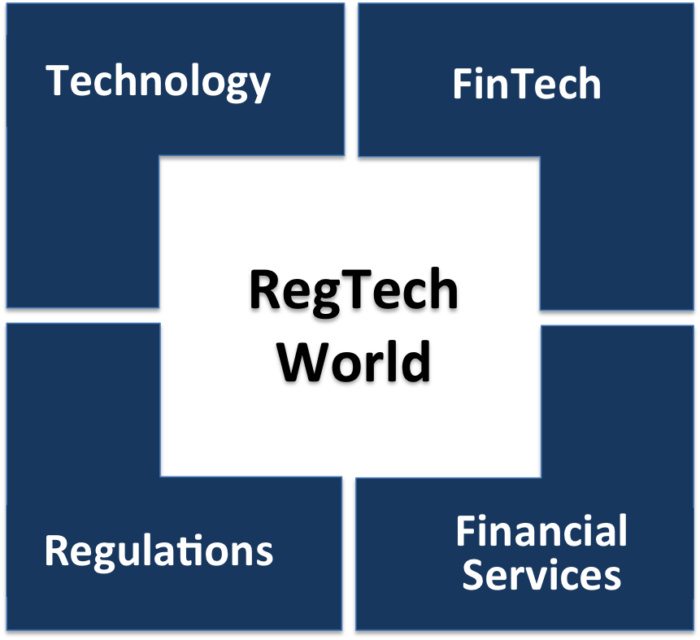

Slow regulations versus fast tech

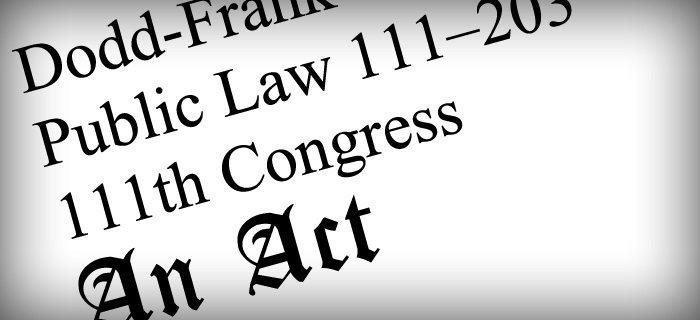

Before 2010, I was writing a lot about technology but it was all heavily geared towards regulations. It was pretty dull, to be honest, but worthy. MiFID and PSD were top of mind, along with Basel III and other global, European and domestic regulations. I wrote a lot about regulations. Then it pivoted at the…