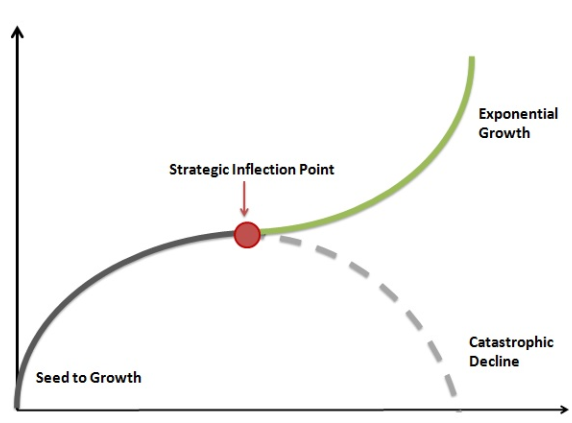

We are in a Strategic Inflection Point … have you got that?

I’m sure you’ve all noticed that artificial intelligence (AI) is the big news of the last year, but have you been watching Nvidia, the chip maker that drives AI? It’s now bigger than Intel and about to exceed Microsoft and Apple in market valuation. Here’s an analyst’s view from Barrons: Nvidia Has More Than Doubled…