Six years ago, I wrote about John Cryan, the then CEO of Deutsche Bank, saying that most people in the bank would lose their jobs to AI. He stated at a German conference that “people behaving like robots doing mechanical things, tomorrow we’re going to have robots behaving like people”.

Thirty years ago, showing my age, I interviewed the head of one financial institution and his comment has stayed with me to this day: “in our firm, we have created a generation of box tickers and button pushers”.

Oh dear.

The threat of massive job losses in white collar work has been around for years. All those call centre workers replaced by chatbots; all those underwriters replaced by software; all those traders replaced by algorithms; and so on and so forth.

Over a decade ago, I was using these two slides to illustrate the difference of the UBS trading floor in Connecticut, USA:

The difference is the global financial crisis of 2008, but also algorithmic trading. Everything that can be automated will be automated. Investment bankers, asset managers and more are no longer needed, and we have debated this for years.

But then we need to consider what is being replaced with what.

For the past ten years, I’ve been talking a lot about AI replacing humans. Lawyers may lose their jobs to AI in JPMorgan; UBS have their roles automated by AI; etc, etc.

This is nothing new. It’s been predicated for years.

The thing is, if all the mechanical jobs can be automated, what do humans end up doing?

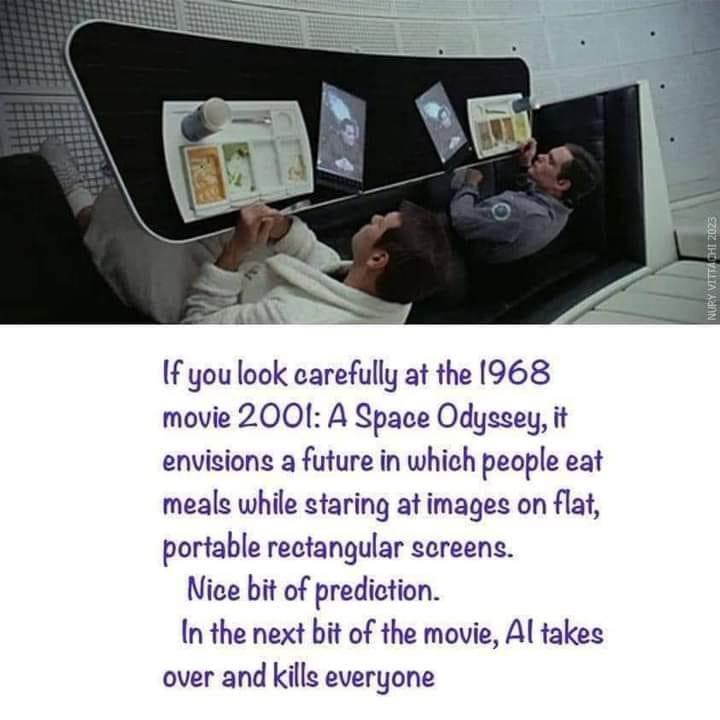

I used to think it was things that humans do best: creativity, art, relationships; but even in these areas I’m being proved wrong.

AI can create poetry, art, music and more. It can even manage relationships better than us. A study by Assistant Professor of Computer Science Adam Poliak found that a panel of licensed healthcare professionals overwhelmingly preferred responses to medical questions from ChatGPT to those given by actual doctors. Why? Because ChatGPT showed far more understanding, patience, understanding and empathy in online answers than those given by doctors.

What does this leave us with?

We don’t know.

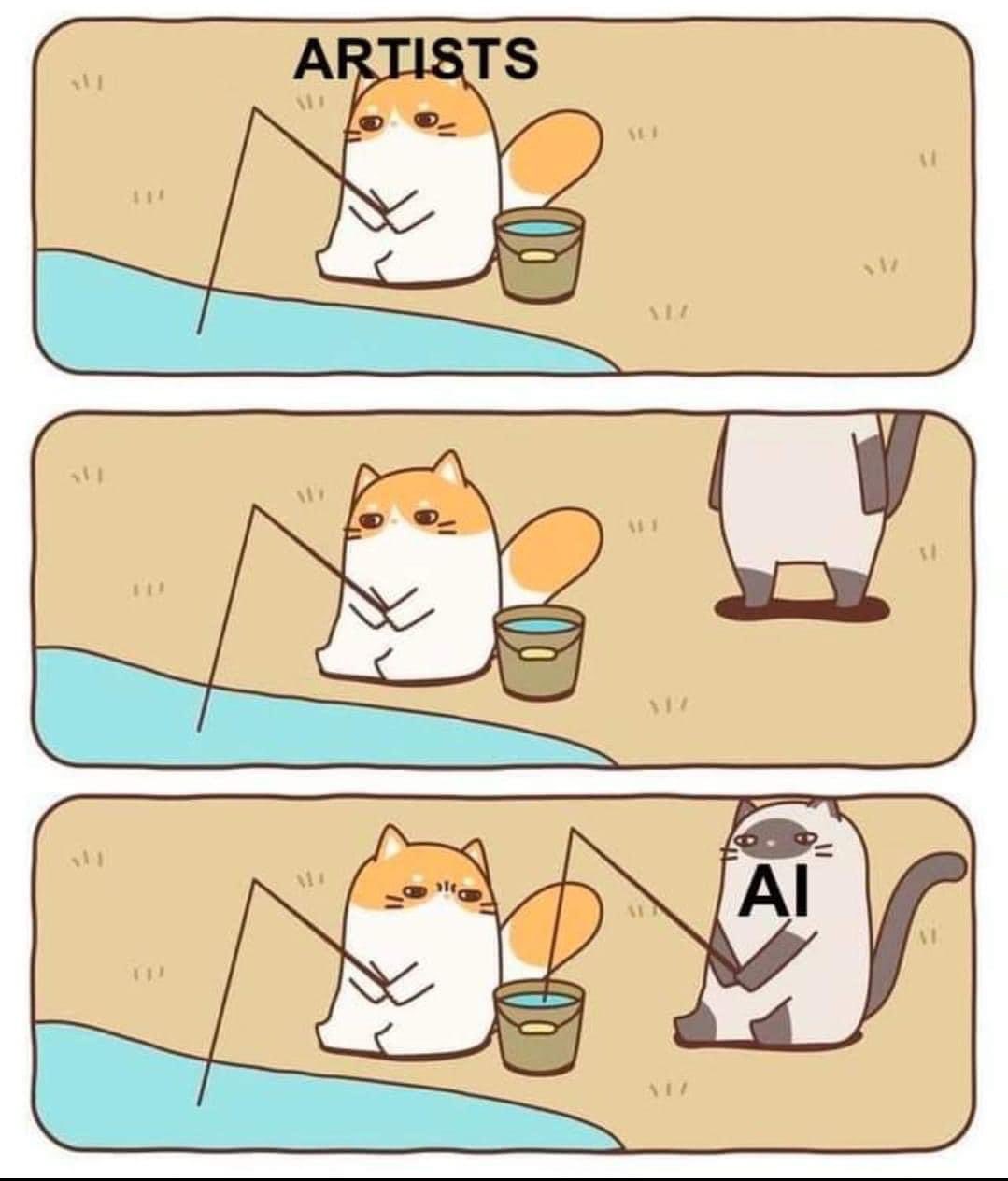

My answer would be that AI is only as good as the humans who provide content. Maybe this cartoon sums it up best:

AI just scoops up creative content from the network and regurgitates it in a form that is easy to absorb. Equally, humans are not necessarily that intelligent:

As we balance the developments of new systems and technologies, humans usually find a way to adapt and absorb such progress. We may be naturally stupid, but we have our ways and means. For example, I was quite surprised that my school was explaining how they track and trace kids who are cheating in their essay submissions. How do they check this? They use AI to check if the essay has used AI to write the essay, and it works apparently.

As humans, we will always create, develop, progress and innovate and, as we create these innovations, we will always find ways to ensure that everyone has a role in the future structure of society, whatever that future structure might be.

So, I am not worried about AI. It’s just a double-edged sword, like any technology. On the one hand, it helps us to do things that are mechanical and should be automated; on the other, it can be used to destroy us if we let it … but we won’t, will we?

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...