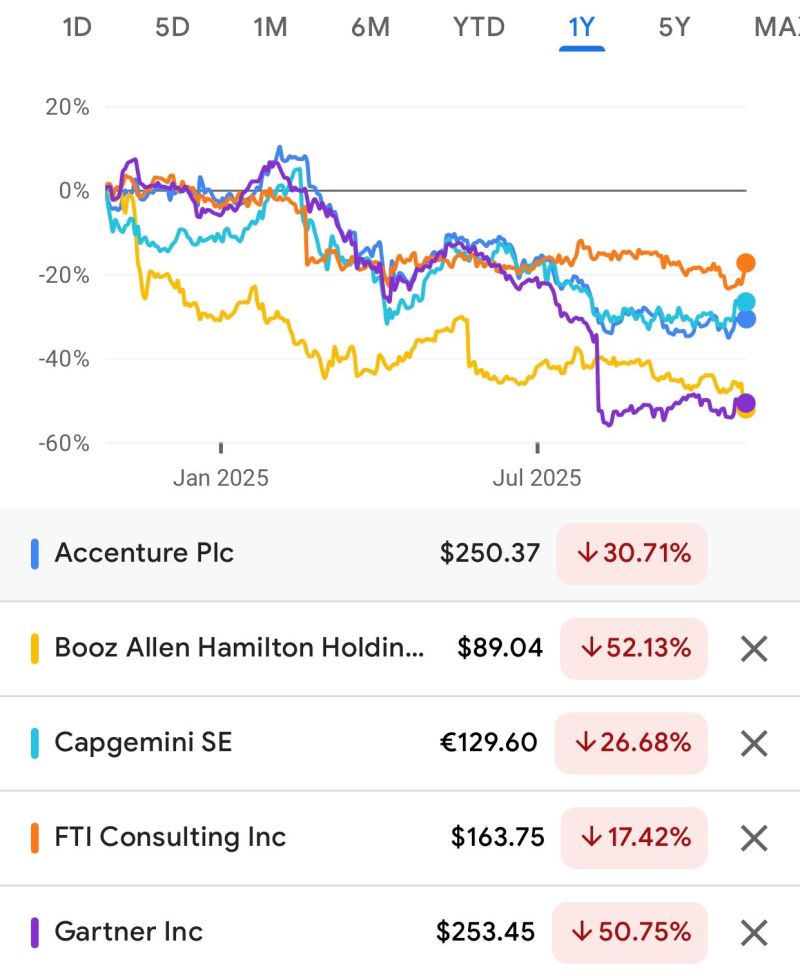

Interestingly, as AI kills search engines and browsers, it also appears to be destroying the market for consultants and research firms. That’s not just a proposition but a reality, if you look at the share price performance of consulting and research firms this year.

Whilst the likes of Accenture and Cap Gemini have dropped by a quarter or more …

Source: LinkedIn user Andre Retterath

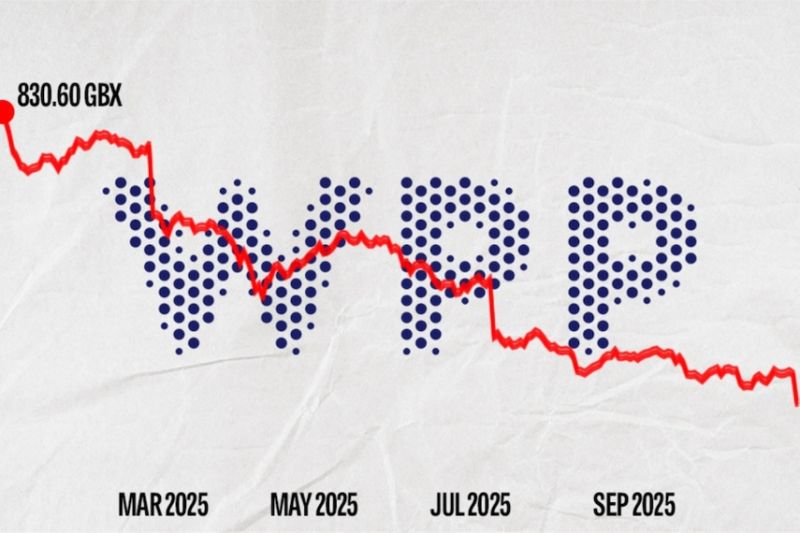

… WPP – Martin Sorrell’s conglomerate of marketing and research firms – has dropped 63% in value this year

Source: LinkedIn user Gustaf Wick (no relation to John)

What’s going on?

Well, like search engines and browsers, everything is being eaten by AI ...

... but maybe we need to temper the hype around this space.

Brian Merchant recently observed in a recent Wired article that it seems like the AI bubble is about to burst.

He notes that there is 17 times as much investment in AI as there was in internet companies before the dotcom bust. So far this year, according to Silicon Valley Bank, 58 percent of all VC investment has gone to AI companies. Nvidia’s latest valuation makes them bigger than Germany’s entire economy.

Merchant believes that such a gold rush is unsustainable (and always has been), and points to research by economists Brent Goldfarb and David A. Kirsch of the University of Maryland. Goldfarb and Kirsch published a report Bubbles and Crashes: The Boom and Bust of Technological Innovation about tech bubbles in 2019 and consider four principal factors that create them: the presence of uncertainty, pure plays, novice investors, and narratives around commercial innovations. By examining some 58 historical examples, from electric lighting to aviation to the dotcom boom, Goldfarb and Kirsch created a framework for determining whether a particular innovation led to a bubble and, interestingly, discovered that plenty of technologies like lasers and FM radio did not create bubbles whilst others, like airplanes, transistors, and broadcast radio, very much did.

Why?

Why is Toyota valued at $273 billion while Tesla is worth $1.5 trillion to investors—when Toyota shipped more cars than Tesla last year, and brought in three times as much revenue?

Well, the four factors mentioned: the degree of uncertainty surrounding a particular innovation; the attentive presence of novice investors; the opportunity to directly invest in companies that specialise in the technology; and whether or not a technology is a good protagonist in a narrative.

Merchant speaking with Goldfarb concludes that AI seems to be similar to the tech bubbles of aviation and broadcast radio:

“Both were wrapped in high degrees of uncertainty and both were hyped with incredibly powerful coordinating narratives. Both were seized on by pure play companies seeking to capitalize on the new game-changing tech, and both were accessible to the retail investors of the day. Both helped inflate a bubble so big that when it burst, in 1929, it left us with the Great Depression.”

Well, that’s cheered me up.

Either way, whatever you believe, AI is a game-changer as the image for this article was generated in a few minutes by AI. AI is eating us and itself maybe therefore?

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...