Having written a book about how fintech can make finance good for the world, the biggest issue is those banks investing in fossil fuel firms. It’s not investing in fossil fuel firms that is the issue, but it’s investing in NEW fossil fuel firm projects. Now, who would do that when we know the planet is heading for extinction? Well, Barclays is a key player and, over the weekend, Chris Packham – a well-known TV personality in Britain – made this comment:

“If anyone here is banking with Barclays, then I suggest you stick your head in a bucket of fuel and set fire to it”.

It does seem that Barclays have an issue, as they are the biggest frackers in the UK and regularly targeted by Extinction Rebellion. This is not something new, as I’ve blogged about Barclays position for years and know they are a target for climate activists, but Packham’s comments are a bit strong. Why are they such a target?

I guess it’s because $3.3 trillion went to fossil fuel expansion thanks to banks who backed coal, oil, and gas with a total of $705 billion in 2023, half of which is going to companies that continue to widen their fossil fuel projects.

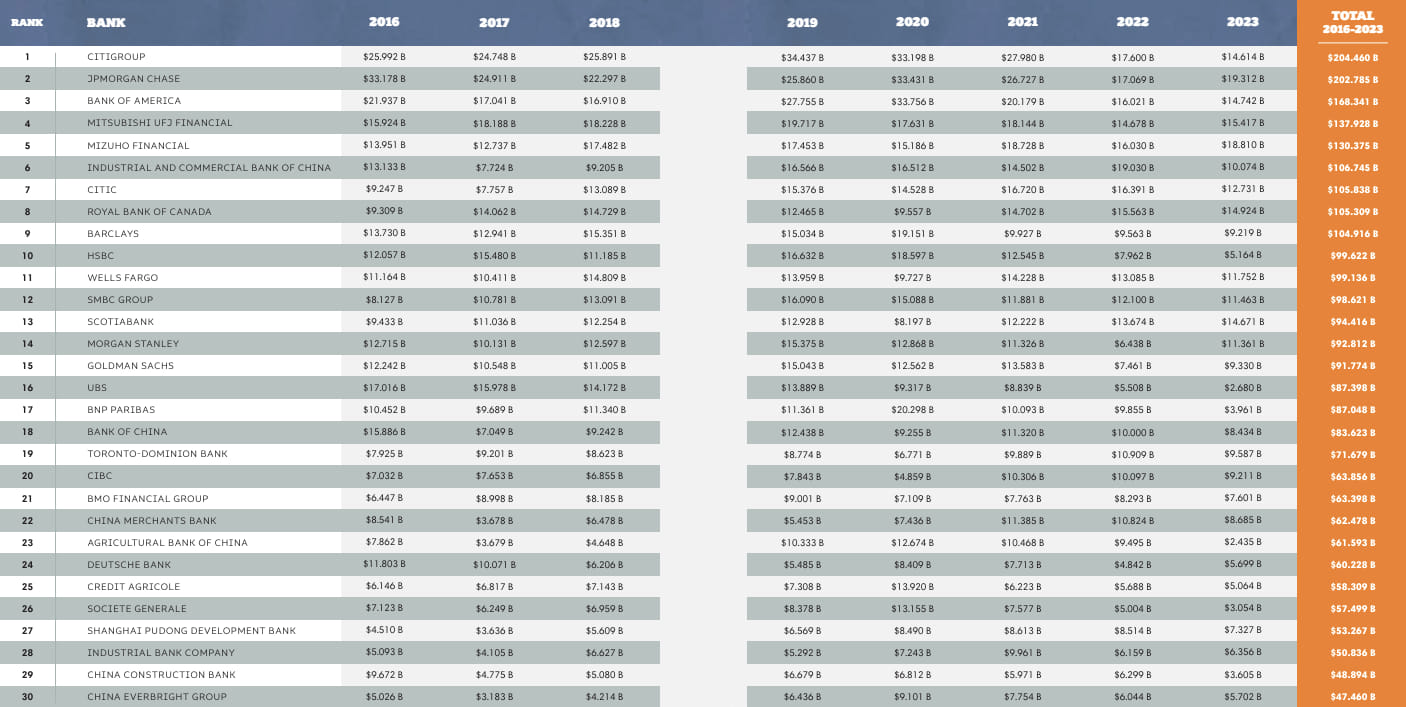

American banks come top of the tables, with Citibank identified as the largest donor to the expansion of fossil fuels, but Barclays is the largest investor in such projects in Europe.

Barclays invested or, rather, loaned $24.2 billion to fossil fuel firms in 2023, with Santander in second place ($14.5 billion) and Deutsche Bank($13.4 billion) in third. Although the figures do vary, dependent upon where you look.

Source: Statista

In fact what’s interesting is, if you look in the aggregate, European banks are the real issue here. European banks have poured US$1.3 trillion into fossil fuels since the Paris Agreement was adopted in 2016 although, some say, it is nearer $7 trillion. They provided US$30.3 billion to the top 100 fossil fuel developers in 2022, which is a quarter of their funding worldwide, and Barclays Bank is the leader of the pack although, just for context, the combined pack of French banks are the leading nation pouring money into fossil fuel firms.

Either way, Barclays has a problem.

Now, I know it’s not simple to change this but it does create a dilemma. The first part is that you cannot switch coal, oil and gas off overnight. As Ana Botin, Executive Chair of Santander Group said in a Bloomberg interview five years ago:

“We cannot just cut the energy off in Poland, where a lot of the economy is still powered by coal. But we did announce … that we are not going to finance any new coal projects”

And there’s the rub and the big challenge: are these banks funding fossil fuel expansion or decline? And why won’t they stop doing this ...

... because it makes money.

According to some reports, 14 percent of European bank profits come from interest on their fossil fuel lending and, when driven by shareholder return and annual bonuses, why would you ever want to stop providing that credit line, even though it is fuelling a planet destroying, climate enemy agenda? More than this, a report by Finance Watch calculated the capital that would be needed for EU banks to cover their existing fossil fuel exposures and the 22 largest EU banks would need to cough up $34 billion in capital, which is about 40% of their 2021 profits, to sort out their issue.

Ah well …

The thing is that long-term, are we going to leave our children with a home or will they have to move to Mars for a future and, if the latter, will we do the same to that planet?

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...