Many years ago, I was presenting to a country suffering sanctions. No longer able to access the SWIFT network and pretty much excommunicated by most banks worldwide, they were suffering. Of course, they could do nested accounts, where you bury your bank in a pyramid of other banks, but that is pretty complicated, so I told them to invest in bitcoin.

The whole reason is that, with bitcoin, they could move money worldwide in real-time with no government intervention. Obviously they were listening: Russia's Use of Crypto Schemes; Iran Counts on Bitcoin to Evade Sanctions; and there’s more.

Then, on the other hand, I see a headline almost every day saying that governments are going to crackdown on cryptocurrency usage, particularly China. China banned bitcoin mining and trading in 2021. Did it work? …

…

…

No.

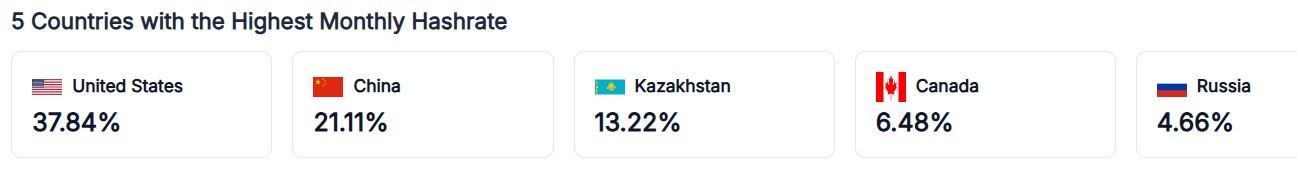

It worked for five minutes, but China is now back to being the second largest bitcoin mining community in the world after the USA (I was a bit surprised to see Kazakhstan in third place!).

Source: World Population Review

The latest move is in the November budget by the UK Chancellor Rachel Reeves which, interestingly, was quite crypto friendly.

Crypto escaped fresh tax rises in the UK's latest budget statement. However, the government is pressing ahead with tougher reporting and regulatory measures to tighten oversight of the sector amid concerns over jurisdictional competitiveness.

Why so positive?

Because a “a rainy island with a hostile tax system is a hard sell”, according to Richard Muirhead, co-founder and Chairman of Fabric Ventures.

The core issue here is that cryptocurrencies have several features that, for a government, must be undesirable. A lot of the funds move across borders with no oversight; they cannot be taxed therefore; much of crypto investing is making a lot of untaxable returns for those trading; it is enabling the avoidance of sanctions; it is a global platform with zero national regulatory controls …

Shall I go on?

However, as a government, you cannot crack down on crypto because it makes your country undesirable to the crypto whales who now control much of the world.

This is why the libertarian dream is backed heavily by Donald Trump’s GENIUS Act created by his tech leaders BFFs, such as Elon Musk and Peter Thiel. These are the guys digging our graves, trying to escape Earth whilst building super underground bunkers to protect themselves and their families.

What is the libertarian dream though?

- Market-based solutions: free-market principles to drive innovation and solve problems, favouring competition over government control;

- Technological advancement: technology can be used to overcome human limitations and create a better future; and

- Scepticism of government: a complete distrust of government as it stifles progress and the world should be driven by private enterprise and individual freedoms.

Bearing in mind that wealth is concentrated in just a few billionaires hands, it all seems a bit dystopian and like something out of Metropolis to me.

Does that make me a Statist? What’s that? An advocate of a political system in which the state has substantial centralised control over social and economic affairs.

No it doesn’t. It makes me a realist.

There must be controls over networks. Does it need to be government controls? Yes. But, who is the government? The network? The central government of the nation? Or something in between?

I would argue the latter, which is why stablecoins get interesting as they can represent a hybrid of centralised and decentralised structures when it comes to money and payments.

This means you have security, regulation and oversight, integrated with global trade digitally across borders. Meanwhile, the key to all of this is whether governments can still control their tax and currencies or, more likely, that the horse has already bolted the gate and the technologists allow us all to trade with zero government control, regulation or knowledge.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...