What is a secure data vault and should a bank be one?

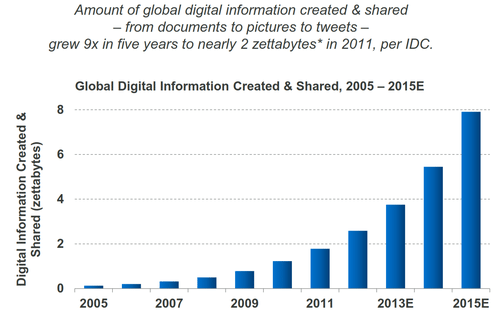

I gave a presentation the other day and, as usual, concluded that banks should position themselves as data vaults. One person then asked: what data should a bank make secure? which is a good question to ask, as it led to a healthy debate and improvement of clarity of view. Today, we produce exabytes of…