There are people who run the world and those who watch it. I’m in the latter group, but constantly watch Elon Musk, Peter Thiel, Reid Hoffman (the PayPal Mafia), Mark Zuckerberg, Larry Ellison, Larry Page, Sergey Brin, Bill Gates and more for their thoughts and actions. Also Warren Buffet, Charlie Munger and others. But one name that has influenced all of us – just ask Jack Ma! – is Jeff Bezos.

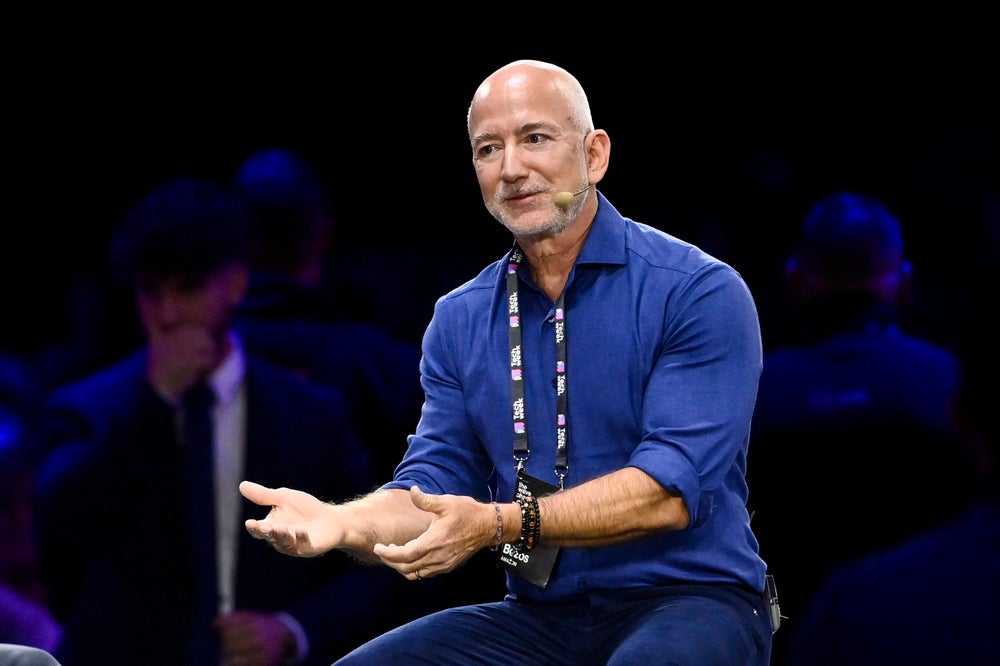

I’ve never seen Bezos on stage – in fact, I didn’t even know he did ‘live’ performances – but he appeared suddenly last week at the Italian Tech Week in Turin. Maybe he wanted a holiday in the Italian lakes?

Anyways, I have summarised his speech with the title of this blog:

“Financial bubbles destroy everything. Industrial bubbles create the future”

Jeff did not say those words, but it is a summary of his theme. So, if you have 40 minutes, here is the discussion with John Elkann, Chairman and CEO of Stellantis:

https://www.youtube.com/live/E0x3UZDKSNo

If you don’t have 40 minutes, here is a summary by Endrit Restelica, founder and CEO of Jumbo:

We’ve seen bubbles before. The dot-com bust wiped out companies overnight, bankrupted those who overreached, and erased trillions in paper wealth.

But it also left behind fiber-optic cables and e-commerce infrastructure that still power the world today.

The same thing happened with biotech in the ’90s: most investors lost money, but society walked away with life-saving drugs.

That’s the difference between financial bubbles and industrial bubbles. Financial bubbles (like the banking crisis in 2008) leave only destruction.

Industrial bubbles, on the other hand, can be messy, but when the dust settles, the world is left richer. The failed companies disappear, but the inventions, tools, and infrastructure remain.

Today, AI is in its own industrial bubble. Every idea gets funded, good and bad. Valuations defy gravity - teams of six people with no product are being handed billions.

But hype doesn’t mean the underlying technology is fake. AI is real. And its impact won’t stop at “AI-first companies.” It’s a horizontal technology that will run through every single industry - manufacturing, hotels, consumer brands, everything.

The market in the short term is a voting machine, but in the long term, it’s a weighing machine. Your job isn’t to chase the vote. Your job is to build something heavy enough to be weighed.

We’re living through multiple golden ages at once - AI, robotics, space. Just like the plow, electricity, or the internet, these tools will increase abundance for everyone.

This is one of the best times in history to be alive and building.

So don’t get distracted by whether we’re “in a bubble.” Focus on fundamentals. Focus on building something that lasts.

Finally, if you want more detailed breakdown of what Bezos said, but don’t have time to watch the video, here are key highlights & quotes (by topic):

- The AI “Bubble” Talk & Investment Dynamics

- Bezos cautioned that the current enthusiasm around AI resembles a bubble — many ideas, experiments, and startups are being funded indiscriminately.

- But he frames it more precisely as an “industrial bubble” rather than purely financial: while overhyped valuations may collapse, the underlying technology and infrastructure that survive will bring lasting value.

- He drew a parallel to the dot-com era (circa 2000), pointing out how during the internet bubble many companies failed, yet foundational infrastructure (e.g. fiber optics, connectivity) persisted and powered growth.

- Bezos emphasized that a disconnect often arises during bubbles: “stock price is an output … you have very little control over” vs the “fundamentals of the business.”

- Still, he strongly believes the societal benefits of AI will be “gigantic” and pervasive — it won’t just belong to AI-native startups, but to every industry (manufacturing, services, consumer goods, etc.).

- Entrepreneurship, Learning & Strategy Advice

- Bezos advised young founders to gain experience in well-run companies first: learning how hiring, interviewing, operations, scaling, etc. are done well, before launching something on their own.

- He discussed how he handled idea overflow in Amazon’s early days: having too many ideas can overwhelm an organization; the key is pacing, prioritizing, and releasing ideas at a rate the company can absorb.

- On vision vs execution: be stubborn about long-term vision, flexible about methods and details. He noted that people who are often “right” sometimes change their minds frequently, whereas those who are wrong often cling too rigidly.

- The importance of centering on customer needs as a stable anchor in a changing world: he used Amazon’s focus on fast delivery and low prices as examples of durable customer expectations.

- Space, Infrastructure & the Next Frontier

- One of the more striking predictions: Bezos envisions gigawatt-scale data centers in space becoming viable in the next 10–20 years. The rationale: constant solar power, no weather interference (no clouds, no rain).

- He argued that as Earth-based data centers grow, their demands on electricity, cooling, water become unsustainable; orbital data centers may at some point become more efficient.

- Yet, he acknowledged challenges: launch costs, maintenance, risk of failure, upgrading infrastructure in orbit, etc.

- More broadly, he sees a convergence of “bits & atoms” — software and physical infrastructure (robotics, space, manufacturing) — as critical to future tech progress.

- He also forecasted a future where millions of people live in space within a few decades, though he emphasized that much of the early work might be done robotically (humans go by choice).

- Personal Stories, Values & Meta Reflections

- Elkann and Bezos shared stories about their grandfathers and family influence, highlighting traits like resourcefulness, kindness, perseverance.

- Bezos talked about his upbringing: summers on his grandfather’s ranch, repairing machinery, learning to solve problems with limited resources.

- He shared a childhood memory: calculating how many years of life his grandmother lost from smoking (based on radio anti-smoking campaigns). This anecdote was told to illustrate his early awareness of cause/effect, health, reasoning.

- He reflected on the role of kindness and long-term thinking in leadership and technology: that in fast-changing times, moral and human foundations matter.

In summary, Jeff’s overall themes included:

- Optimism with caution: Bezos is bullish on AI, space, and tech, yet constantly flags risks of hype and misallocation.

- Bubble vs Reality: He makes a clear distinction between speculative excess and fundamental technological progress.

- Foundational infrastructure often survives market shakeouts — even if many ventures fail.

- Grand vision + disciplined execution: The tension between dreaming big and operating methodically is a recurrent thread.

- Long time horizons: Many of the biggest payoffs he describes lie 10–20 years out (space, orbital infrastructure).

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...