Society is so digital, we do more with devices than with each other

Talking of how fast things change, here are a few Friday facts to make you smile (or feel ill). The UK Office of Communications (Ofcom) run regular surveys on our digital lifestyles. This year the impact of smartphone and tablet computing hits the radar and shows how things have changed fast. For example, this year’s survey…

Society is so digital, we do more with devices than with each other

Talking of how fast things change, here are a few Friday facts to make you smile (or feel ill). The UK Office of Communications (Ofcom) run regular surveys on our digital lifestyles. This year the impact of smartphone and tablet computing hits the radar and shows how things have changed fast. For example, this year’s survey…

Mobile money statistics and comparison of UK with US, Japan and more

I got this report from Monitise a month ago, but only just got around to writing about it. It's stats about mobile money and, if anyone knows me well, they'll know that I like stats. So here are some numbers: 1,008 million people use Facebook mobile every month 341 million people only use Facebook mobile 50…

The Top 1000 Banks in the World 2014

Each year, The Banker magazine (to which I contribute a monthly column) publishes their list of the Top 1000 banks. It’s a great research resource that I’ve been tracking since 1994, when half the banks in the top 10 were Japanese. Now, half of them are Chinese. Ten years ago, they were all American (apart from a…

Britain: leading the way in digital banking

As the author of a book called Digital Bank, a headline that reads Brits embrace digital banking cannot be ignored. Sure enough, it’s the publication of the British Banker’s Association’s report The Way We Bank Now, the second report analysing the move to phone and online banking by the great British public. This year it…

The Changing Face of Payments Report, 2014

In late 2013, we researched the views of how payments markets are responding to change. The results are intriguing, so here’s the management summary. If you would like a free copy of the report, just download here. In late 2013, the Financial Services Club ran an online survey, in collaboration with Cognizant and VocaLink, about…

The Changing Face of Payments Report, 2014

In late 2013, we researched the views of how payments markets are responding to change. The results are intriguing, so here’s the management summary. If you would like a free copy of the report, just download here. In late 2013, the Financial Services Club ran an online survey, in collaboration with Cognizant and VocaLink, about…

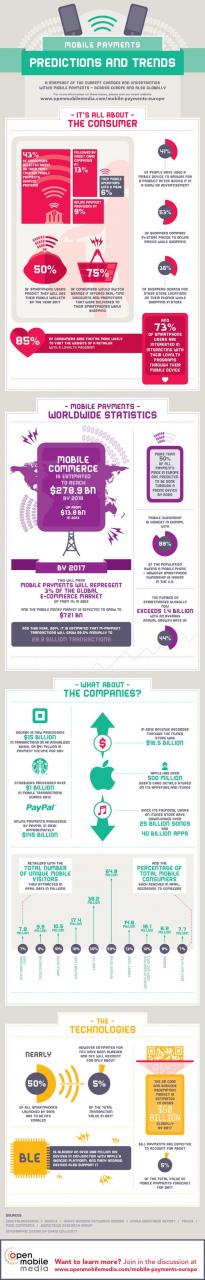

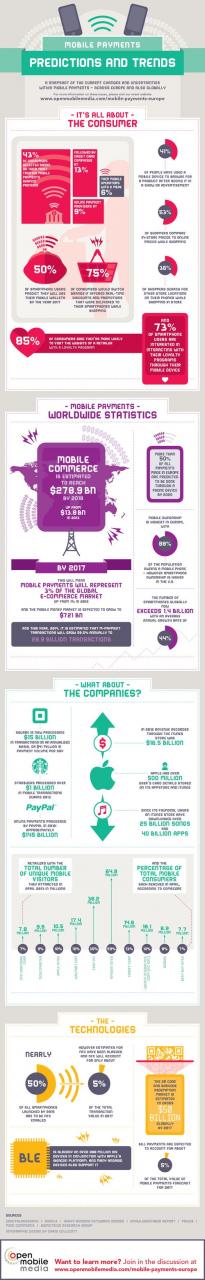

1.4 billion people have smartphones increasing at 44% per annum (infographic)

A fantastic infographic was sent over to me today by the folks at Open Mobile Media. Main headlines include: banks are the most trusted mobile payment providers (43%) half of all smartphone users expect to adopt the use of mobile wallets in the next three years 1.4 billion people now have smartphones, increasing at 44%…

1.4 billion people have smartphones increasing at 44% per annum (infographic)

A fantastic infographic was sent over to me today by the folks at Open Mobile Media. Main headlines include: banks are the most trusted mobile payment providers (43%) half of all smartphone users expect to adopt the use of mobile wallets in the next three years 1.4 billion people now have smartphones, increasing at 44%…