Here’s what the new normal looks like

There’s lots of talk about civil unrest, an unjust society, the need for a universal basic income, a change in attitude towards everything from capitalism to socialism to democracy to inclusion. Good discussions but hard to know how it plays out. In many countries, people are suffering so much. They’re starving, they have no government…

You might be staying in more than you expect

When Digital Human came out, its subtitle was The Fourth Revolution of Humanity includes Everyone. The premise was based upon humanity entering a fourth phase where every human on Earth could connect with every other human on Earth by just having a mobile telephone. Not only could they connect, but they could talk, trade, transact and…

The Impact of the COVID-19 Pandemic on Financial Inclusion

I spent some time recently chatting with Joanne Dewar, Chief Executive Officer, Global Processing Services (GPS). I spotted GPS a while ago, and blogged about how they worked with Monzo, Starling, Revolut and more last October. Anywho, Joanne wrote a brilliant piece on the Nasdaq website the other day, which she kindly has given me…

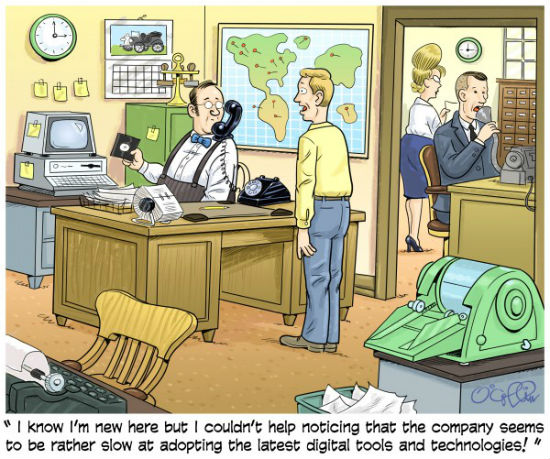

Build, Buy or Transform the Bank?

I was recently watching an online poll that asked the best way for a traditional bank to compete with the new digital banks. Should they build a new bank, buy a digital bank competitor, or transform the old bank? The vote was split fairly equally between all three choices after over 1,000 votes. #FinTech poll….

Is Facebook’s Libra the next Paypal?

What if we make money truly global, stable and secure? That’s Libra’s ambition and I’ve got to hand it to the guys at Libra. Having announced their idea to create a global currency last summer, and then see it ripped to pieces by regulators, they’re back. Yes, it’s Libra 2.0. What’s the difference between 1.0 and…

The failure of government (#coronavirus)

I’m really frustrated between what the government is saying, the media is reporting, the behaviour of banks, the thrust of business and the reality of life. Governments worldwide are locking down and, at the same time, saying they’re going to help citizens and business; media is telling everyone there’s help, support, money, aid out there;…

What does the #coronavirus crisis mean for #FinTech?

Someone asked me what the coronavirus pandemic means for the future of FinTech. I’ve blogged a bit about that already, referring specifically to this great presentation by Finch Capital: But equally, you may think that times are dull and boring, locked in at home and nothing going on, but there’s loads happening. Critically, what’s happening…