As usual, clicking over LinkedIn, I got a chart that made me sit back and smile a bit. What chart? This one:

Source: Brice Groche, LinkedIn

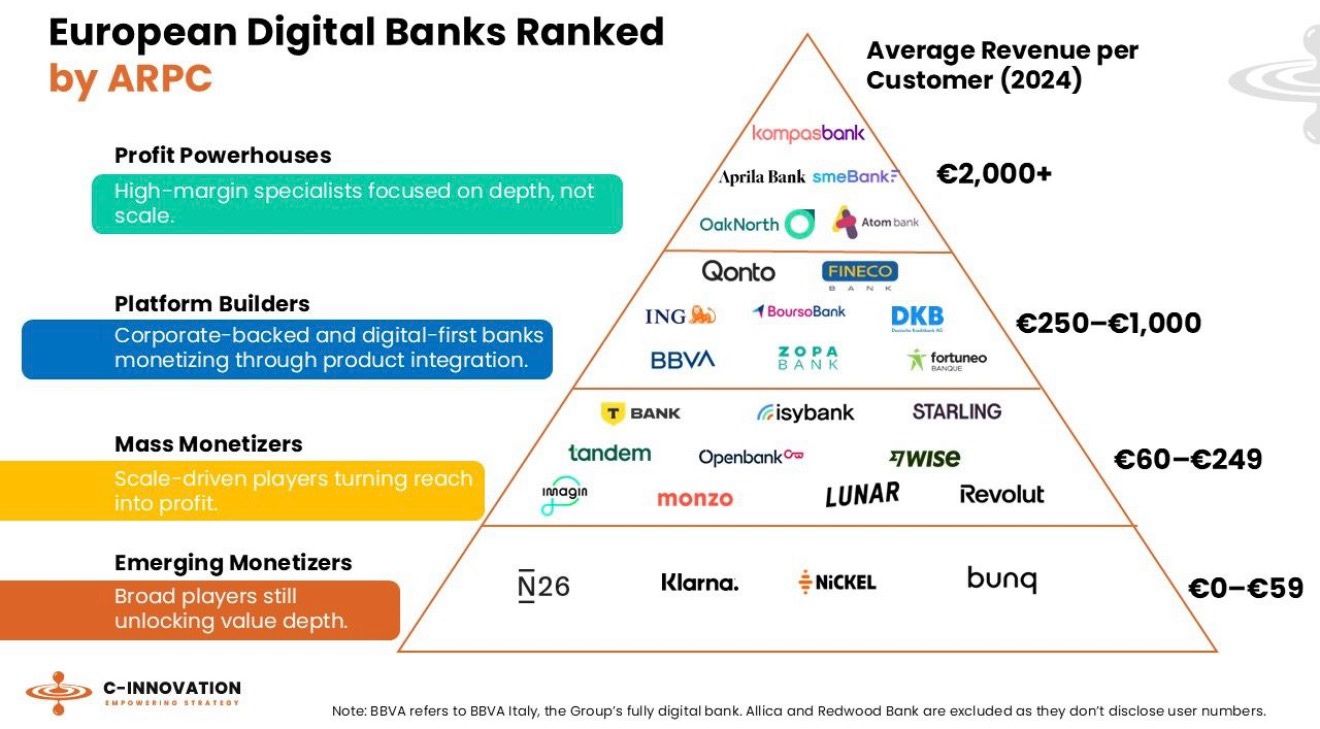

The chart outlines the revenue models of Europe’s digital finance firms, and what it made me realise is the big difference in strategies of challenger banks and start-ups. When you look at this chart in a simplified form, it illustrates those who focus upon loans and credit (depth) versus those who focus upon payments and transactions (shallow).

What this means is that you make far more profit from a long-term mortgage or credit card deal than from just processing $10 online.

Most traditiaonl banks provide all of these services, which is why they talk about cross-sell ratios and packaged accounts. Old bankers want customers to have their main deposit account with the bank, and then add adjacenet services from credit to insurance to maximise the share of wallet they can provide.

What interests me here is that neobanks and fintech start-ups are more focused upon narrow-line services, in terms of just doing payments and transactions.

A great example is Wise, formerly TransferWise, who have a shallow, transactional system, but one that works well. While Wise reported significant growth in revenue and customer base in the six months leading up to September 2025, its underlying operating profit decreased. Wise reported revenue growth of 11% but a 15% drop in underlying operating profit for the six months ending September 30, 2025.

Analysts view Wise as a highly profitable and potentially valuable company due to its rapid growth and ability to disrupt the financial industry, according to eToro and MoneyWeek.

Interestingly Wise first became profitable, six years after its founding and, as transactional payments business primarily focused upon cross-border payments, is doing pretty well.

Another shallow business is Revolut, but it is trying very hard to become deep. This is why Revolut wants a full banking licence in Britain, where it has the most customer traction.

Revolut, like Wise, started with the focus upon travellers and cross-border payment transactions but now wants more depth, which is why it now talks about the company as a financial superapp.

It might be working as the firm has recently exceeded over 65 million customers worldwide with a net profit of $1.0 billion and a profit before tax of $1.4 billion last year. The company seems to be in a strong roll too after achieving a net profit of $545 million in 2023, up from $428 million in 2022 … but then there is a nagging concern: the United Kingdom.

Although the UK government is keen to support Revolut, the regulators and, specifically, the Bank of England’s Andrew Bailey does not. Why? Because the UK is the critical market for Revolut. It is the firm’s number one marketplace with over 12 million users and Governor Andrew Bailey is worried that if they get a full banking license, there may be many issues.

Mr. Bailey blocked a meeting with the UK government to speed up Revolut's full banking license, citing concerns that the Bank of England's regulatory independence should not be influenced by political intervention. While Bailey denies any "falling out" with the Treasury, the incident highlights a tension between the government's goal of "regulating for growth" and the Bank's commitment to regulatory independence and stability, particularly given Revolut's past regulatory issues.

What are those issues?

Accounts and honesty.

The delays are partly due to past concerns raised by auditors about the verification of Revolut's revenues, which the Bank of England insisted needed to be resolved before granting the initial license.

Revolut did get a limited UK banking license in July 2024 but it is struggling to get a full license, which would give it depth. Specifically, the ability to hold deposit accounts and offer full lending and credit services, similar to Atom and their ilk.

In fact, Revolut represents a major fall-out between the government, the central bank, the regulators and the markets.

The thing is that the deeper relationships financial firms have with clients, the more regulation is needed. Interesting …

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...