I often talk about quantum computing and how it could break the encryption keys of our current financial system, including bitcoin and cryptocurrencies. In fact, the first time was seven years ago, when I referred to The Quantum Resistant Ledger. Even way back then, there was a company working on ideas to avoid encryption being unencrypted.

Seven years later, everyone’s talking about it from the Bank of International Settlements to Citibank. Citibank’s latest report from the Citi Institute is pretty insightful. They estimate that quantum computers will break widely used public-key encryption systems from bitcoin to banks, and estimate that its probability at doing this is 19-34% by 2034 and 60-82% by 2044. Put that in context: it means that most cryptocurrencies and bank encrypted systems will be broken in the next twenty years.

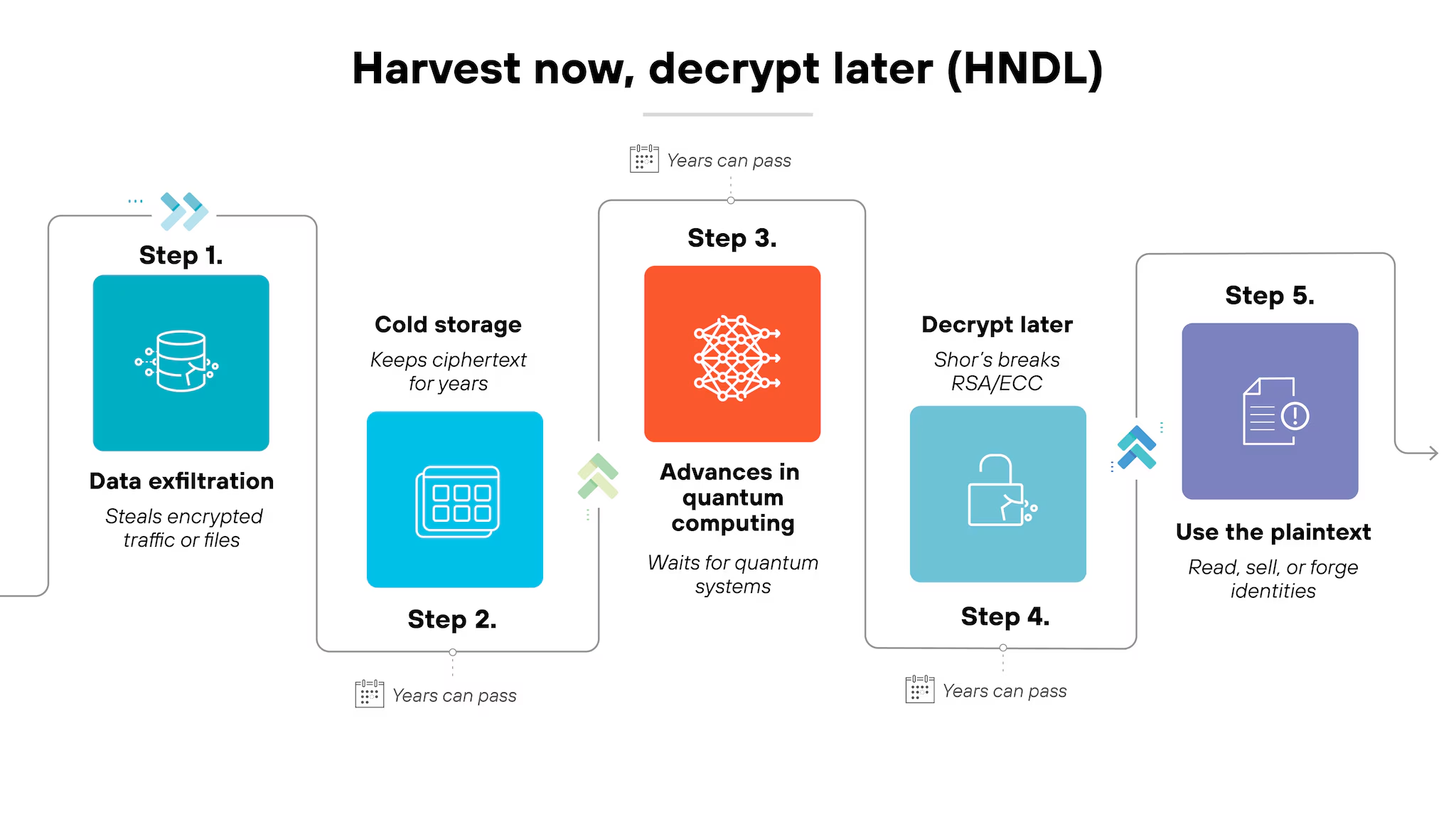

The report delves deep into a concept called Harvest-Now, Decrypt-Later (HNDL). What’s that? HNDL is a cybersecurity threat in which encrypted data is collected and stored today so it can be decrypted when quantum computers can break current encryption systems tomorrow. The entire process is built on patience: steal what's valuable now, wait until technology can unlock it. This is explored in-depth by Palo Alto Networks, and it is fascinating stuff.

Equally, going back to Citi Institute, they list a range of quantum threats:

- Cryptography Risks: Quantum computers could break all of today’s encryption systems, compromising digital signatures, secure communications, IoT ecosystems, and critical infrastructure.

- Economic Exposure: A single-day quantum attack on a major U.S. bank could cost over $3 trillion in GDP, with broader impacts across sectors like finance, healthcare, and telecommunications.

- Blockchain Vulnerability: Quantum computers threaten blockchain security by breaking digital signatures, exposing coins with public keys already revealed on-chain.

And recommend a bunch of things that financial firms should focus upon right now:

- Strengthen Cryptographic Foundations: Design systems around algorithms standardised by organisations who deploy direction, such as the International Standards Organisation (ISO) and the National Institute of Standards and Technology (NIST).

- Build Crypto-Agile Systems: Enable quick adaptation to new cryptographic standards.

- Deploy Quantum-Safe Shields: Implement overlays for immediate protection against HNDL risks.

- Adopt Quantum-Ready Cloud Computing: Leverage cloud platforms for faster PQC (Post-Quantum Cryptography) adoption.

- Collaborate Across Ecosystems: Work with vendors, partners, and regulators to ensure seamless migration to quantum-safe systems.

And the report ends up with a five-point plan for doing something:

- Identify: Map public-key cryptography usage across the organization.

- Prioritize: Focus on critical systems and long-lived data.

- Enable: Develop crypto-agility and hybrid approaches.

- Migrate: Execute phased transitions aligned with regulatory guidance.

- Sustain: Continuously manage keys and update algorithms as quantum capabilities evolve.

Their report concludes that quantum computing poses unprecedented risks to global security and economy, with potential impacts in the trillions of dollars. While PQC standards are available, the challenge lies in implementing them at scale. Institutions must act now to mitigate risks, protect sensitive data, and prepare for the quantum era. Collaboration across industries and ecosystems is essential to ensure a smooth transition to quantum-safe systems.

You can read their full report here but, in case you can’t be bothered, I’ve shared it below:

Meanwhile, if you missed the BIS report on quantum and its conclusions, here’s the summation:

1️⃣ Quantum risk is real, not theoretical

Future quantum computers can break today’s public-key cryptography — the same foundations used by banks, payment rails, and blockchains.

2️⃣ Central banks are already upgrading the rails

The BIS, Bank of France, Bundesbank and Bank of Italy successfully tested post-quantum cryptography inside live-like payment systems (TARGET2).

3️⃣ Payments can go quantum-safe — today

Liquidity transfers were executed using quantum-resistant digital signatures, proving migration is technically feasible.

4️⃣ Performance trade-offs are manageable

Post-quantum cryptography is slower, but well within tolerances for critical financial infrastructure — with clear optimisation paths.

5️⃣ Crypto won’t sit outside this shift

Stablecoins, tokenised deposits, and RWAs that integrate with traditional rails will need to align with post-quantum security standards.

🌍 Real-world example

The Eurosystem tested replacing traditional RSA signatures with quantum-resistant signatures for central bank liquidity transfers — the same pipes that underpin wholesale money markets and settlement.

If central banks are hardening these rails now, every digital asset that touches them will inherit these requirements.

Why This Matters for Crypto & Stablecoins

Stablecoins aren’t just code — they’re financial infrastructure.

- Issuers rely on banking rails

- On- and off-ramps depend on payment systems

- Institutional adoption depends on long-term security guarantees

- Quantum-safe cryptography becomes a credibility requirement, not a nice-to-have.

What Happens Next

- Banks and FMIs begin phased quantum-safe migrations

- Regulators embed post-quantum expectations into standards

- Stablecoin and RWA platforms must design for cryptographic agility

- The line between TradFi rails and on-chain money tightens further

The takeaway: the future of money is being secured now — quietly, deliberately, and with crypto very much in scope.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...