Regulation

SEC to crackdown on HFT?

I gave my first presentation for a while last week on capital markets and what’s top of mind. Here are the headlines of key areas of focus: High Frequency Trading (HFT) Dark Pools Best Execution Post-Trade Transparency Global Trading Platforms MiFID II I’ll review these areas in more depth during the week, and start today…

Save Bulgaria’s Stock Exchange

I had a reach out from Patrick Young, investment advisor, author of "The Exchange Manifesto" and regular commentator on capital markets. Patrick co-authored an opinion piece with Victor Papazov, the founder and former CEO and chairman of the Bulgarian Stock Exchange, in the Wall Street Journal yesterday. He's given me permission to reprint the article…

How the Dodd-Frank Legislation impacts Capital Markets

I just got this in my intray from Woodbine Associates, an American research firm that works with the exchange, broker/dealer, asset manager, hedge fund and technology vendor communities. It’s really interesting and talks about the impact the new American reforms, known as the Dodd-Frank Legislation, and how this law will impact the Capital Markets. Therefore,…

Why banks have no competition

I had a couple of really interesting dialogues with bankers yesterday. The first was with a career banker who is now working with one of the New Banks on its launch. The second was with an Asian bank manager running his bank's UK operations. As I talked with both, they expressed their frustrations with the…

Revising MiFID and RegNMS for HFT

Gawd, I hate acronymns and look at that! Three in one blog entry title!!! Anyways, for the nerdy-nerd equities guys, this will grab their attention. It's all to do with trading in European and American stocks and shares using High Frequency Trading (HFT) systems, and the regulations therein with EU MiFID rules applying over here…

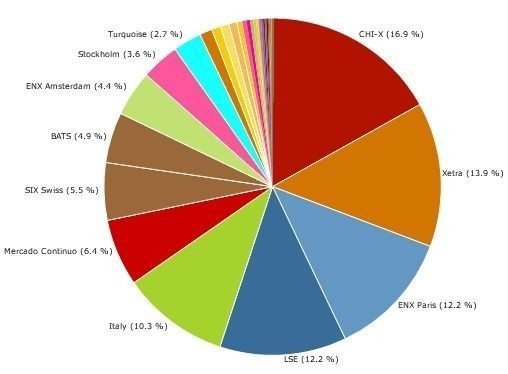

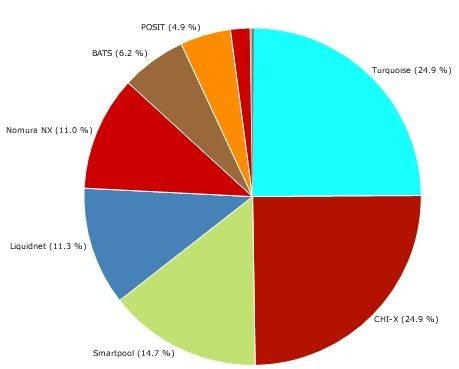

Monthly MiFID MTF Monitor: May 2010

We are pleased to provide our fifth month of monitoring the MTF performances in European Equities trading, in partnership with Thomson Reuters Equity Market Share Reporter (EMSR). Market Share based upon Euro Value May 2010 April 2010 Source: Thomson Reuters Equity Market Share Reporter Market Share based upon Volume of Trading May 2010 April 2010…