Mobile Money: the Samee and Dave Show

Another great evening at the FSClub last week with the Samee and Dave show. OK, it’s not a double-act although I’m trying hard to make them into one, with Samee the straight guy and Dave the fungi obviously. Samee Zafar and David Birch are both great speakers about payments and, in particular, mobile payments. As…

MiFID II: the post-trade agenda

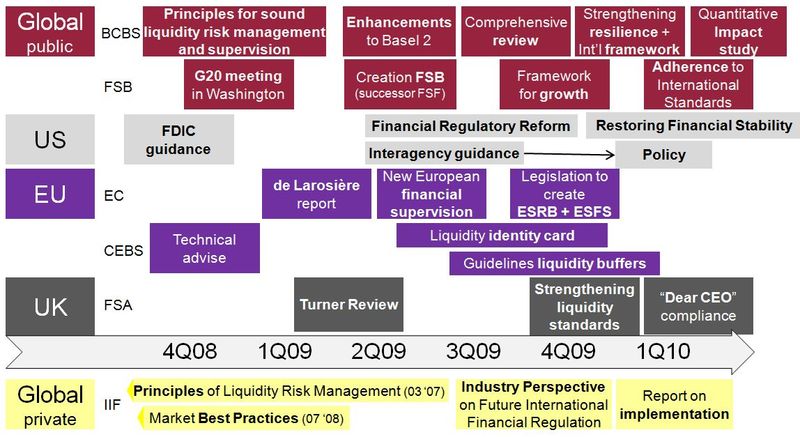

One of the big topics in capital markets is intra-day liquidity and post-trade transparency. Such discussions are far more noticeable now because the whole reason for this crisis, according to some, was the loss of trust between counterparties. That loss of trust was based upon counterparties not having enough liquidity to cover their positions. After…

Target 2013: Modernising Payments in Ireland

In a report prepared by the National Irish Bank (NIB) and released today, Andrew Healy, CEO of the NIB, presents ideas for modernising payments in Ireland, with two key objectives for 2013: Reduce cheque-use by 95% by 2013 Reduce cash usage to below the EU average by 2013 For a long time now, we’ve known…

After the PSD and SEPA, has anything changed?

Last year, we performed a major survey in anticipation of the implementation of the PSD and SEPA Direct Debits, to see how the world viewed these areas. The research received over 350 responses from financial professionals worldwide, and found a general cynicism about the effectiveness of the PSD in particular, due to inconsistencies in interpretation…

More UK banking stats

Following on from yesterday's number – UK Bank Stats: a fascinating portrait of life -I was sent another report today from TheCityUK, the trade body that promotes the interests of the City of London.There’s loads of numbers in this document that are useful, which I will post in a few separate blog entries starting with…

A SWIFT note on remittances

A final note on remittances and I've already been taken to task by one reader, who points out that a 'migrant worker' in one country is another country's customer overseas. This is a key point for some banks, as they enable their customers to migrate and have full financial services whilst working overseas. That's an…

Why banks should avoid the remittance markets

Great conversations continue in the remittances space, or money transfer space if you prefer, with a chat with the global transaction services folks from a major bank. This bank has a dilemma: are they in the remittances space or are they not? They really want to be in this space but are worried about risk…

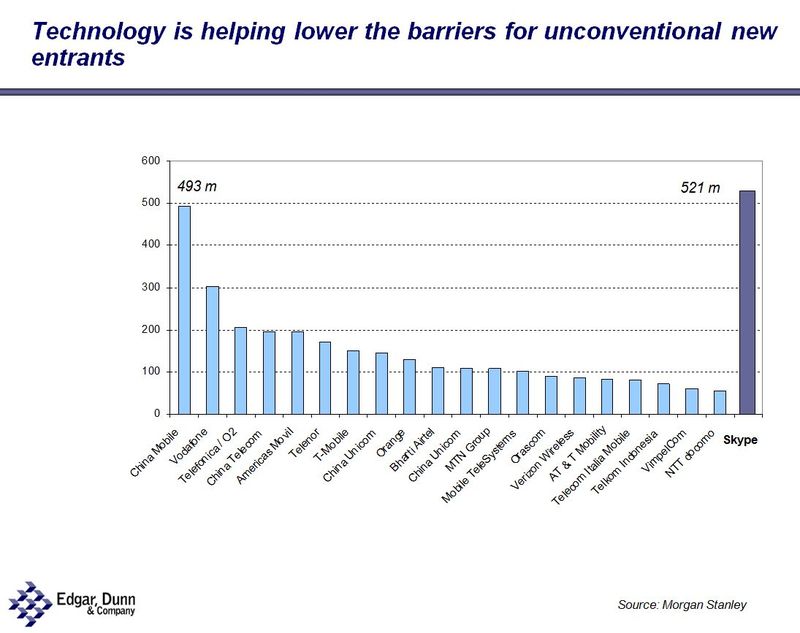

Why is there no global mobile remittance service?

We had a really interesting free-ranging conversation about remittances and new services for remittances yesterday. Oh yes, I should say that I’m at a remittances conference so that’s the reason why. The discussion was about the NEXT BIG THING in money transfer … or rather whether and if there is a NEXT BIG THING in…