Is a Financial Transaction Tax (FTT) inevitable?

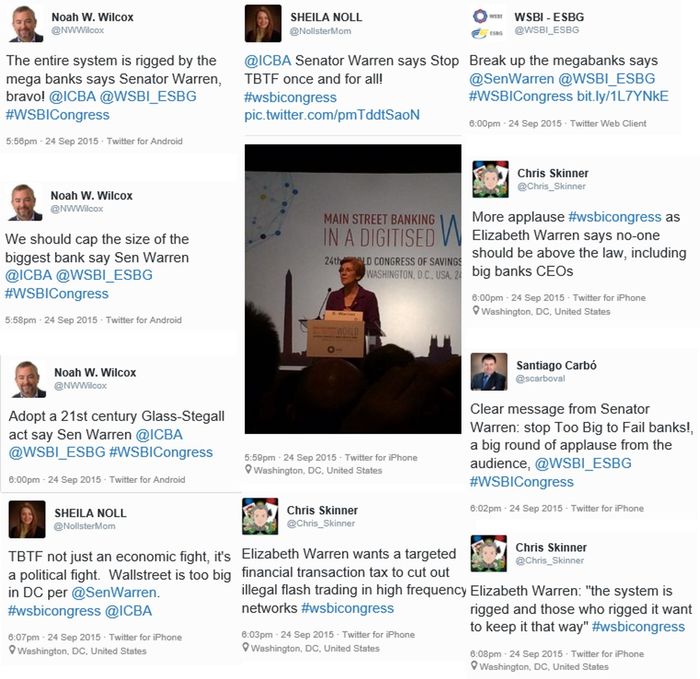

So last week I was honoured to present at a conference in Washington just before Senator Elizabeth Warren, the leading voice in America for changing the bank system. Senator Warren made a strong-worded speech condemning big bank mentality. A few choice comments included a condemnation of Jamie Dimon, who apparently was personally calling congressmen to…