You may not have spotted it this week, but there has been a number of major strategic changes and moves by fintech leader Stripe. I’ve followed Stripe since their founding in 2010, and use them as a poster child of change in finance and technology, as demonstrated by their fast cycle growth from a company opened in 2011 to a $95 billion unicorn in 2021, now valued at $65 billion due to the fintech bloodbath.

What’s the latest?

Well, the biggest announcement this week is decoupling merchant checkout and payments from the rest of their financial stack. Here’s Techcrunch’s take:

Stripe announced that it will be de-coupling payments — the jewel in its crown — from the rest of its financial services stack. This is a big change, considering that in the past, even as Stripe grew its list of services, it required businesses to be payments customers in order to use any of the rest. Alongside this, the company is adding in a number of new embedded finance features and a new wave of AI tools.

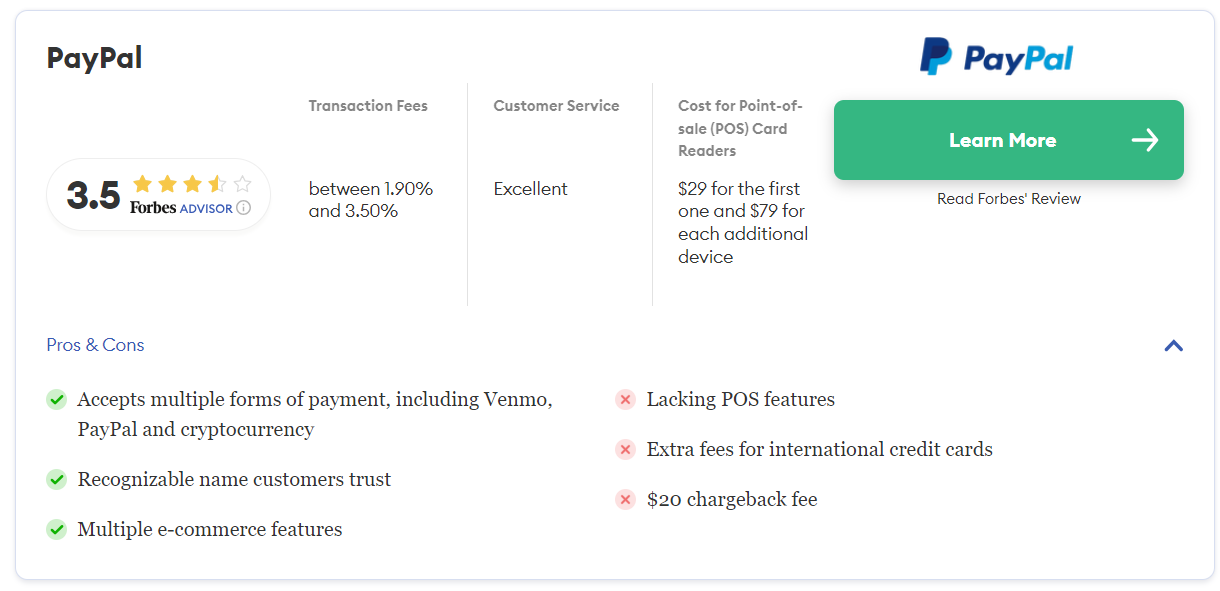

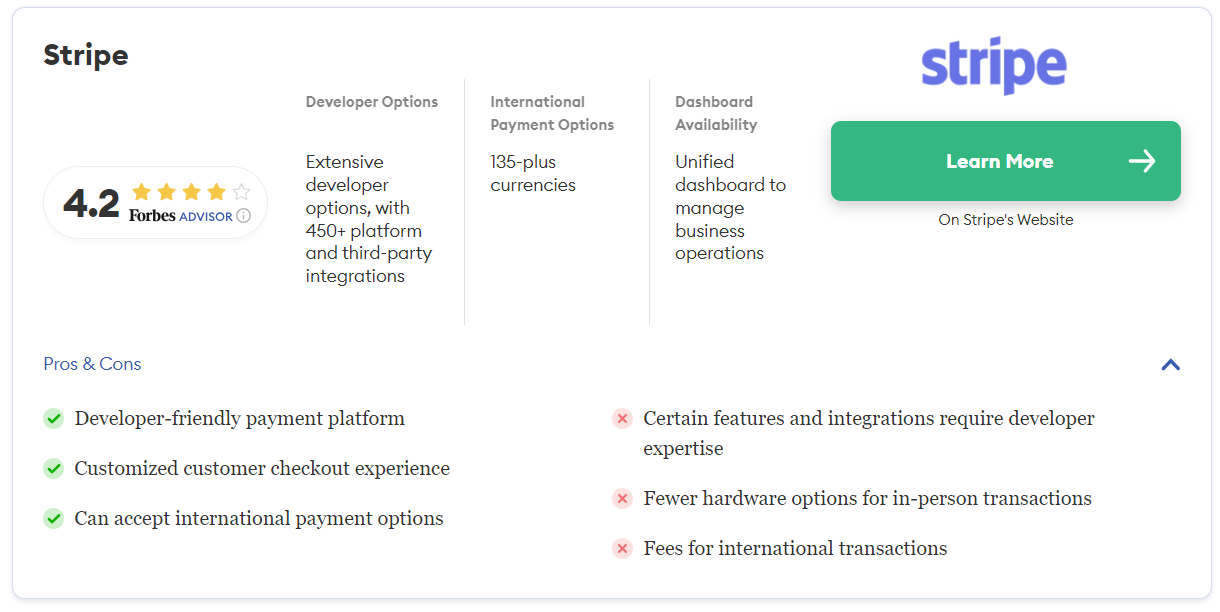

So, this is big news and responds to increasing competition from Adyen and PayPal. According to Forbes, PayPal is better for SMEs whilst Stripe is better for larger firms.

Stripe is better suited for companies that want flexibility and the ability to customize practically every process of the online payment experience.

You can find out a lot more of the comparison on Forbes.

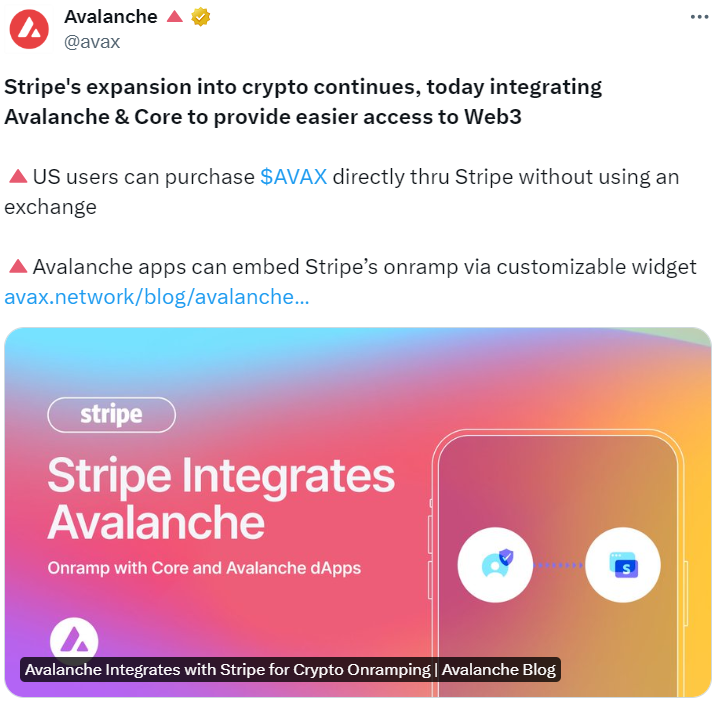

In other breaking news, Stripe have returned to the crypto markets and embraced them fully by integrating Avalanche for fiat-to-crypto onboarding. What is Avalanche? Well, according to their developers at Ava Labs:

Avalanche is the fastest smart contracts platform in the blockchain industry, as measured by time-to-finality. Avalanche is blazingly fast, low cost, and eco-friendly.

Are you still with me payments professionals and bankers?

John Egan, Head of Crypto at Stripe, said that:

“We're excited to add AVAX into our onramp's family of supported networks. Further enabling consumers to onboard into Avalanche's growing dApp ecosystem is closely aligned to our goal of making it safe and easy for everyone to access the power of Web3”.

So, Stripe has a Head of Crypto. Very good.

Are you still with me payments professionals and bankers?

And then, to just double-down on this commitment, Stripe has integrated stablecoins for checkout APIs this week too! According to Fintech Futures the new feature “will enable checkout customers to transact in USDC stablecoins, issued by Circle, with options to toggle wallets between the Solana, Ethereum and Polygon networks initially”.

John Collison, co-founder, makes clear that crypto is back.

I guess all of this is so exciting because Stripe held a big conference in the USA this week called The Stripe Sessions (why didn’t they invite me?).

So, when’s the IPO guys?

Well, after processing more than a trillion dollars of payments last year, they say there’s no rush to go public:

“2023 was a big year. We hit dual milestones of $1 trillion in payment volume and being cash flow positive. We don’t disclose the historical financials, but obviously Stripe has been in build mode up to this point.” said John Collison, Stripe’s co-founder and president.

What amazes me is that, in quoting that quote, The Financial Times states that the company is among the most valuable private businesses in the US, alongside Elon Musk’s SpaceX and artificial intelligence company OpenAI. Note: private.

It’s a fantastic achievement for brothers John and Patrick Collison, along with their investors obviously. I wish them continued success into the future and yes, they are still my poster child for the fintech revolution.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...