Well guys, it doesn’t look good. Most banks and economic think tanks reckon the world is in a dive. Happy New Year!

Much of this has been caused by the economic uncertainty of the world superpower called the USA. Donald Trump’s tariff policies has caused huge nervousness and so the economies of all countries are on a rollercoaster.

The Independent summarises it nicely and reckons that President Donald Trump’s trade wars have not only caused the stock market to fluctuate wildly, but raised U.S. household costs by an estimated $1,100 in 2025, according to the nonpartisan group The Tax Foundation.

On the macro level, it has cascaded into a global stagnation. The Organisation for Economic Cooperation and Development (OECD) predicts Real GDP to slow by 1.7 percent next year.

Looking at few bank analytics, the global economy is not in great shape.

Let’s start with JPMorgan who reckon that there is a 35% probability of a U.S. and global recession in 2026. Ouch! Having said that, AI is still hot. Hussein Malik, Head of Global Research at JPMorgan says that he sees: “AI investment continuing to drive market dynamics and support growth.”

Morgan Stanley are more bullish about the outlook, seeing markets grow by around 3.2% this year, but they caution that it is a double-edged sword.

“On one hand, consumer demand or AI-driven productivity could boost growth above the baseline forecast; on the other hand, the U.S. economy could be hit harder than expected by issues including monetary policy, tariffs and immigration.”

Interestingly, the American banks are nervous imho. They think the unpredictability of Donald Trump’s administration creates huge uncertainty. Europe feels different, even though the Americans want to abolish Europe, well, Elon Musk at least.

Anyways, BNP Paribas’s Chief Economist Luigi Speranza says that: “Global economic activity is expected to maintain solid momentum in 2026, as uncertainty fades while policy remains supportive.”

Woo-hoo! Unfortuanetly, he goes on to say:

“ECB President Christine Lagarde’s now familiar refrain of ‘we are in a good place’ does more than sum up the eurozone outlook; it offers an effective snapshot of the global economy at large.”

“We are in a good place.”

Really?

I’m not sure the rest of the world would agree, going back to my comment that most of the rest of the world believe the EU dream will fail.

We shall see.

ING looks around the world and gives a fine perspective on each region. They think the USA is stable, even with the tariffs and taxes; the Eurozone will grow; Central and Eastern Europe is also strong; meanwhile, the UK and China are stumbling, but the rest of Asia is doing well. Interesting.

Finally, CaixaBank notes the disparities in growth between Europe (1.3%), the US (1.8%) and Asia (4.5%) in 2025. The world axis is changing and Western economies are weak compared to the rest of the world.

Their research shows slowing global growth for the next few years …

… but do caveat this with the comment “we have the same feeling at this time of autumn as we did in 2023 and 2024, when the reality at the end of the year was much better than the baseline forecast scenarios drawn up at the beginning of the year had predicted”.

Let’s hope so.

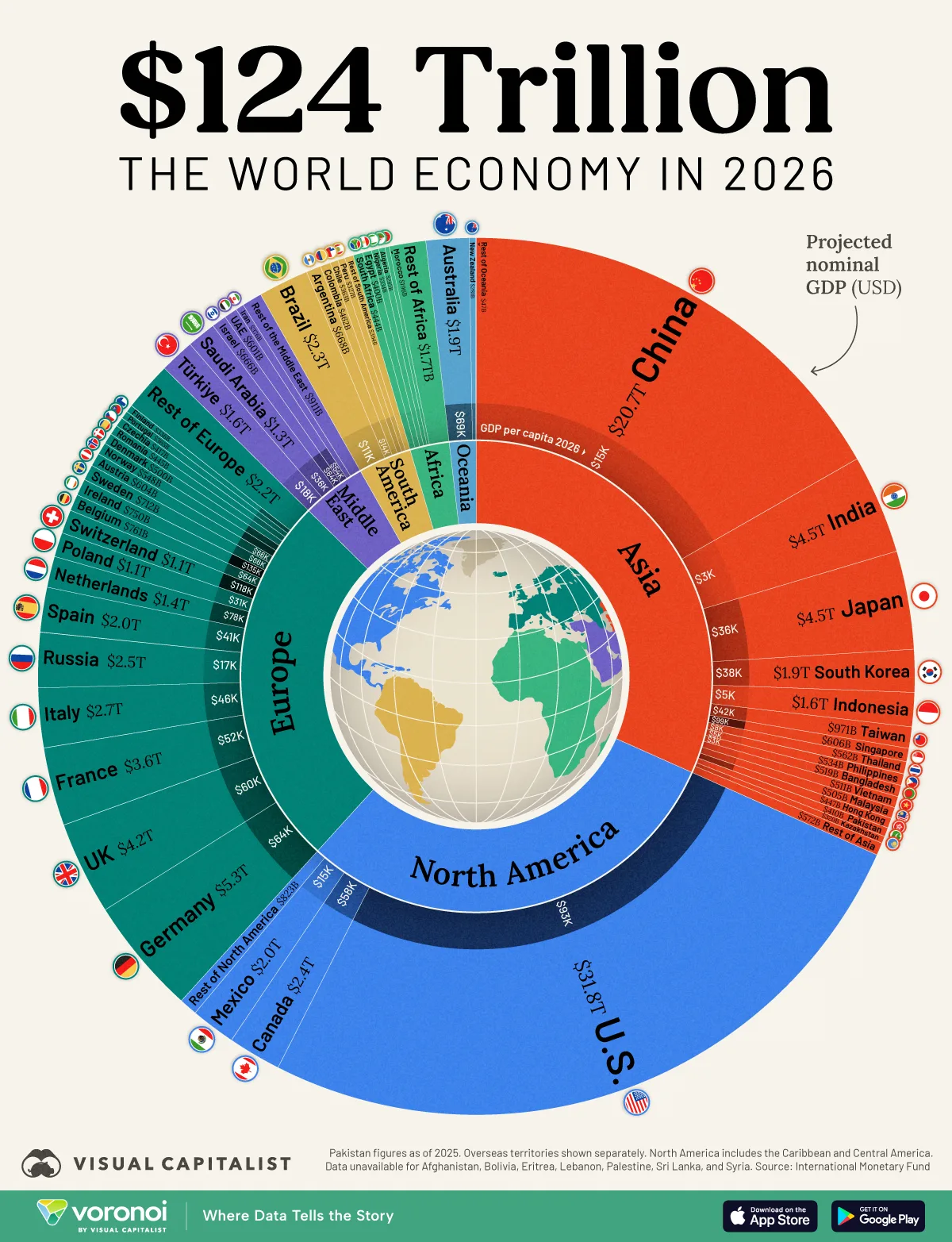

Anyways, Visual Capitalist summarises the world economy nicely with this chart:

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...