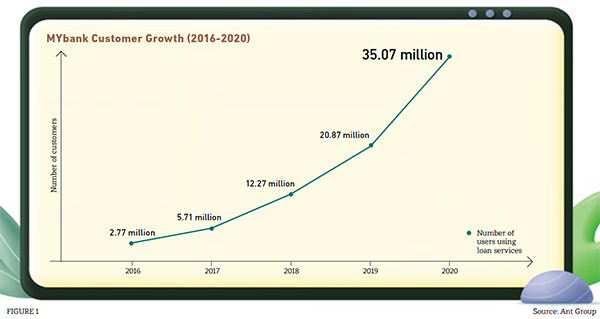

I'm always looking for innovations in new banks and spent some time with MYbank, the bank created by Ant Group in 2014. My first visit was in 2017, and the bank was doing well. Focusing upon SMEs, the bank shot to massive growth volumes, making a staggering $30 billion in loans in first quarter 2022 combined with 32% year-on-year growth.

There's a nice case study about the bank written by Singapore Management University and a couple of paragraphs stand out:

Banking had traditionally paid more attention to high-net- worth individuals (HNWI), and concentrated on having fewer accounts and more one-on-one relationships. However, MYbank had decided to direct its attention to technology to enable quick transactions, handle a large volume of low-income consumers, and lower operational costs to create a sustainable business model. Its strategy was to use automation, standardisation, and Artificial Intelligence (AI) to reach a very large number of customers with low balances.

It was the large volume of such customers without access to formal financial lending that proved to be the ticket to MYbank’s success. There were many examples of inclusive finance models implemented globally, but very few could match the scale of MYbank. For example, Bangladesh’s Grameen Bank, the pioneer in inclusive finance, had 9.33 million members in 2020 after more than a decade of existence, while MYbank had more than 70 million users by 2021, only six years after its inception.

Similarly, a few years ago, I bumped into Henry Ma, CIO of WeBank China, who outlined the ABCD of their fintech approach:

- A is for Artificial Intelligence;

- B is for Blockchain;

- C is for Cloud; and

- D is for Data.

I thought this was nice and simple, as it reminded me of that old song L-O-V-E*, and blogged about his speech because it astounded me that a bank could run an account for less than half a dollar! Three years later, in another interview with a WeBank executive – Arthur Wang, CFO – I picked up a couple of quotes that really stood out.

#WeBank has grown their customer base to more than 340 million individual customers and almost 2.8 million SMEs in just five years. Their per-account IT operational and maintenance annual cost is about $0.40, a tenth of the cost of regular big banks.https://t.co/gksKYA2zZb

— Chris Skinner (@Chris_Skinner) December 1, 2023

And this one in particular:

“The current transaction volume of our banking system can be as high as 800 million financial transactions per day. This is equivalent to the capability of the five big banks in China, but WeBank spent one-tenth of their IT costs to achieve the same.”

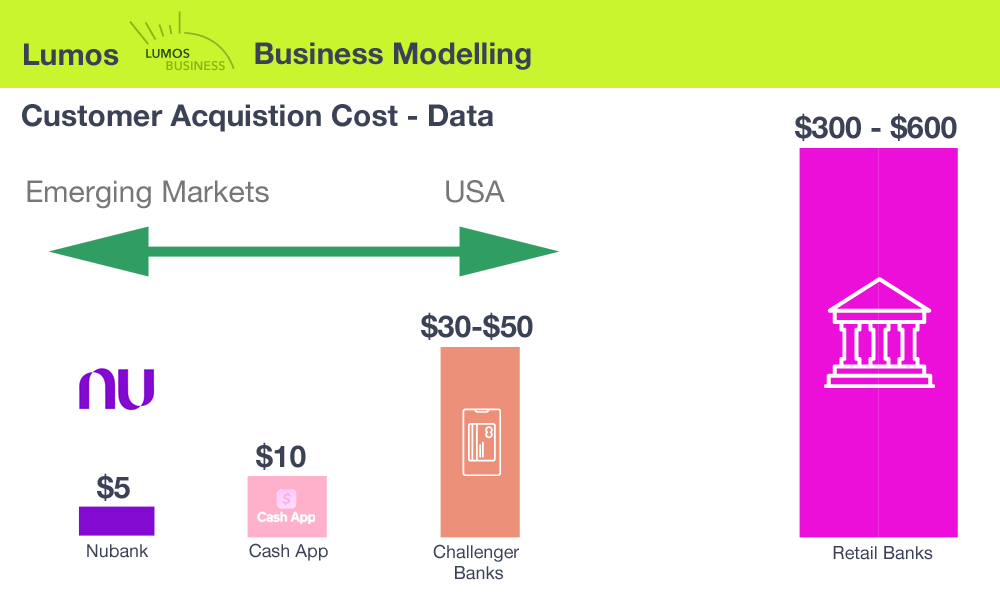

Sure, it’s a jab at big banks but if a fintech start-up can administer accounts at one-tenth of the cost, that is the thing. One-tenth of the cost and lightning fast. Xiaomi-backed XW Bank can process online loan applications in less than forty seconds, with the fastest processing taking just seven seconds.

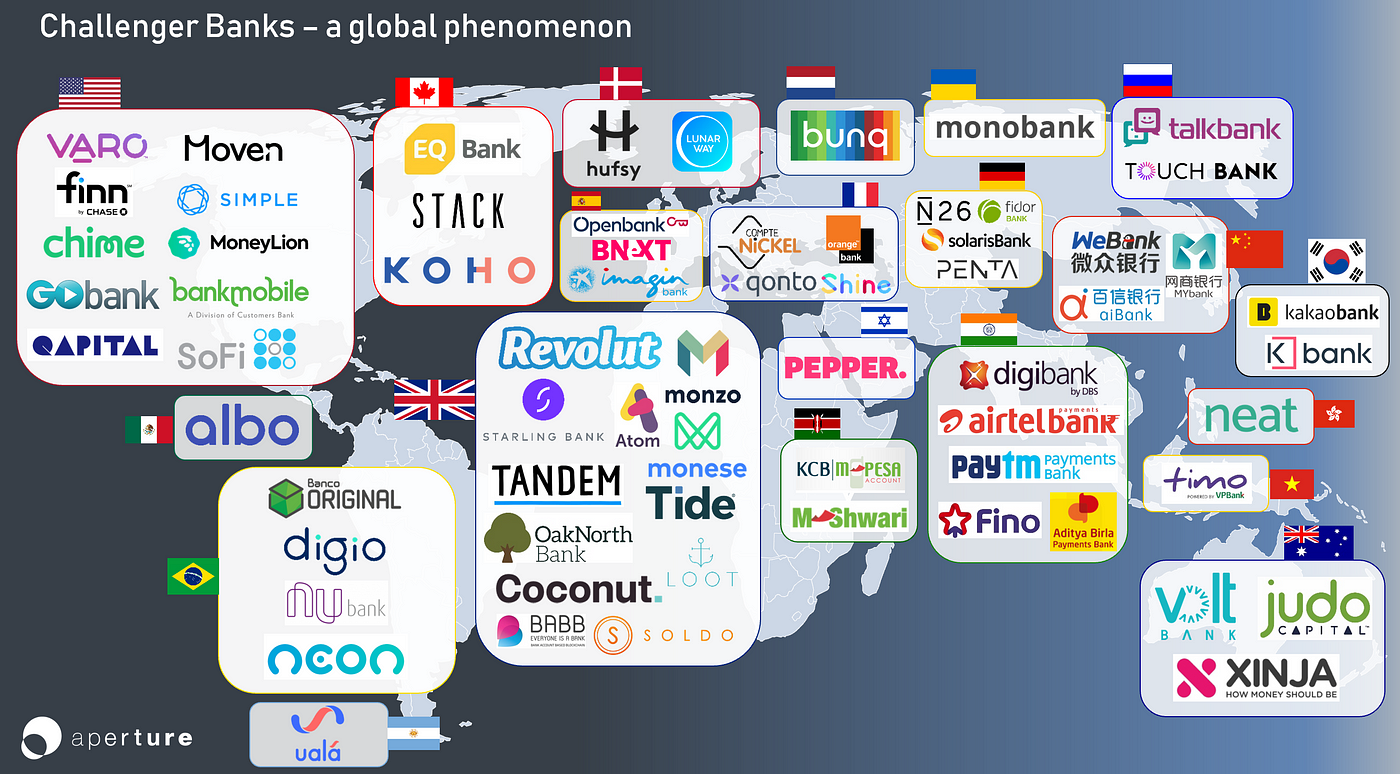

All of these examples are Chinese, but the same phenomenon can be seen worldwide. Monzo is attacking America; Bunq is coming back to Britain; NuBank is expanding across the South Americas and likely other territories soon.

This is why challenger banks are getting attention, even if you personally dismiss them. Alphabet or Google if you prefer, are investing in Monzo at a valuation of $4 billion through their VC fund; Tymebank in South Africa just snagged an investment of $77 million through an investment led by Tencent, the owners of WeBank; Charlie, a new banking app in the US catering to the 62+ community, just landed $23 million in a Series A funding round led by TTV Capital; Mexican challenger Albo has secured $40 million as part of its Series C funding round, which was led by Morpheus Ventures … I could go on, but the core point is that there are serious savings to be made by automating bank services using the ABCD approach.

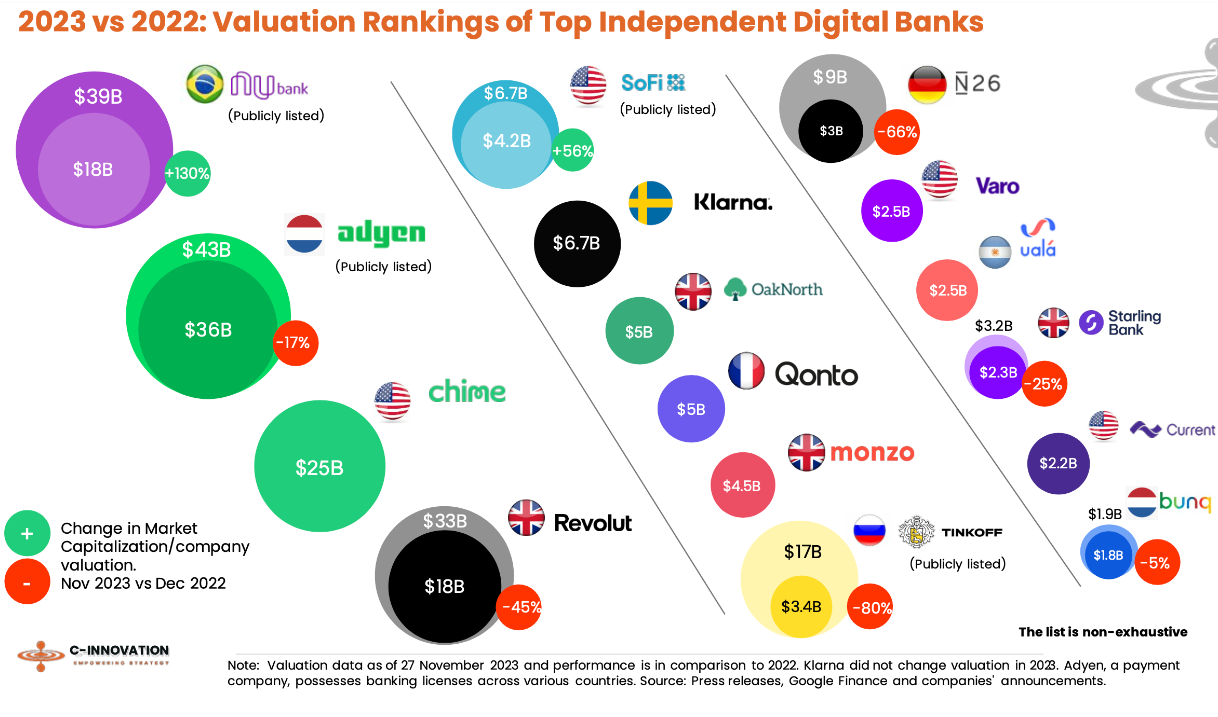

This is why I was really taken with this update from C-INNOVATION’s Ramy Mohan on challenger bank valuations. This chart particularly resonated:

If you haven’t noticed C-INNOVATION, notice them now and definitely read their latest update on challenger banks.

And I guess the final thing I would share is this:

Source: Lumos

Postscript:

Just an fyi, I'm running a series of immersive workshops on banking, fintech and tech so, just mentioning that it may be a good time to consider this for your 2024 kickoff planning!

And for more about the WeBank story, have a listen to Jim Marous’s Banking Transformed interview with Henry Ma, CIO of WeBank, last year:

* L-O-V-E is an old song written by Bert Kaempfert and Milt Gabler, recorded by Nat King Cole for his 1965 studio album. Here’s Michael Bublé singing it with Diana Krall

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...