12.9%). The shares of the Chinese renminbi and the Swiss franc rose to 8.5% and 6.4%, respectively.

- Inter-dealer trading accounted for 46% of global turnover (almost unchanged from 47% in 2022). The share of trading with “other financial institutions” was 50% (up from 47%). At $4.8 trillion, turnover with other financial institutions was 35% higher than in 2022, mostly driven by 72% higher trading of outright forwards and a 50% increase in spot transactions with this counterparty group.

- Sales desks in the top four jurisdictions – the United Kingdom, the United States, Singapore and Hong Kong SAR – accounted for 75% of total FX trading (“net-gross” basis). Singapore gained market share, reaching 11.8% of the total (up from 9.5% in 2022).

I really took note of one of those headlines which is that the US dollar is involved in nearly 90% of all trades. We can talk about dedollarisation, but if the world is moving $10 trillion a day, of which $9 trillion are US dollar denominated, then I don’t see that happening for a long time.

You can download or read the full report here and, if you have two minutes, the summary highlights video from the BIS is worth a view.

* Note that the figures relate to April 2025, when the survey was made, and so I would expect that right now $10 trillion or more is moving around the world of which $9 trillion is backed by the US dollar

** OTC over-the-counter FX, or Foreign Exchange, refers to forex trading that does not happen on a formal exchange, but instead directly between two parties, such as a client and a bank or dealer, through a network. This allows for customised contracts to meet specific needs but comes with less transparency and regulation than exchange-traded instruments, creating potential risks. This system is run by a few hundred traders worldwide, who represent the whole currency system of the world, according to LoopFX,

Blair Hawthorne, founder of LoopFX, made it clear to me with this quote:

“What’s striking isn’t just that FX turnover hit $9.6 trillion a day - it’s who is behind that growth. Since the 2022 BIS survey, overall volumes are up about 28.5%. Dealer-to-dealer trading rose by roughly 25% - from about $3.50 trillion to $4.37 trillion per day - but institutional investors expanded their activity by nearly 60%, climbing from around $820 billion to $1.3 trillion per day. In short, the buy-side has been the fastest-growing client segment in global FX.”

*** A spot forward (or spot transaction) is the immediate exchange of currencies at the current market rate, typically settling within two business days. In contrast, an outright forward is a contract to exchange currencies at a future, predetermined date and at a specific, agreed-upon rate, which accounts for interest rate differentials between the currencies. Spot transactions are for immediate needs, while outright forwards are used for hedging future currency risk or locking in a rate for a future business obligation.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...