As blogged yesterday, the GENIUS Act can open the doors for closed-loop networks using stablecoins that circumvent the traditional four-pillar model of issuer, acquirer, merchant and processor. Yes, it could save billions in interchange fees, but there’s another movement in stablecoins trying to change the world. This one is trying to get rid of SWIFT, the fifty year old institution for cross-border messaging around payments and settlement.

Who could want to attack SWIFT?

Well, many have in the past – Ripple being the main contender – but they’re still going strong today and you have to bear in mind that SWIFT is not a company but a community. It’s a community of over 11,000 banks in more than 200 countries – mainly in Europe and America – that allow global transactions to work across borders.

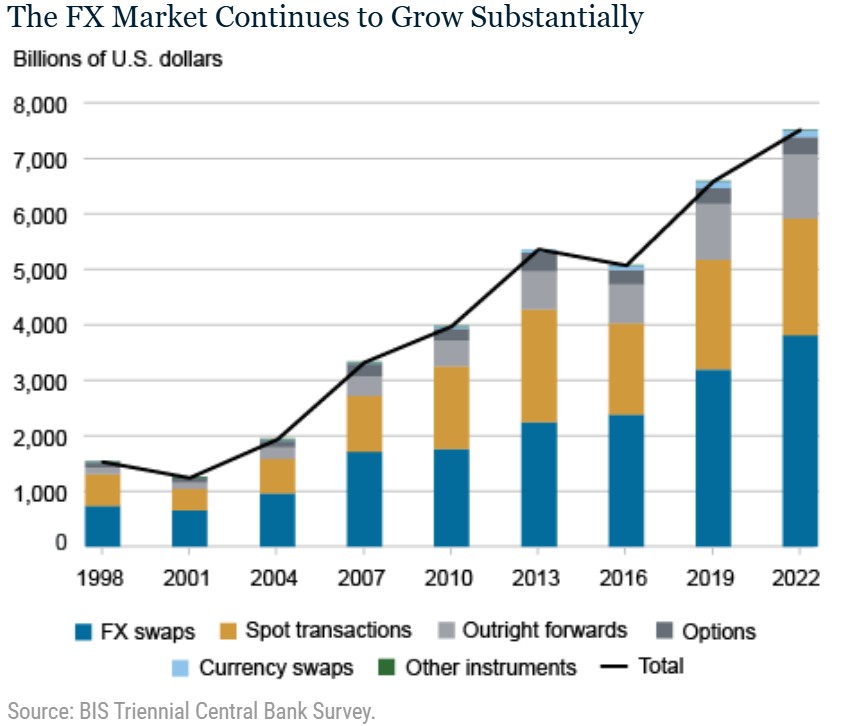

Created in the 1970s to replace telex and telegraph, SWIFT aimed to establish a secure, standardised, and automated private network that was more secure, trusted, efficient, accurate and reliable as a method for financial institutions to communicate and transfer funds globally. It still does that today, although the world has changed a lot in fifty years. For example, global FX (foreign exchange) trading was just a trillion dollars a day in 2000 … today, it’s almost eight trillion dollars a day.

The world has changed.

The thing is that we would all accept the world has changed, but does that mean the infrastructure that supports the world should change or, more importantly, be replaced?

Many have argued that the infrastructures created in the 1970s for the financial world are now creaking and groaning at the seams. Visa, MasterCard, SWIFT and more are often critiqued for being behind the innovation curve. Visa, MasterCard, SWIFT would claim they are keeping up and changing with the community they serve. The community they serve being the global financial community.

The question is: are they keeping up?

Obviously, their answer is yes. Visa* bought Tink in 2022 and is partnering with many other fintech firms, as is MasterCard**; and SWIFT*** has been running Innotribe for years, their centre for creating innovative change in global trade, and a place where I first encountered bitcoin back in 2011.

But what we are seeing today is potentially radical change to rebuild the payments system, which some call the rails whilst others call it the plumbing. Whatever you call it, like the railways and water systems, we have years-old infrastructures trying to work with modern-day systems and succeeding or failing in their own individual ways. The most shocking example of a failure was the collapse of an Italian bridge in 2018, although there are many others.

The big question is whether the rails, the infrastructure, the plumbing, is fit for purpose in today's world.

Anyways, back to the payment giants, there are many who think SWIFT needs replacement. As mentioned Ripple is one, whilst the latest debate on LinkedIn is that Tether is “building the rails to replace SWIFT”. Really?

According to Graham Cooke, CEO and founder of Brava Labs who focus upon stablecoin systems, Tether’s investment in Transak is starting the rebuild of the rails for the global cross-border trading system using stablecoins.

What is Tether?

Launched in 2014, Tether is a blockchain-enabled platform designed to facilitate the use of fiat currencies in a digital manner. More importantly Tether, often referred to by its currency codes USD₮ / USDT, is a cryptocurrency stablecoin pegged to the United States dollar. With over $150 billion in reserves, it is an important player.

What is Transak?

Transak enables users in more than 75 countries to move money between fiat and stablecoins through local payment methods, bank transfers, cards, and virtual IBANs via a single API.

Tether and Transak are an interesting combination to create global currency transfers in a seamless, simple way via APIs and stablecoins. There is the claim that companies like Tether and Transak are rebuilding the rails of currency movements and payments worldwide.

I’m personally unsure of where this is going. After all, if you are the incumbent with 11,000 banks supporting you, will new kids on the block takeover? It is similar to the discussion of Visa and MasterCard. If you have almost 2.5 billion card users and millions of merchants onboard, it is hard to displace you isn’t it … or is it?

I guess the point is that Blackberry, Nokia, Blockbuster, Kodak and others all thought this way, and that’s why they no longer exist the way they did. They are a shadow of their former selves as better alternatives hit the market and gained the traction.

So, the bottom-line for me is that SWIFT, Visa and MasterCard need to watch the stablecoin market developments closely and, oh, it seems they are!

* Visa has made several recent fintech acquisitions to enhance its global payments network and services, including the acquisition of Brazilian core banking platform Pismo for $1 billion in 2023, London-based cross-border payments fintech Currencycloud for approximately £700 million in 2021, and European open banking platform Tink for $2.2 billion in 2021. These acquisitions aim to strengthen Visa's ability to facilitate global money movement and develop more transparent, efficient, and digital payment experiences.

** Mastercard has acquired several fintech companies to expand into various areas, including acquiring Finicity (2020) to bolster its open banking services, Minna Technologies (2024) to improve subscription management, VocaLink (2016) to enhance UK payment infrastructure, and Aiia (2021) to strengthen its open banking capabilities in Europe. Recent investments include a minority stake in MTN Group Fintech (2024) and Corpay (2025) to expand into digital payments and cross-border transactions in emerging markets and commercial services, respectively.

*** SWIFT does not acquire fintechs but collaborates with and integrates fintech services into its existing infrastructure. Notable examples include Ebury who are becoming an active participant on SWIFT’s GPI payment scheme and blockchain integration with platforms like Chainlink for digital asset transactions.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...