Apple rules the world. Assailed by Google/Alphabet, Facebook/Meta, Samsung and more, Apple has sustained an incredible trajectory to become a three-trillion-dollar company. Apple is now worth more than the entire FTSE100 list of companies ...

In terms of competitors, only Microsoft comes close which, some say, is mainly due to OpenAI’s ChatGPT, but Apple’s dominance is clear when we shine the light on their recent moves into financial services.

I’ve tracked this for a long time and was initially sceptical about Apple Pay. My conversion was when they partnered with Goldman Sachs to launch a credit card which, since then, has spanned out to savings and maybe one day a deposit account? In fact, I recently posted the question: should Apple buy Goldman Sachs, as Goldman Sachs is starting to wobble on their commitments to retail consumer finance, as evidenced by their issues with Marcus.

But then they just go and grab $10 billion of savings in just four months and go WOW! In an update on Silicon Republic last Thursday:

Apple’s savings account offering, which launched in the US four months ago, has reached a milestone of $10bn in deposits as more users sign up to the high-yield savings scheme offered by Goldman Sachs.

Admittedly it is because Apple Savings offers one of the best interest rates in America – 4.15 per cent – but also because it is easy – 97 per cent of customers using Savings have chosen to automatically deposit their Daily Cash rewards – cashback when making purchases with the Apple Card – into their savings account.

In case you are not aware, Cash Rewards operates automatically so that, when customers in the US pay with their Apple Card, they get cash back on all purchases. By default, all purchases grant users 1% in cash rewards and 2% for all purchases made using Apple Pay. Transactions with select merchants can even unlock 3% in rewards.

The Apple approach, as usual and in recent times more so, represents a first principles approach of re-inventing finance to fit their audience and brand. Jennifer Bailey, vice-president of Apple Pay and Apple Wallet, said that the company seeks to “reinvent” financial product categories every time it launches a new one, keeping a users’ financial health in mind.

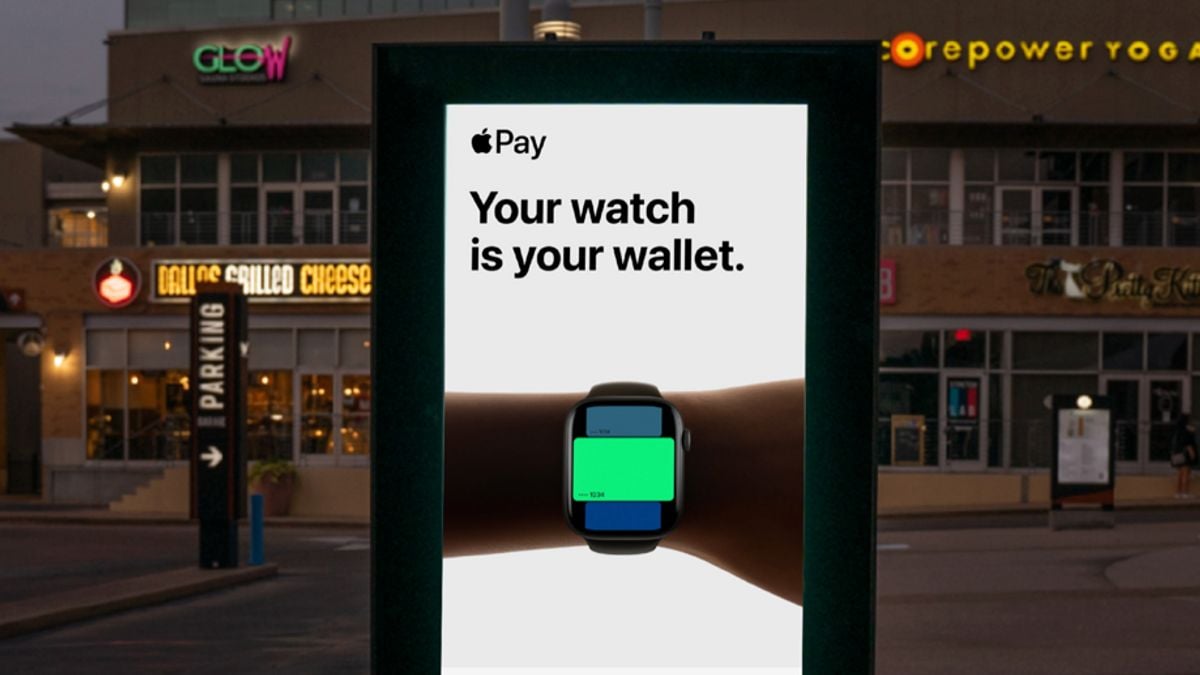

Interestingly, this news was hot on the heels of more Apple financial news as they announced a new marketing campaign Pay the Apple Way. Marketing Dive reports on a new marketing move to promote the Apple Pay service. This builds upon highlighting the Apple Savings offer in the US and the other recent announcement of BNPL (Buy Now, Pay Later) with Apple Pay service.

The press release details that they are focusing upon digital out-of-home experiences, or DOOH as marketing folks call it. Here’s the announcement:

“Pay the Apple Way” is meant to present a solution to the inconveniences of traditional money-dealing like carrying around a bulky wallet, struggling to find the right card and feeling concerned about privacy. Apple is flexing the ease of its Pay feature, which allows payments to be made directly from an Apple device, with a DOOH experience that’s being billed as both dynamic and immersive,

From my personal view, I’ve found Apple Pay amazing yet, for many months, I wouldn’t go near it. My original view? Why do I need this? My view now? What’s a plastic card for?

The main difference is contactless payments and QR codes but, more than this, I needed a kick to make the move. The kick for me was the pandemic, avoidance of cash and living in a country where everyone accepts a contactless payment (even merchants on the street).

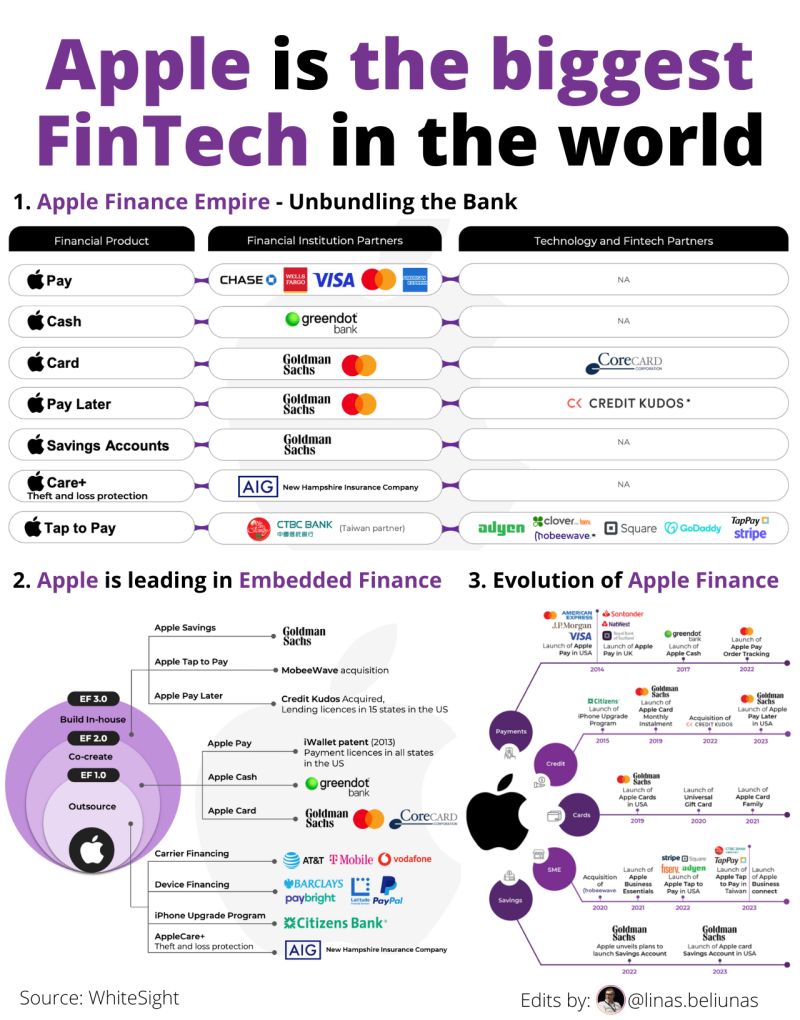

It is fascinating that we could previously discount Apple as a serious financial player. I wouldn’t say that now and, if you are interested in more on this topic, checkout this update from Linas Beliunas.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...