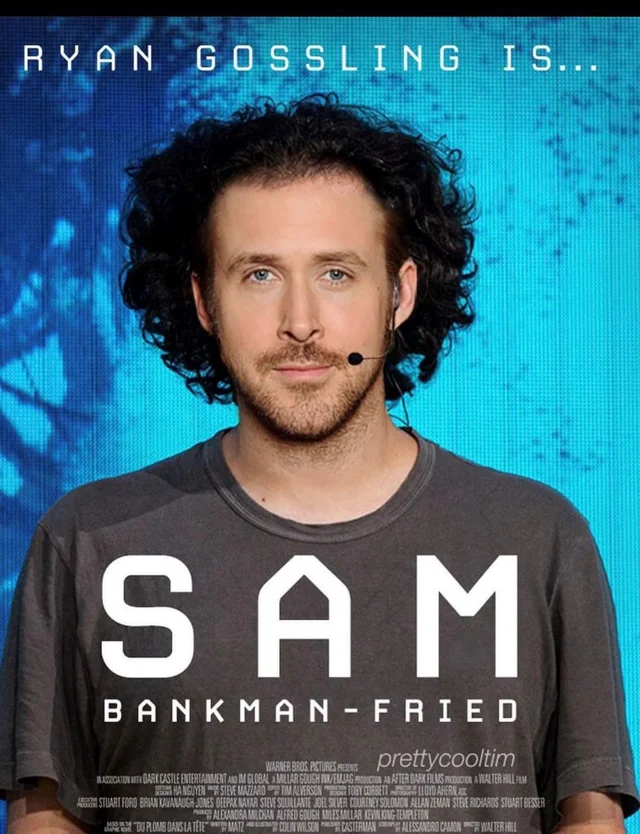

Netflix to launch “A Fried Bankman” starring Sam Bankman-Fried?

A preview of Michael Lewis’s FTX series: “A Fried Bankman” During the holiday season, I binge-watched Billions once more. It’s a great series, and up there with West Wing and House of Cards. But it is fiction based on fact. The fiction is the dramatisation of a hedge fund skating on thin ice against the…