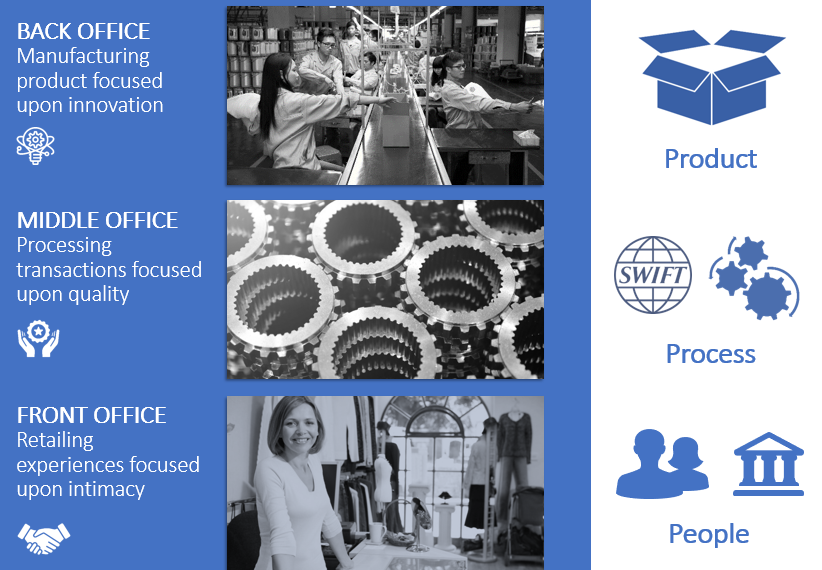

For a long time, I’ve had this chart that shows how banks can become digital banks by moving from the distribution of paper through buildings with humans to the distribution of data through software and servers. It’s a stable of my presentations and the argument is that the front, middle and back office needs to move from a focus upon product, processes and people (last century structure) to a focus upon apps, APIs and AI (this century structure).

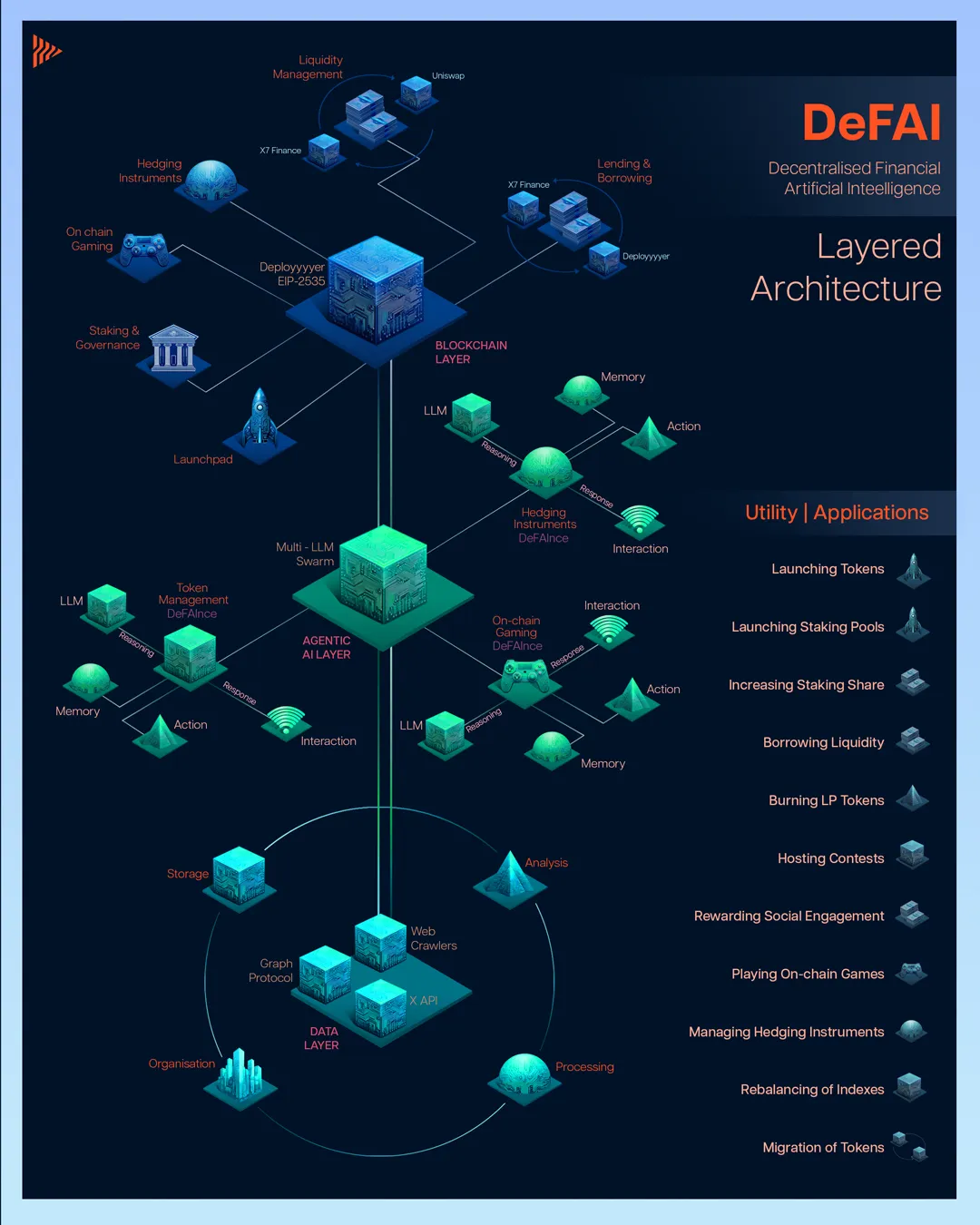

I could waffle on about this for hours but then realised, today, my chart is out-of-date. That’s because I got this new chart from @deployyyyer ...

... and it made me realise that the mantra of apps, APIs and AI has moved on to a discussion of agentic AI (deployyyyer call it DeFAI), blockchain and data. You can frame it as you like.

DeFAI – the combination of decentralised finance (DeFi) and AI – is the focus of my latest book Intelligent Money, although the thinking is developing all the time. For example, when the book came out last year the main view was around AI being used to answer questions; with agentic AI, the view this year it is all about AI asking the questions on your behalf, creating the answers and giving them to you on a plate.

This means that the new front, middle and back office of a bank or fintech or company is no longer focused upon apps, APIs and AI, but more around agentic AI, blockchain tokenisation and data.

Agentic AI delivers the experience. It does more than this. It manages the experience based upon your delegated authority. You no longer need to login, authenticate and respond; your AI agent does it for you. That’s what agentic AI is all about: it is your delegated agent to manage your digital life for you. Or that’s what is should be and will be, as we’re not there yet. The key is that, when you think about Agentic AI as your delegated digital agent, it is acting and deciding things on your behalf. That is your front office relationship.

Then we have the back office, which I’ve always argued is all about the data. You cannot be intelligent with dumb data – another thing I’ve said for a long time – but what is smart data? Smart data is where you have a consistent, consolidated, co-ordinated, current structure of data about customers and clients that is holistic and robust. There are very few firms who have such a system, as data gets fragmented, shared and unreliable very quickly. Think about your own data on your PC and the challenges therein, and you’ll know what I mean. The key is to be on top of the data. You cannot feed and make agentic AI work without a back office that completely understands the data that is needed to feed it.

And then you have the middle office. The infrastructure. Historically this has been SWIFT, Visa, Mastercard, Vocalink, the EBA, STEP, TARGET, Fedwire, FedNow and such like. But imagine this … all of those systems evolve into smart contracts and blockchain-based systems. In fact, you don’t need to imagine this. It’s actually happening. SWIFT has moved to tokenisation, as have Visa and MasterCard. In other words, the middle office infrastructure is tokenisation, smart contracts and blockchain.

This is the new world. It has moved on from apps, APIs and analytics to agents, tokens and data. The structure is similar but different, and it’s a long way from product, process, people. The era of paper processed by buildings with humans is dead. The new age of data processed by data with tokens is now.

Are you with it?

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...