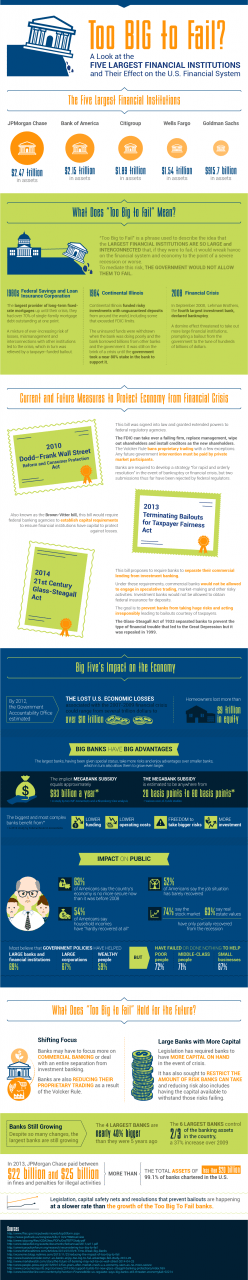

What does ‘too big to fail’ really mean? [Infographic]

I just received this fantastic infographic from the New Jersey Institute of Technology, discussing developments since 2008 and the financial crisis. The context is whether the Big 5 American Banks are still too big to fail (TBTF), and whether the US government has introduced effective controls under Dodd-Frank to avoid the TBTF situation if another financial…