Will micropayments drive crypto adoption?

We’ve talked for years about the need for micropayments. I can remember in the 1990s that the pay-per-view model demanded a payment for a single piece of information. Why should I subscribe for $30 a month to a website where one article has become relevant? Surely, I could pay $0.50 cents to read that one…

The best challenger bank in the world?

Brazil’s FinTech giant Nubank just crushed its 2Q 2023 earnings. We have never seen growth like NU’s in any challenger bank. In fact, some would claim – including me – that this ten-year-old company is not only the strongest neobank in the world, but one of the best-run digital banks ever, maintaining solid profitability. Here…

What if your money is inside your brain?

Building on yesterday’s idea of the future world, where our brains are connected 24*7 in real-time to the network, what would that mean for financial services? Well, I’ve blogged about this a few times already: Invisible banking is the place to be Nobody wants embedded finance Specifically, if we think of money as part of…

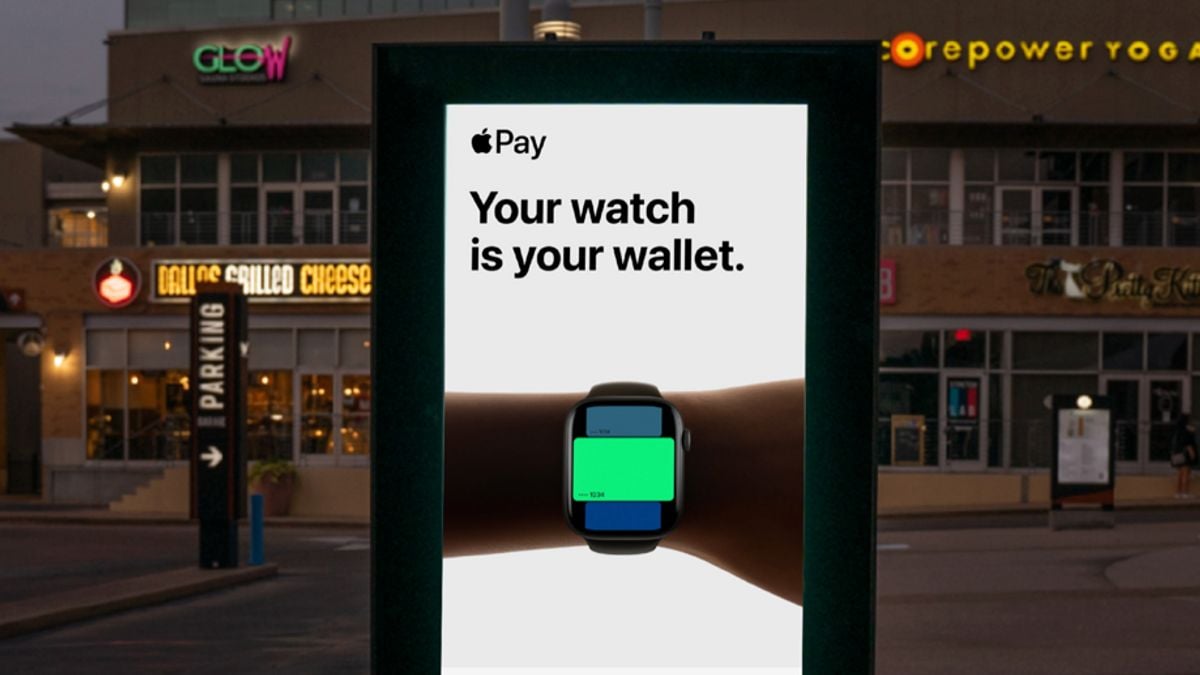

Everybody wants to rule the world … well no, Apple does

Apple rules the world. Assailed by Google/Alphabet, Facebook/Meta, Samsung and more, Apple has sustained an incredible trajectory to become a three-trillion-dollar company. Apple is now worth more than the entire FTSE100 list of companies … In terms of competitors, only Microsoft comes close which, some say, is mainly due to OpenAI’s ChatGPT, but Apple’s dominance is…

As Anne Boden’s successor is sought, can Starling make it as a bank and tech provider?

Always a controversial figure, Anne Boden has hit the headlines again after stepping down as CEO of Starling Bank. Her announcement of remaining on the Board but no longer being the leader of the bank was originally made in May: Boden, who owns 4.9 per cent of the bank she founded in 2014, said she…

The Top 10 of everything FinTech!

Nice update this week regarding the Top 10 of everything FinTech from FinTech magazine. First, they listed the Top 10 UK FinTechs by value: Clearbank is a Centaur, valued at $590 million Atom is also a Centaur, with a valuation of $596 million PPRO moves us into the Unicorn world, with a value of $1…

The Evolution of Fintech and Its Impact on Banking: A Paradigm Shift by ChrisGPT

I asked ChatGPT to write an article in my style. Here’s what it came up with: Introduction In the fast-paced world of finance, few have embraced the power of technology and innovation as passionately as the fintech industry. Over the past decade, fintech has revolutionized the way we think about banking, disrupting traditional financial institutions…

The world of opportunities, if you know where to look

2023 is proving to be a punishing year for banks, finance, technology and fintech. Firms have seen massive downgrades of their market cap, and we have seen the demise of major companies ranging from Silicon Valley Bank, First Republic and Credit Suisse. Some say that this is a crisis. However, it seems more like a…