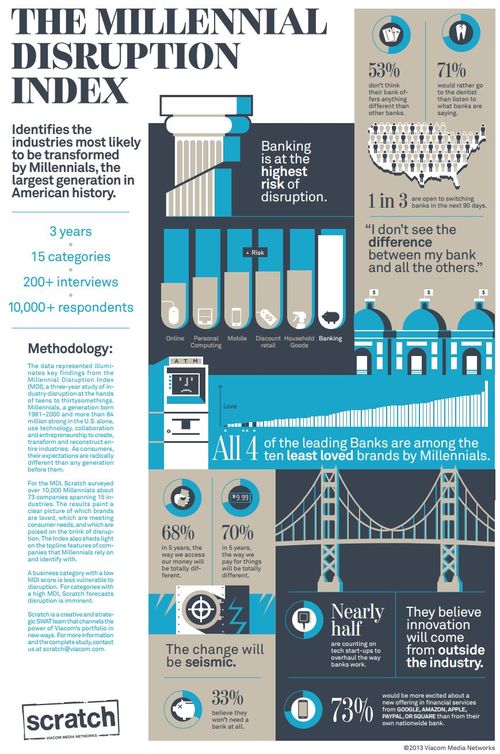

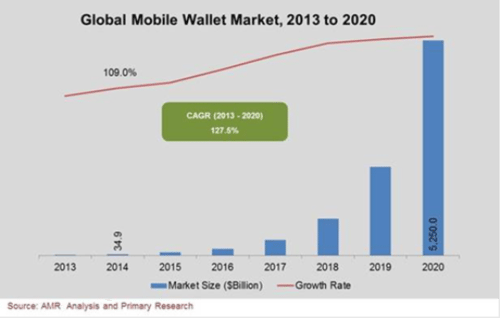

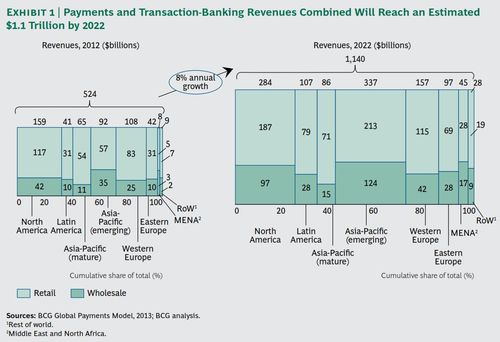

The time is ripe for disruption in banking

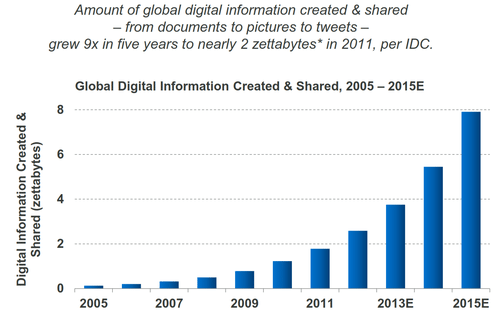

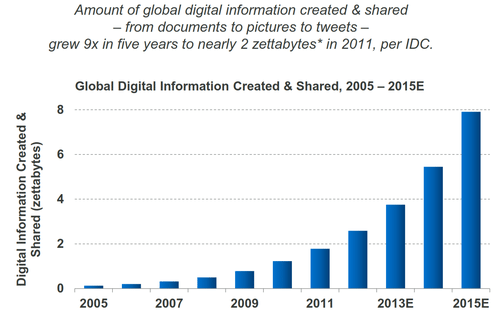

Building on yesterday’s debate about Google and co coming into banking, and the previous discussions of such: Imagine less than 50 banks left in the world by 2030 (why most will not become digital) If you think 'rip out and replace our systems' is naive … think again … and there’s been loads more, I was…