Space … the final frontier … these are the voyages of the challenger bank Trekkie. Our mission: to boldly go where no bank has gone before.

Today, we landed on planet Earth and decided to look at financial inclusion, and the role of banks in ensuring everyone has access to an account. In some countries, this has already happened. Thanks to Aadhaar and the Unified Payments Interface (UPI) in India, for example, almost 90% of adults now have a bank account.

Nearly 90% of those aged 18 and above had access to an account at a formal financial institution in 2020-21, according to data released by the government on Tuesday. The report on the Multiple Survey Indicator for 2020-21 launched by the National Sample Survey Office (NSSO) showed that 92.4% of men and 86.3% of women had an account in a bank, another financial institution or a mobile money service provider.

Recognised as one of the world’s best digital banks, WeBank – part of WeChat and the Tencent empire in China – has become one of the biggest banks in the world since it was launched in 2016. It has been operating 24x7 without any interruption, with the peak daily transactions reaching 800 million and product availability being 99.99975%. To date, WeBank has successfully served more than 350 million individual clients and 3.4 million MSMEs. Most of these customers could never get a bank account before, as it was too expensive and, being blue-collar workers, they didn’t earn enough. That’s why a key to the WeBank service is that it costs less than half a dollar year to deliver.

Their compatriot competitor, Ant Group who run AliPay, have also done amazing things in China. Most recently, they’ve had a focus on financial inclusion, particularly for women in rural China.

In 2022, Ant Group’s philanthropic donations amounted to RMB 790 million (approx. USD 111.6 million), bringing the cumulative philanthropic spending to RMB 2.7 billion (approx. USD 381.5 million) since 2019. Among these efforts, the "Cyber Mulan" program empowered women's development in three key areas: basic protection, employment and career support, and diverse growth opportunities. It provided 3.75 million insurance policies to rural women, offered job training and digital employment opportunities to 10,000 women, extended interest-free or lower-interest loans to over one million women entrepreneurs, and supported 70 rural female football teams.

Pretty cool, huh?

In South America, Nubank has become one of the largest banks in the world thanks to their reach and breadth of financial inclusion. Recent data from the Brazilian Central Bank indicates that Nubank ended 2022 with 75 million customers worldwide and 70 million in Brazil, representing a growth of 39.1%. A year earlier, the fintech’s total customer base was 53.9 million.

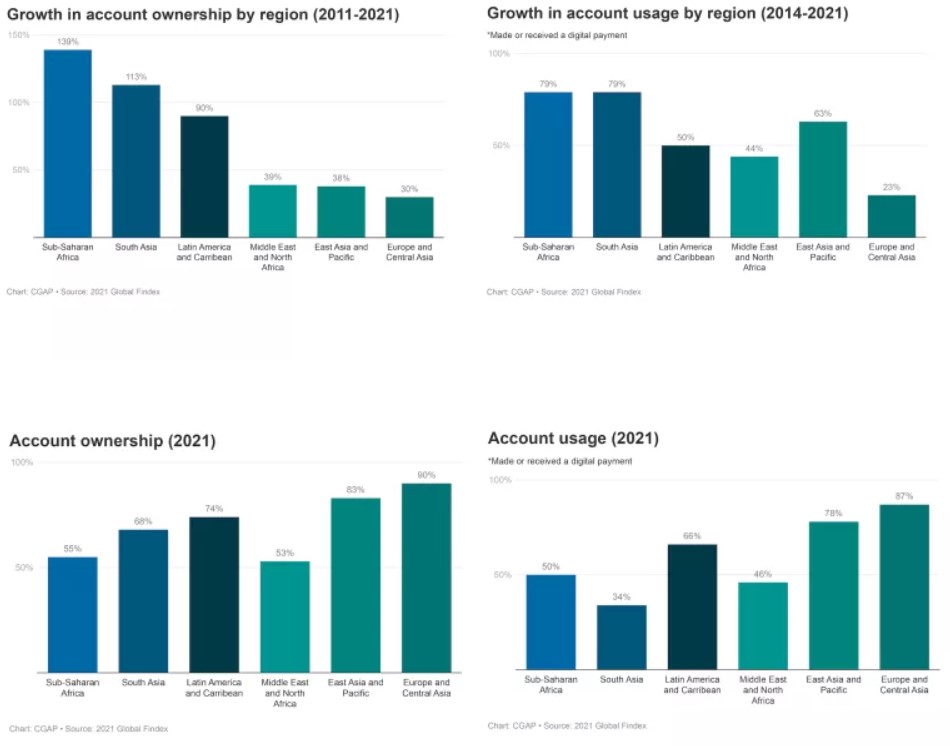

In Africa, it has been less successful, but it is still successful. Between 2011 and 2021, Sub-Saharan Africa financial account ownership more than doubled from 23% in 2011 to 55% in 2021 compared to the global growth average of 50% (from 51% to 76% over the same period).

Source: CGAP

So, what’s the point of this?

The point is that technology has reached the parts of the planet that no-one could reach before. When those points are reached, everyone on planet Earth can be included. They can be included in talk and trade and, more importantly, in transactions and finance. Everyone on planet Earth is now part of a network of connectivity that enables them, for less than half a dollar a year, to have access to a bank account to trade, transact and talk. THIS IS TRANSFORMATIONAL.

Postscript:

When will banks stop seeing financial inclusion as charity? The Finanser, March 2017

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...