Digital Bank

10 ways in which AI will make finance better

Financial companies rely on streams of data and complex IT infrastructures, and operate in a constantly evolving regulatory environment, making them prime candidates for AI data-driven innovation. However, risks associated will need to be managed. Here are ten ideas as to where these developments will make a difference: Hyper-personalized marketing and customer experiences:By leveraging alternative…

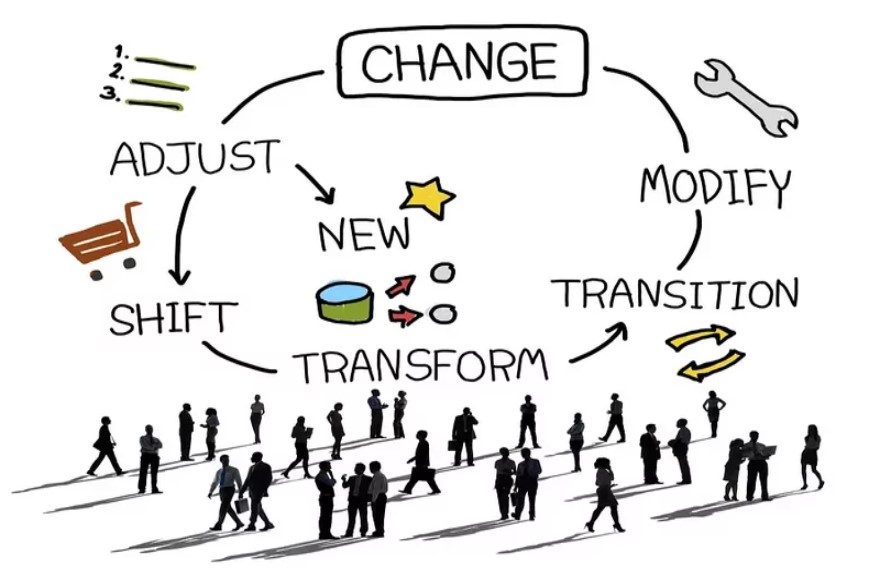

I know I need to change … but into what?

In most presentations, I use this quote from Charles Darwin: It is not the most intellectual of the species that survives; it is not the strongest that survives; but the species that survives is the one that is able best to adapt and adjust to the changing environment in which it finds itself. Although he…

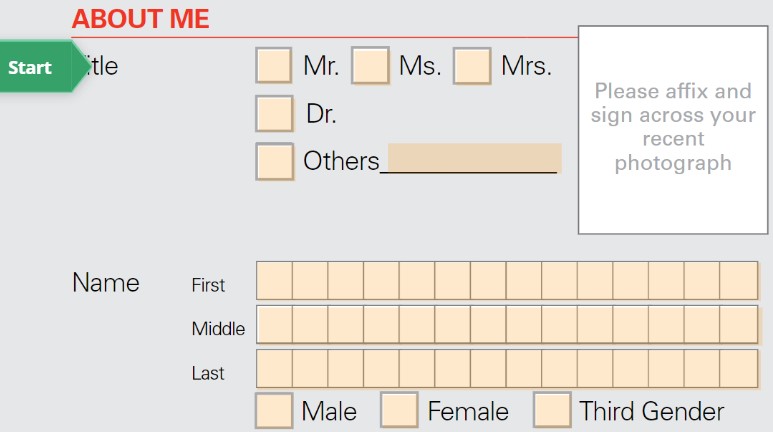

Why is the bank asking me if I’m a Mr, Mrs or Ms?

A new Pew Research report documents that, in 2021, 68% of 25-year-olds were living outside their parents’ home, 22% were married and 17% had a child, according to a Pew Research Centre analysis of the most recently available Census Bureau data. In 1980, 84% were living on their own, 63% were married and 39% had a child, the report said….

The world of opportunities, if you know where to look

2023 is proving to be a punishing year for banks, finance, technology and fintech. Firms have seen massive downgrades of their market cap, and we have seen the demise of major companies ranging from Silicon Valley Bank, First Republic and Credit Suisse. Some say that this is a crisis. However, it seems more like a…

How AI will impact your business

Some people may think McKinsey are a dark force, but their research is pretty good. In the latest white paper, they summarise what is happening with AI and GPT (Generative Pre-trained Transformer) and, with all the buzz around ChatGPT and BankGPT, the paper is worth sharing here. These are the key take-aways: Generative AI’s impact…

Is it physical versus digital or both … and what role does money have in this space?

I’ve realised that my thoughts these days seem to focus mainly on artificial intelligence (AI), cryptocurrencies, the metaverse and space travel. That’s not surprising as that’s where Elon Musk, Jeff Bezos and Mark Zuckerberg are focused. These are the future technologies and capabilities that are inspiring our next generation. The question is: what if we…

The complexity of logistics and treasury operations? It’s all automated by the tag on the bag!

We treat our world very simplistically, and yet we have made our world incredibly complex. When you think we can land a spacecraft on a meteor hurtling through space, it’s amazing what we have achieved. What makes this interesting is the way in which humans have created incredible infrastructures, supply chains and logistics on Earth…

Europe’s new payments regulation – from PSD2 to PSD3

I’ve always expected a PSD3 (the third European Payment Services Directive), as PSD2 had flaws. For example, banks were complaining that an OpenAPI for Trusted Third Parties is fine, but what about a reciprocal agreement or, if you prefer, why should we give them our data if they won’t give us theirs? Or maybe you…

The launch of the digital euro was yesterday

Yesterday, the European Union kicked off the digital euro proposals focused upon ensuring cash is still accepted, whilst complementing cash with a digital version of the euro. The two proposals are summarised as: A legislative proposal on the legal tender of euro cash to safeguard the role of cash, ensure it is widely accepted as a means…