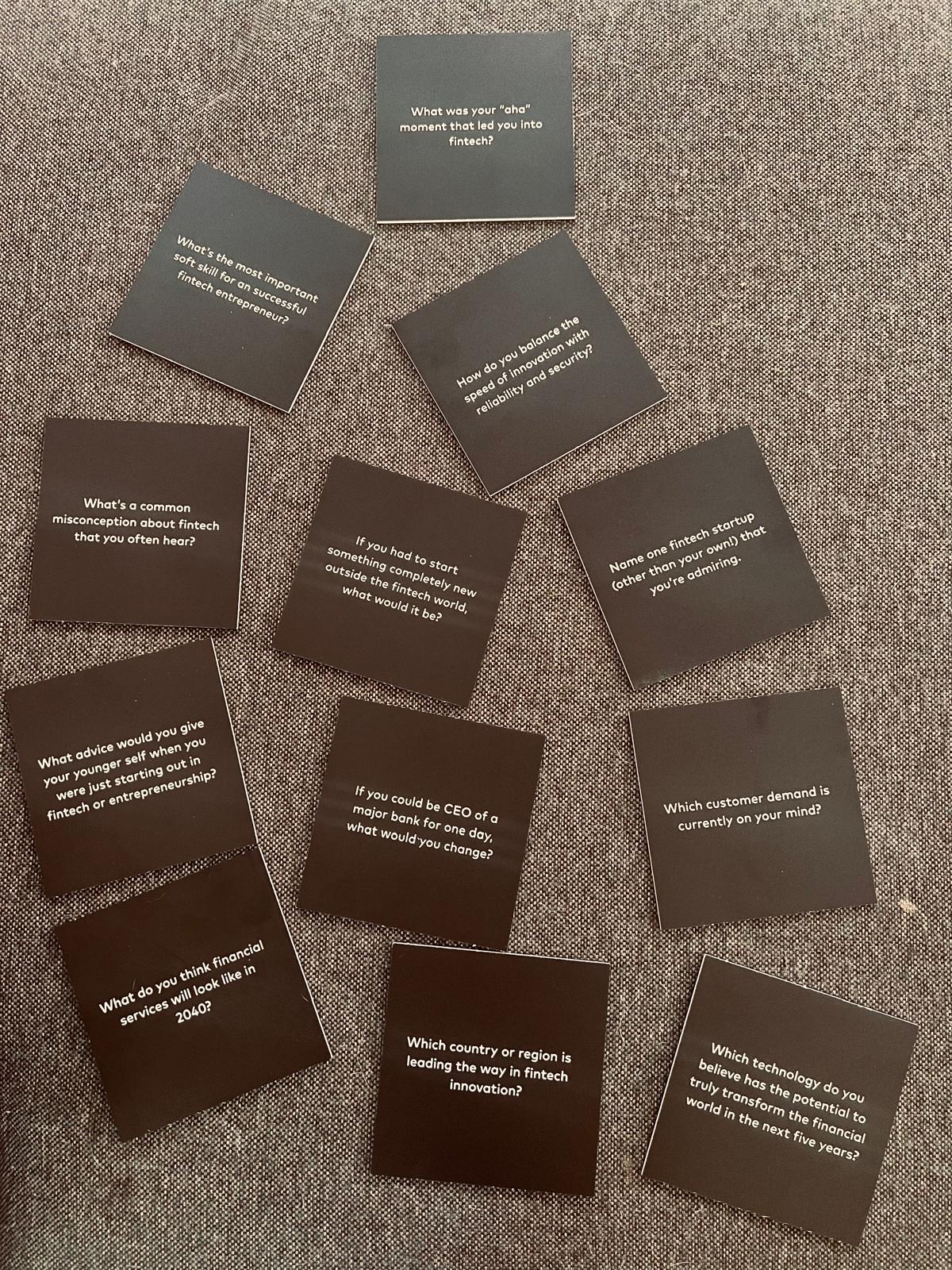

I went to a conference the other day where the organiser left a load of beer mats with questions about fintech.

I picked them up and decided to write my thoughts. Trust you enjoy this ...

What was your ‘aha’ moment that led you into fintech?

I never really had a moment, as I’ve been around the integration of finance and technology for the whole of my life but, if there was an ‘aha’ moment, it would have been when cloud computing and the smartphone combined at the end of the 2000s in the wake of the Lehman Brothers collapse that led to the financial crisis. The reason being that we had two transformative technologies coming together at a time when most financial institutions were weak.

Which technology do you believe has the potential to truly transform the financial world in the next five years?

There is not just one, but several. We are talking digital identity and trust, and DLT (Distributed Ledger Technology) offer ways to secure these things, but it is more to do with how it is structured from ZKP (Zero Knowledge Proof) to secure attribution. Then, waiting in the wings, is AI, AGI, Agentic AI and Quantum. The key is that these are massive buckets of change and not just one thing. It’s all about the use cases. So, imagine Quantum AI for digital identities using DLT and ZKP … that’s what excites me the most right now.

Which customer demand is currently on your mind?

The main thing I am focused upon today is safety and security. When it comes to financial services, am I safe and secure in making this payment? There is so much happening from APP (Authorised Push Payment) to romance scams and fraud, that the key is how to assure customers their money is safe and their payment is secure.

Name one fintech startup that you admire.

The question is a bit difficult as how do you define a ‘start-up’ these days? Is Stripe, Adyen, Klarna, Nubank, Ant and so on a ‘start-up’. No, although they are firms I admire. So, if we are referring to a start-up that has not reached the IPO stage, I’d probably point you towards Yonder. Yonder is a UK credit card proving popular with GenZ, which was started by a group who came out of Clearscore in 2022 and is backed by some famous folks like Rio Ferdinand, the former England footballer.

How do you balance the speed of innovation with reliability and security?

It’s a really hard balance, which I blog about often. In fact, this question is the core of fintech. Tech is innovation; fin is reliability and security. Obviously, the twain must meet; the question is how. If technological innovation is allowed without checks, balances and regulations; it fails. If financial security is placed too high then it acts like a straitjacket and stops innovation. The key balance has to be: will this innocation cause losses and, if so, it must be clear. This is why cryptocurrency exchanges like Coinbase clearly sign that you should not invest unless you are prepared to lose it all. That’s on their homepage and it is there for that reason: be prepared to lose all your money, whilst you speculate to make a million.

If you had to start something completely new in the financial world, what would it be?

Most of us would answer something with AI. The thing is what thing with AI? For me, it would be a financial planning tool that advised me of my future financial plans, risks, expsoures and investment opportunities. It would be like an integrated AI version of PFM and Charles Schwab or eToro. The thing is that I would not need to take actions – the system would do it all for me, unless I said no with my Meta Raybans.

If you could be CEO of a major bank for one day, what would you change?

I’d get rid of half of the executive team and replace them with people from Microsoft, Amazon, Alphabet (Google) and Meta (Facebook).

Which country or region is leading the way in fintech innovation?

Usually, I point to China, but everywhere in the south is leading the way from Nubank in South America to PayTM in India to Flutterwave in Africa to Ant Group in Asia. That’s where my eye is focused.

What’s the most important soft skill for a successful fintech entrepreneur?

For me it is all about communication. Being able to lead and rally people through clear language that creates emotion, vision and direction. It is all about communication.

What’s a common misconception about fintech that you often hear?

Well, I think a lot of people thought it wouldn’t threaten or replace traditional banks. Revolut, Nubank, Ant and others have proven this wrong although, at the same time, right. Revolut, Nubank, Ant and others are not replacing old banks; they’re creating new banks that work better.

What advice would you give your younger self when you were just starting out in fintech or entrepreneurship?

Invest in bitcoin. No, seriously, it would be that you should not fear failure. Every failure is a chance to move on and succeed.

What do you think financial services will look like in 2040?

Read my blog.

1 in 3 banking jobs to disappear by 2040

No-one cares about payments in 2040 except us

Life in 2040 with Albert and Jessica

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...